Is Politics Obsolete? How People Outpace Politicians by Max Borders and Jeffrey A. Tucker

Hillary Clinton talks of cracking down on the gig economy. Donald Trump speaks of telling American corporations where they can and can’t do business abroad. Bernie Sanders says we have too many deodorant choices. They all speak about immigrants as if it were 1863.

What the heck are these people talking about?

More and more, that’s the response many people have to the current-day political speeches and rhetoric. It’s a hotly contested election, somewhat like 2008, but this time around, public engagement is low, reports Pew.

That’s no surprise, really. Whether it’s the leftists, the rightists, or everyone in between, all of these politicians seem to be blathering about a world gone by — one that has little to do with the 21st century. If they’re not tapping into people’s baser instincts of fear and nativism, they’re dusting off 20th-century talking points about creating “good jobs.”

Maybe there was a time when the political culture seemed to keep up with the pace of innovation. If so, those times are long gone. The rhetoric of electoral politics is exposing the great rift in civic life.

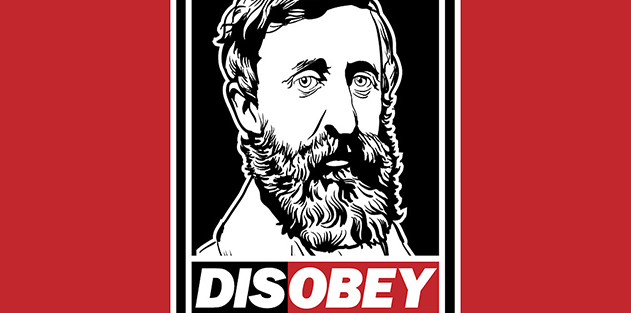

The tools we use every day, the technologies we love, the way we engage each other, the means by which our lives are improving are a consequences of innovation, markets, community, and globalization — that is, by the interactions of free people. Not by politics. And not by the systems politics creates.

The political election is a tired old ritual in which we send our hopes and dreams away to distant capitals. Why do we outsource them to politicians, lobbyists, and bureaucrats: people who are trapped in a system that rewards the worst in people? What’s left of governance is logrolling, spectacle, and unwanted interference in the lives of everyone else.

Politicians seem more concerned with putting the genie of innovation and entrepreneurship back in the bottle than doing anything meaningful. After the election, we try our best to ignore them and get on with life.

Politicians seem more concerned with putting the genie of innovation and entrepreneurship back in the bottle than doing anything meaningful.

In 2012, US voters reelected Barack Obama, and now we’re gearing up to elect someone else. Candidates will talk about their visions and their wonderful plans for the country. But in the last three years, virtually none of the incredible, beautiful upheaval we’ve seen has had anything to do with the presidency or with anyone politician’s plans.

In fact, when you think about what government has done for us in recent years, only one new program comes to mind: Obamacare. Opinions vary on whether that program has been deeply disappointing or an unmitigated disaster.

Now, take a step back and observe the evolution of commercial society and how it is bringing us unprecedented bounty. The digital sector of emergent, market-generated, people-driven, technology-fueled innovation is fulfilling human aspirations and spreading useful services to people in all walks of life. National borders seem ever more arbitrary. Surprises await us around every corner. Our political systems can claim credit for none of it.

And yet, we are once again being asked to turn to politicians to drive progress.

Consider how much our lives and technologies have changed since the last presidential election. Smartphone ownership has gone from 300 million to 2 billion, meaning that most of the population of the developed world — and large parts of the rest — now have access to a wireless supercomputer in their pockets. As a result, we are more in touch than ever.

There are now dozens of ways for anyone to keep in contact with anyone else through text messaging and video, and most of the services are free. Transportation in cities has fundamentally changed due to ridesharing and app-based systems that are outcompeting municipal taxis. Traditional travel lodging has been disrupted through mobile applications that turn every empty room into a hotel, and finding permanent lodging is easier than ever. You can find the ratings for any service or establishment instantly with a click or a tap, long before you purchase. You can feasibly shop for and buy a house without ever having stepped inside of it.

Cryptocurrency is becoming a viable alternative to national monies, and payment systems on distributed networks are being customized for peer-to-peer exchanges of property titles.

