Wealth Inequality: Predictably Irrational by Max Borders

Note: A new video on income inequality has gone viral. In this video, the authors want us to believe that wealth inequality is far away from our national “ideal” distribution.

[youtube]http://youtu.be/QPKKQnijnsM[/youtube]

The following is my response to the video and the study on which it was based:

Everyone knows the social sciences are fuzzy. Economists, political scientists, and anthropologists bring their moralistic baggage into the ivory tower as soon as they decide what to study and what not to. Social science is value-laden. But there is baggage and then there is a naked agenda. In the first case you might be a victim of selection bias or other unconscious human processes that cause you to misinterpret your data. In the latter case you simply start with a political agenda along with its (often dubious) premises, and go from there.

Michael I. Norton of Harvard and Dan Ariely of Duke fall into the latter category. In a 2010 study, Norton and Ariely appear to be engaging in a kind of democracy-by-proxy. They claim that Americans really want more “wealth redistribution,” and they have the evidence to prove it.

Here’s their own description of the findings from a Los Angeles Times piece, “Spreading the Wealth.”

We recently asked a representative sample of more than 5,000 Americans (young and old, men and women, rich and poor, liberal and conservative) to answer two questions. They first were asked to estimate the current level of wealth inequality in the United States, and then they were asked about what they saw as an ideal level of wealth inequality.

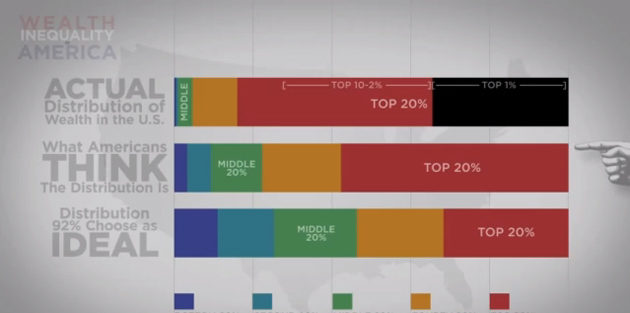

In our survey, Americans drastically underestimated the current gap between the very rich and the poor. The typical respondent believed that the top 20% of Americans owned 60% of the wealth, and the bottom 40% owned 10%. They knew, in other words, that wealth in the United States was not distributed equally, but were unaware of just how unequal that distribution was.

When we asked respondents to tell us what their ideal distribution of wealth was, things got even more interesting: Americans wanted the top 20% to own just over 30% of the wealth, and the bottom 40% to own about 25%. They still wanted the rich to be richer than the poor, but they wanted the disparity to be much less extreme.

What should we conclude from this? Norton and Ariely did succeed in proving that Americans don’t know who has how much money.

Strangely, Norton and Ariely proceed to ask the same Americans who are ignorant about the current wealth distribution what their “ideal” distribution is. Those surveyed then dreamed up what they thought would be a good breakdown, even though no such ideal exists in that great Tablet in the Sky. From all of this surveying, they conclude something that cannot readily be concluded:

[O]ur results suggest that policies that increase inequality—those that favor the wealthy, say, or that place a greater burden on the poor—are unlikely to reflect the desires of Americans from across the political and economic spectrum. Rather, they seem to favor policies that involve taking from the rich and giving to the poor. [Emphasis added.]

Notice “suggest” and “seem.”

You see, Norton and Ariely can’t claim those surveyed favor coercive redistribution. They merely infer it—and in curious fashion. Absent any context, the most ardent libertarian surveyed might wish that poor people had more resources and yet not support forced redistribution. I know I do. But even if they learned most people favor redistribution at some point, we cannot conclude such desires justify forced redistribution, much less prove that redistribution is a good thing.

And this is where Norton and Ariely’s malpractice really begins.

Academic socialists with bees in their bonnets are eager to point out which quintile has what at every turn, as if concern for the poor somehow automatically translates into worries about the assets of the rich. One reason they do this is they believe laypeople are ignorant: If they were enlightened, they would change their minds and want to alter the distribution.

Somehow, though, this self-same group of distribution-ignorant Americans—when polled about a complete abstraction like the distribution of assets over quintiles—suddenly becomes endowed with a magical insight. Again, Norton and Ariely want us to think this special insight provides justification for redistributionist policies. But why should we think that Americans factually ignorant in one area would have some sort of mystical authority on the timeless and intractable questions of justice?

In other words, Norton and Ariely conclude that asking Joe Sixpack, Jill Accountant, and Barb Waitress their thoughts about an abstraction like national income quintiles limns some great truth about right, wrong, and the good. Even the venerable soft egalitarian John Rawls would likely have bristled at this, for it is an intrusion into a discipline (philosophy) that demands more than what amounts to the naturalistic fallacy dressed up in finery of Gallup and Zogby.

