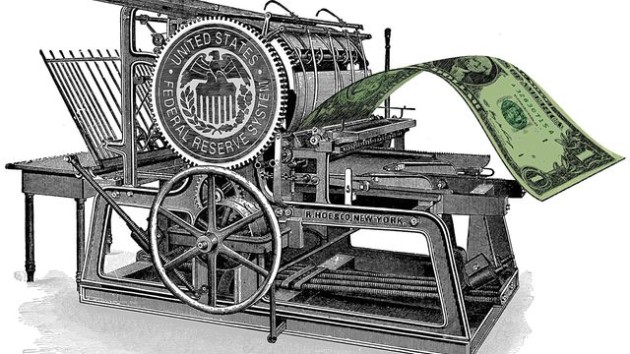

Root Cause of the “Income Equality” Crisis — The Federal Reserve’s Monetary Policy

The latest political slogan is “income equality.” Various news outlets report that the rich are getting richer and poor getting poorer. Various politicians cry out for more government intervention, more government programs and expanded government funding to address this national crisis. Cries are heard daily from politicians to raise the minimum wage.

But who is really behind this growing income inequality crisis? According to one monetary policy expert it is the U.S. Federal Reserve.

James Rickards in his book “The Death of Money: The Coming Collapse of the International Monetary System” explains how this has happened in America and will happen again. Rickards writes, “Critics from Richard Cantillon in the early eighteenth century to V.I. Lenin and John Maynard Keynes in the twentieth have been unanimous in their view that inflation is the stealth destroyer of savings, capital, and economic growth.”

Rickards warns, “Inflation often begins imperceptibly and gains a foothold before it is recognized. This lag in comprehension, important to central banks, is called money illusion, a phrase that refers to a perception that real wealth is being created, so that Keynesian ‘animal spirits’ are aroused. Only later is it discovered that bankers and astute investors captured the wealth, and everyday citizens are left with devalued savings, pensions and life insurance.” [Emphasis mine]

Rickards finds that the 1960s and 1970s are “a good case study in money illusion.” “Two lessons from the 1960s and 1970s are highly pertinent today. The first is that inflation can gain substantial momentum before the general public notices it… Second, once inflation perceptions shift, they are extremely difficult to reset,” states Rickards.

Is the Federal Reserve contributing to a money illusion?

According to Rickards, “[S]ince 2008 the Federal Reserve has printed over $3 trillion of new money, but without stoking much inflation in the United States. Still, the Fed has set an inflation target of at least 2.5 percent, possibly higher, and will not relent in printing money until that target is achieved. The Fed sees inflation as a way to dilute the real value of U.S. debt and avoid the specter of deflation. There in lies a major risk.” [Emphasis mine]

Rickards notes history tells is, “[A] feedback loop will emerge in which higher inflation leads to higher inflation expectations, to even higher inflation, and so on. The Fed will not be able to arrest this feedback loop because its dynamic is a function not of monetary policy but of human behavior.”

Rickards predicts:

- Skyrocketing gold prices and a crashing dollar;

- Russian, China and the International Monetary Fund will stand ready with gold and SDRs, not dollars, to provide a new reserve asset; and

- When the dollar next falls from the high wire, there will be no safety net.

Richards in his book notes, “The coming collapse of the dollar and the international monetary system is entirely foreseeable… The international monetary system has collapsed three times in the past century – in 1914, 1939 and 1971. Each collapse was followed by a tumultuous period.”

Rick Santelli explains what he believes is happening in the U.S. today. Brian Maloney from MediaEqualizer.com writes: “So what exactly are his [Santelli’s] points? It’s actually simple.” (see chart right):

Rick Santelli explains what he believes is happening in the U.S. today. Brian Maloney from MediaEqualizer.com writes: “So what exactly are his [Santelli’s] points? It’s actually simple.” (see chart right):

- By keeping interest rates artificially low, the Janet Yellen led Federal Reserve has encouraged reckless government borrowing and spending while crushing savers, especially America’s retirees.

- The Fed has focused all its efforts on making the rich even richer through Quantitative Easing while working people suffer and are ignored by Washington’s elite.

Who wins and who loses when there is another financial crisis like the DOT.com bust in 2000 and the housing crisis of 2008? The winners are the bankers and savey investors (the 1%) and their political allies. The losers left holding the bag are citizens living on Main Street U.S.A.

RELATED ARTICLES:

Billionaire Warns: Yellen Collapse ‘Will Be Unlike Any Other’

Bubble Paranoia Setting In as S&P 500 Surge Stirs Angst – Bloomberg

Bank for International Settlements fears fresh Lehman crisis from worldwide debt surge – Telegraph

Deficit To Soon Skyrocket To Historic World War II Heights

OECD Fears Middle Class Civil Unrest Is Coming | Zero Hedge

Trackbacks & Pingbacks

[…] The latest political slogan is "income inequality." Various news outlets report that the rich are getting richer and poor getting poorer. Various politicia […]

Comments are closed.