The mass distribution and availability of mobile applications with maps means that you are never lost, and, moreover, that you can be intensely aware of everything around you, wherever you are or wherever you are planning to be. Extended families that are spread out over large geographic regions can stay constantly in touch, chatting and playing games.

The way we help our neighbors and communities is improving. We can contribute to charitable causes with just a click. We are closer to our neighbors and their needs — whether it’s a missing cat, a call for a handyman, or childcare for Saturday night. We can be on the lookout after a break-in and share video of the perpetrators instantly.

The way we consume music has fundamentally changed. We once bought CDs. Then we downloaded particular tracks and albums. With Internet everywhere, we now stream a seemingly endless variety of genres. The switch between classical and indie rock requires only a touch. And it’s not just new music we can access, but vast archives and recreations of music dating to antiquity. Instantly.

Software packages that once cost thousands are now low-cost downloadable apps. Many of us live in the cloud now, so that no one’s life is ruined by a computer crash. Lost hardware can be found with built-in tracers — even stealing computers is harder than ever.

Where we work no longer matters as much. 4G LTE means a powerful Internet connection wherever you are, and WiFi on airlines means staying in touch even while above the clouds. Online document signing means total portability and the end of the physical world for most business transactions. You can share almost anything — whether grocery lists or whole writing projects — with anyone and work in real time. More people than ever work from home because they can.

News is now crowdsourced through Twitter and Facebook — or through mostly silly sites like BuzzFeed. There are thousands of competitors, so that we can know what we want to know wherever we are. Once there was only “national news”; now a news event has to be pretty epic to qualify, and much of the news that we are interested in never even makes old-line newspapers.

Edward Snowden revealed ubiquitous surveillance, escaped prosecution, and now, thanks to technology, has been on a worldwide speaking tour, becoming the globe’s most famous public intellectual. This is despite his having been censored and effectively exiled by the world’s biggest and most powerful state. He has a great story to tell, and that story is more powerful than any of the big shots who want him to shut up.

Pot has been effectively legalized in many American cities, and the temperature on the war against it has dropped dramatically. When dispensaries are raided, the news flies all over the Internet within minutes, creating outrage and bringing the heat down on the one-time masters of the universe. There is now a political risk to participating in the war on pot — something unthinkable even 10 years ago. And as police continue to abuse their power, citizens are waiting with cameras.

Oil prices have collapsed, revealing the fallacy of peak oil. This happened despite pressure in the opposite direction from every special interest, from environmentalists to the oil industry itself. The reason was again technological. We discovered better and cheaper ways of drilling, and, in so doing, exposed vastly more resources than anyone thought accessible.

At the very time when oil and gas seemed untouchable, we suddenly saw electric cars becoming viable options. This was not due to government mandates — regulators tried those for years — but due to some serious innovation on the part of one remarkable company. It’s not even the subsidies, such as they are, that are making the difference; it’s the fine-tuning of the machine itself. Tesla even took it a step further and released its patents into the commons, allowing innovation to spread at a market-based pace.

We are now printing houses in one day, vaping instead of smoking, legally purchasing pharmaceuticals abroad, using drones to deliver consumer products, and enjoying one-day delivery of just about everything.

In the last four years, the ebook became a mass consumer item, outselling the physical book and readable on devices within the budget of just about everyone. And despite attempts to keep books offline, just about anything is now available for download, putting all the world’s great literature, in all major languages, at our fingertips.

Here we go again, playing “let’s pretend” and electing leaders under the old-fashioned presumption that it is politics that improves the world and drives history forward.

And speaking of languages, we now have instant access to translation programs that allow us to email and even text with anyone in a way he or she can understand regardless of language. It’s an awesome thing to consider that this final barrier to universal harmony, once seen as insuperable, is in the process of melting away.

These are all ways in which the world has been improved through markets, creativity, and free association. And yet, here we go again, playing “let’s pretend” and electing leaders under the old-fashioned presumption that it is politics that improves the world and drives history forward.

Look around: progress is everywhere. And it is not because we are electing the “right people.” Progress occurs despite politics and politicians, not because of them.