I wonder: Did any of their respondents have the option of saying, “I don’t think there is such an ideal distribution”? To me the whole exercise is as meaningful as asking people what should be the ideal distribution of vehicle types. Suppose for simplicity there are five categories of vehicle: cars, pickups, buses, local trucks, and transfer trucks. Someone with no concept of the function of each vehicle might say each category should have 20 percent of all vehicles—i.e., 20 percent are cars, 20 percent are trucks, 20 percent are buses, and so on. But once we start to think about what each vehicle does, we might conclude that it makes sense for there to be a different, rather unequal, distribution. Similarly, the distribution of assets in quartiles just doesn’t tell us anything substantive about the function of wealth (e.g., opportunities, quality of life, upward mobility, or what is likely to make any given person better off). The “ideal distribution” is meaningless because it is completely divorced from much more important questions about the way wealth works, which may have much more to do with human well-being than some distribution at some slice in time.

Now, speaking of Rawls, Norton and Ariely actually start their paper by claiming their study is Rawlsian: “We take a different approach to determining the ‘ideal’ level of wealth inequality: Following the philosopher John Rawls (1971), we ask Americans to construct distributions of wealth they deem just (”Building a Better America—One Wealth Quintile at a Time,” Perspectives on Psychological Science 6, no. 9 (2011), doi: 10.1177/1745691610393524).” People may have good reasons to disagree with the late Rawls, but his theory is elegant and sophisticated. Norton and Ariely have no business hitching their wagon to Rawls’s A Theory of Justice.

Rawls’s theory was a product of a philosophical reasoning. His theory requires people to think about what sort of society they would want to be born into if they didn’t know what their own circumstances would be. Rawls thought people would want a high degree of political freedom, but also security; they would want the least well off to be cared for lest they themselves be born as the least well off. Most importantly, perhaps, Rawls’s theory—right or wrong—was a product of philosophical deliberation, not about opinion polls in which people simply come up with a distribution and have academics point to the results as Utopian. So when it comes to Rawls’s work, one can only conclude that Norton and Ariely are shrouded in a veil of ignorance.

Norton and Ariely also never consider the possibility that some of their respondents might want to see a different wealth distribution carried out through means other than forced redistribution by the state. For example, might we rid government of all the favor-seeking schemes that protect the assets of banking CEOs and agribusiness moguls and shift costs onto the poor and middle class? If people had greater information about the circumstances of time and place—like the effect of taking X dollars from businessman B means B can afford to hire fewer people—would they think differently about matters? Ask people for idealized abstractions and you’ll get idealized abstractions. After all, aren’t people “predictably irrational”?

Maslow’s Covered

In his own critique of Norton and Ariely, George Mason University economist Don Boudreaux reminds us that money ain’t everything:

That Americans “drastically” underestimate the wealth of “the very rich” compared to the wealth of “the poor” reveals that the difference in the number of dollars owned by “the very rich” compared to the number of dollars owned by “the poor” translates into a much smaller—that is, far more equal—difference in living standards. In other words, differences in monetary wealth are not the same as differences in living standards.

Indeed, maybe the reason Americans misjudge the actual wealth distribution is that most consider themselves wealthy in Boudreaux’s more subjective sense—at least when it comes to the things that matter. (Bill Gates might be able to fly in a private jet, but we can both fly. He might be able to afford $10,000-per-plate caviar, but we can both eat well.) Standard of living is different in important ways from the measure of assets distributed over a population.

As far as “the gap” is concerned, one of the major themes of this book is: If your goal is to alleviate poverty or perhaps to raise the baseline for what constitutes a minimum level of income that would allow most everyone to escape distress, that’s something reasonable people can talk about.

But that is not the same thing as worrying about what assets the wealthy control.

Suppose you asked the same Americans in the Norton-Ariely study, “If you could guarantee that every poor person in America had their basic needs met, would you agree to abandon your ‘ideal’ wealth distribution?” Their answers might surprise you. That’s because many people conflate the distribution of wealth and concern for the poor. Indeed, we don’t find any upper limit on income anywhere in Rawls, either. Rawls’s only criterion was that the least advantaged benefit from inequality. If you’ve ever been to North Korea or Cuba, it’s pretty obvious that they do.

ABOUT MAX BORDERS

Max Borders is the editor of The Freeman and director of content for FEE. He is also cofounder of the event experience Voice & Exit and author of Superwealth: Why we should stop worrying about the gap between rich and poor.