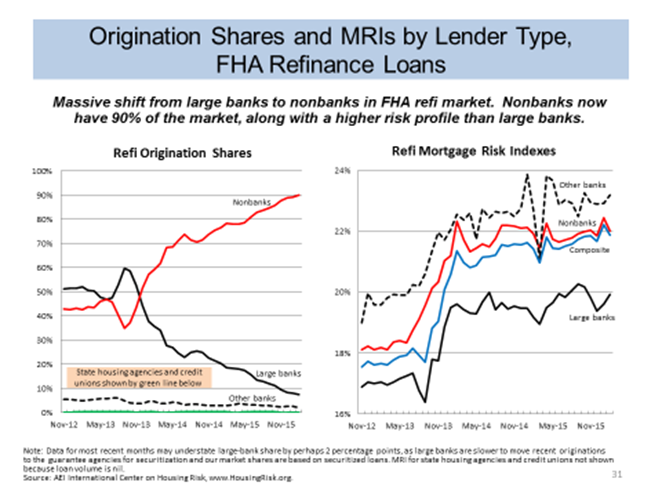

ALERT: Banks Exiting the FHA Refinance Market

The below chart (left panel) shows a shift away from both large and other banks that dwarfs even what has happened with share shift for lender FHA purchase loan share. Said another way, banks in general have largely exited the FHA refinance market, with non-banks accounting for 90% share in February.

This is a continuation of the three plus year trend of bank withdrawal from FHA lending, a market they dominated just 3-4 years ago.

Contributing to this shift are concerns over:

- Regulatory risk and legal liability

- Reputational risk

- Servicing costs

- Customer relationships

- FHA’s extremely high risk profile (right panel above)

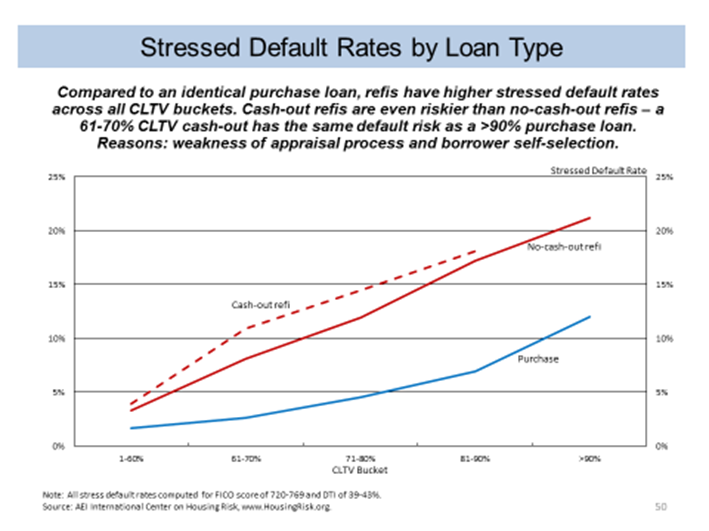

The shift away from banks to non-banks has important ramifications, as non-banks are much more willing to originate high risk loans. As the chart below demonstrates, refinance loans are much riskier than purchase loans with the same characteristics and non-banks now control 90% of FHA finance securitizations using Ginnie Mae:

To view the entire National Housing Risk Index and other Risk Measures briefing click here.

Leave a Reply

Want to join the discussion?Feel free to contribute!