Retailers Head to Energy Boom States

Here’s an example of how the benefits of the shale energy boom radiate beyond the oil and gas industry. The Wall Street Journal reports that Home Depot opened only one store [subscription required] this past fiscal year, and it was in Minot, North Dakota, near the Bakken shale formation.

Home Depot went there because energy production is driving economic growth:

“If you had said to me seven years ago, you’ll be opening a store in Minot, North Dakota, I would have asked, Why?” Chief Executive Frank Blake said in an interview. “One of the great stories of the U.S. is the shale oil development, and it’s happening in areas where we don’t have a lot of stores now.”

Michael Glazer, CEO of Stage Stores, wishes his company had stores in North Dakota right now. He told the newspaper:

There’s a correlation between the energy boom and county employment rates. And wherever energy comes in, jobs follow and people spend more at our stores.

Look at North Dakota. Local writer Rob Port of SayAnythingBlog.com reports that because of the oil boom, North Dakota’s unemployment rate is 2.6%, while the nation’s unemployment rate stands at 6.7%.

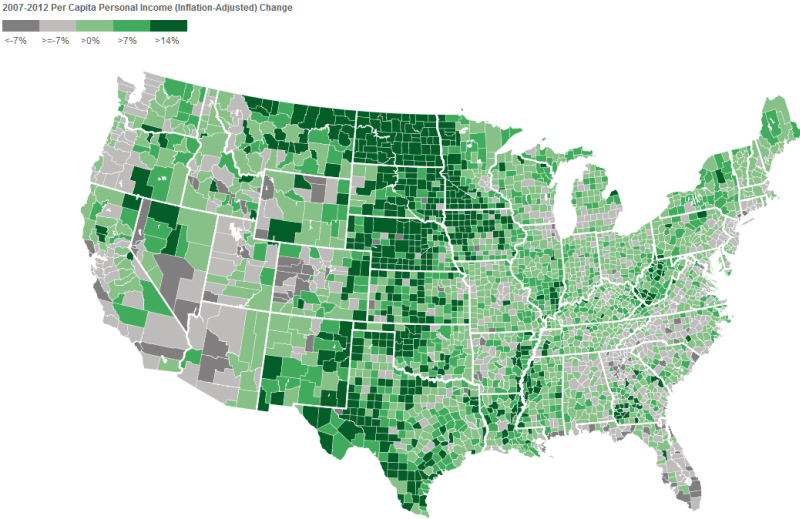

He also posted a map showing that every county in the state saw at least 14% per-capital personal income growth from 2007-2012.

It’s no wonder Home Depot has expanded there.

Other major retailers see these trends as well:

Home Depot is among a number of retailers including Wal-Mart Stores Inc. and GameStop Corp. targeting oil and gas towns in North Dakota, Texas and Louisiana, in an otherwise dour environment for retail real estate.

Natural Gas Intelligence reports that cities in or near energy-rich areas are growing the fastest, according to a Census Department study:

Of the nation’s 10 fastest-growing metropolitan statistical areas, six were within or near the Great Plains and near to some of the country’s largest oil and gas fields, including Odessa, TX; Midland, TX; Fargo, ND; Bismarck, ND; Casper, WY and Austin-Round Rock, TX.

The same was true of micropolitan statistical areas, those ranging in size from 10,000 to 50,000 people, near oil and gas development. Seven of the fastest growing micro-areas were located in or near the Great Plains, with Williston, ND, ranked first in growth, followed by Dickinson, ND, and Andrews, TX.

Jobs and economic growth created by increased domestic energy production are drawing people to these cities. Businesses follow.

States that aren’t sitting on top of energy deposits also benefit from the shale energy boom, according to a 2012 report by IHS for the U.S. Chamber’s Institute for 21st Century Energy. For example:

Among non-producing states, fabricated metal manufacturing in Illinois, software and information technology in Massachusetts, and financial services and insurance in Connecticut are examples of central players in the US unconventional oil and gas supply chain.

The report noted, “By 2035, unconventional oil and gas will add almost $475 billion dollars to the economies of the lower 48 US states.”

As seen by what’s happening in North Dakota, this growth will also ripple outward into the broader economy.