Could Israel Lose the Energy Prize in the Eastern Mediterranean?

Source: Jerusalem Center for Public Affairs, Daniel Wurmser “The Geopolitics of Israel’s Offshore Gas Reserves”, April 4, 2013.

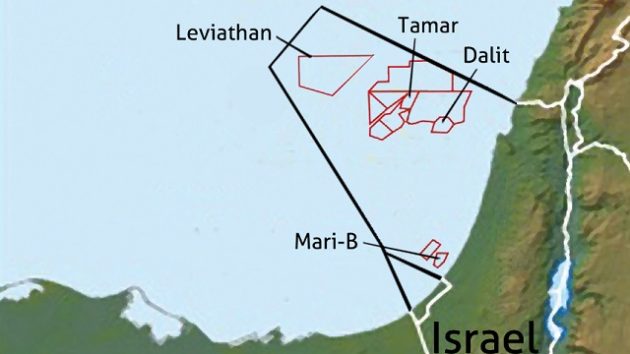

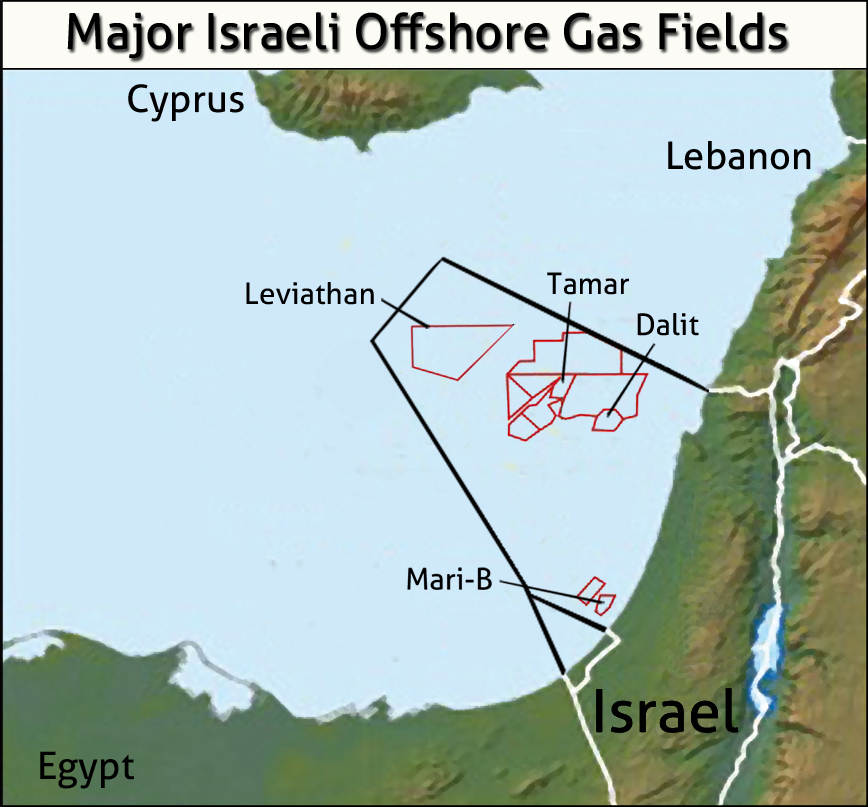

In December 2011, we published what might have been a prescient prediction of Israel‘s emerging energy independence, Will Israel Win the Energy Prize in the Levant Basin? We drew attention to the geo-political opportunities and security risks to the Jewish nation from the discovery and development of significant off shore gas deposits in its Exclusive Economic Zone (EEZ) in the Levant Basin. These have been developed by Houston, Texas-based Noble Energy, Inc. and its Israeli partner, Delek Group, Ltd. (hereafter referred to as “the Consortium”). In 2009 came the discovery of the Tamar gas field with estimated reserves of 7.9 trillion Cubic Feet (TCF) by the Consortium followed by the giant Leviathan field a year later in 2010 with estimated reserves of 21.9 TCF. Production from Tamar began flowing in April 2013 with immediate economic benefits to Israel. A third major gas field discovery in Israel’s offshore EEZ, the Royee, with estimated reserves of 3.2 TCF was announced in mid-December 2014 by Ratio Oil. The potential significance of these energy developments for Israel is huge.

Combined, Israel’s current gas reserves in the leading Tamar and Leviathan gas fields amount to more than 31.6 trillion cubic feet (TCF). The US Geological Survey has estimated that the Eastern Levant Basin in the Mediterranean may conservatively hold upwards of 125 TCF of gas and 81 billion barrels of oil at lower depths.

Using the US Energy Information Administration current NYMEX natural gas futures price as of December 26, 2014 for delivery January 2015 of $3.07 07 per MBTU, the estimated value of the 31.6 trillion cubic feet of estimated reserves in Israel’s offshore fields developed by the Consortium could be worth approximately $97 billion. That is equivalent to over 35.5% of Israel’s 2013 GDP of $273 billion. The impact on the country’s GDP growth would be significant.

As evidence of how Israel values these offshore gas discoveries in September 2014, the Ministry of Defense after a delay of several years, issued tenders to naval shipyards in Germany, South Korea, US and Israel for procurement of four specialized patrol vessels at an estimated cost of NIS 2 Billion ($510 Million dollars) to provide security for offshore gas production platforms. Israel was also concerned about Hezbollah threats to these offshore gas facilities. One of the suspected reasons for an Israel Air Force covert attack in Syria on December 8, 2014 was to prevent delivery of long range missiles including Iranian supplied Yakhont anti-shipping missiles to proxy Hezbollah that might used to attack offshore platforms and Israeli Naval patrol vessels.

However, these prospects of an energy independent future may have been thrown in jeopardy by a ruling in late December 2014 by Israel’s independent Anti-Trust Authority (IAA) essentially declaring the Consortium a monopoly and reneging on prior compromise deals with the Consortium partners. Noble Energy, Inc. and Delek Group had agreed in the compromise to sell interests in smaller developed offshore gas fields in exchange for retaining ownership of both the Tamar and Leviathan gas fields in Israel’s EEZ. The Consortium partners have requested an early 2015 hearing on the IAA ruling. Many believe this unprecedented IAA ruling may have been a political maneuver aimed squarely at the caretaker government of Israeli PM Netanyahu in the midst of a campaign for a snap election on March 17, 2015. The question before us is could Israel lose it’s much sought after energy prize in the Eastern Mediterranean?

Potential Economic Benefits to Israel from its Off Shore Gas Developments

One indication of the importance is reflected in the long term economic benefits to Israel. An Ernst & Young report released at a January 2014 energy conference in Israel pegged the value of those economic benefits to Israel at $52 billion reported by Globes Israel Business:

The Tamar gas field, which began production in April 2013, boosted Israel’s GDP by almost half a percentage point, and it is projected to boost GDP by 1.5 percentage points in 2014.

Ernst & Young Israel found that the main component of the gas’s value is not the government’s expected tax revenues from oil and gas, but the savings to the economy from the purchase of cheaper natural gas for electricity production, industry, and transportation. Gas currently costs Israel Electric Corporation (IEC) (TASE: ELEC.B22) about $6 per million BTU, a third of the cost of the alternative fuels – diesel, industrial oil, and liquefied natural gas (LNG) – all of which are imported.

Tamar Gas Platform offshore Israel: Source Noble Energy, Inc.

Tamar comes on line beginning Israel’s Energy Independence

The intervening three years have witnessed the opening of production for the Tamar field and negotiations of several deals to export production authorized by the Israeli cabinet.

The Consortium had opened up smaller gas deposits before discovering on January 1, 2009 the Tamar gas field with 7.9 TCF, 50 miles offshore Haifa. The Consortium committed $3 billion for development of Tamar. In March 2012 the Tamar Consortium “signed a 15-year, US$14 billion deal with the Israel Electric Corporation (IEC) to supply it with 42 billion cubic meters (BCM) of natural gas, with an option to increase the gas purchases up to $23 billion. By March 2012, the consortium developing Tamar had signed deals worth up to a total of $32 billion with six Israeli companies, committing up to 133BCM.” Delivery of Tamara’s first gas to Israel’s national power company began in April 2013. The growing Tamar field deliveries to the IEC eliminated reliance on supply of Egyptian gas via pipeline from the Sinai frequently disrupted by terrorist bombings.

Leviathan gas platform offshore Israel Source Ynet.org.

Leviathan Emerges but Strategic Investment Deals Falter

In 2010 came word of the discovery and development of the large Leviathan gas field located 81 miles West of Haifa and 29 miles southwest of the Tamar field with an estimated 21.9 TCF that lies in Israel’s EEZ. Leviathan is due to begin producing gas in 2017. Leviathan attempts at exports have taken its lumps. That is reflected in the failure to reach a deal with Australian energy concern, Woodside, Pty.

Meanwhile, the Woodside Leviathan Partners deal hasn’t been inked. UPI had this update on talks with the Delek Group:

Bloomberg News reported that Woodside, the No. 2 oil and gas producer in Australia, would pay more than $2 billion for a 30 percent stake in the Leviathan natural gas field from partners Delek, Noble Energy and Avner Oil Exploration.

Delek said, however, that a formal deal was still in the works.

“The negotiation between the Leviathan partners and Woodside toward signing a binding agreement is ongoing,” the company said. “Should a significant development in relation to the above-mentioned negotiations take place, the partnerships will publish an immediate report.”

Woodside’s CEO Peter Coleman at a Houston HIS/CERA energy conference in early March 2013 expressed “confidence” about closing on the purchase of Nobel partner interest in the overall Leviathan deal.

Negotiations between the Consortium and Woodside continued. In February 2014, a Memorandum of Understanding (MOU) was signed for final negotiations between the Consortium and Woodside. There was the hope that the Woodside deal might finally close at an enhanced its price for purchase of a minority interest in Leviathan which would provide LNG technology.

On May 21, 2014, Bloomberg reported, “Woodside Scraps $2.6 Billion Israeli Gas Deal as Talks Fail”:

Woodside Petroleum Ltd. (WPL), Australia’s second-biggest oil and gas producer, scrapped an agreement to buy a quarter of Israel’s largest natural gas field for as much as $2.6 billion after talks to complete the deal collapsed.

“Negotiations between the parties failed to reach a commercially acceptable outcome,” the Perth-based company said today in a statement. Woodside had been in talks with a group includingNoble Energy Inc. (NBL) to invest in the Leviathan venture.

Tamar and Leviathan Consortium Potential Gas Deals with Jordan and Egypt

Agreement between the Consortium and the Israeli government allotted up to 40 percent of Tamar and Leviathan production for export. The US State Department thought this might be useful for development of regional economic and peace prospects. That resulted in negotiations of gas delivery projects with a Palestinian energy group and major Jordanian potash and bromine companies. A potential Egyptian contract may be in the works, as well. Consortium partner Noble Energy played a key role in facilitating these initial agreements. The New York Times reported:

Noble helped break the impasse by striking a separate deal with two Jordanian mineral companies, Arab Potash and Jordan Bromine. The companies will buy about $500 million of gas over 15 years from Tamar.

Jordan is one of the latest deals for Leviathan. In January, Noble and its Israeli partners reached an agreement to supply a power plant under construction in the West Bank by a Palestiniangroup.

Industry experts say that Noble will need more long-term commitments to support the expense of Leviathan. The project is expected to cost as much as $8 billion, and the Jordan deal accounts for only about 9 percent of the gas.

The most likely anchor customer is Egypt, a huge and growing market. Today, two gas export facilities on the Mediterranean are sitting largely idle. The Egyptian government is blocking exports in order to meet high domestic demand and stave off power blackouts.

This year, Noble reached nonbinding agreements with the owners of both of these facilities — British Gas, the large British producer, and a joint venture of Italy’s ENI and Spain’s Gas Natural Fenosa — to supply their facilities from Tamar and Leviathan. As part of the deals, the gas would also probably flow to the domestic market in Egypt.

Source: Turkish News September 8, 201.

Turkish Double Dealings over Offshore Gas in the Levant Basin

Turkey under Islamist Premier, now President, Recep Tayyip Erdogan had threatened the Republic of Cyprus with retaliation over the discovery of the Aphrodite gas field off the southern coast of the Republic an EU member. The Aphrodite field with 7 TCF of natural gas is located 24 miles west of the giant Leviathan field with 21.9 TCF in Israel’s EEZ. Both the Aphrodite and Leviathan fields were developed by the Noble Energy, Inc. and Delek Partners consortium. We noted the quickening pace in November 2011 of geo-political moves and countermoves over exploitation of these strategic gas fields in the Levant Basin:

- On November 2, 2011 Israel signed a bilateral energy development agreement with Cyprus, and Noble Energy announcing the development of a major LNG facility off the Island nation’s south coast;

- On November 16th Turkey announced an offshore drilling deal with Shell Oil in an area in the waters close to the Turkish enclave in northern Cyprus;

- On November 20-21, Israel’s then deputy Foreign Minister Danny Ayalon met with Greek officials to discuss joint exploration of the region’s gas fields;

- On November 23rd, Turkish Energy Minister Taner Yildiz said Israeli and Cypriot energy exploration in the Mediterranean was illegal, an agreement should first be reached with all relevant parties, and resources should be equally shared; and

- On November 25th, Russia announced that it was sending its aircraft carrier the Admiral Kuznetzov for maneuvers in the disputed area offshore of Cyprus in a clear demonstration of support for Greek Cypriot claims and as a warning to the Erdogan regime in Ankara.

In mid-September, 2011, two Israeli Air Force (IAF) F-15s flew over both the Republic of Cyprus and the Turkish northern enclave after buzzing a Turkish research vessel off Cyprus’ southern coast in violation of Cyprus’ EEZ. An Israeli helicopter loitered overhead near a Turkish research vessel, Piri Reis, while the later was in the Aphrodite gas field claimed by the Republic of Cyprus. IAF AWACs aircraft were patrolling along the EEZ of Cyprus and Israel, at an altitude of more than 40,000 feet. They were monitoring Turkish intrusions over Cypriot airspace. In symbolic retaliation, Turkey’s Air Force jets made passes over a Greek island off Turkey’s southwestern coast.

A week prior to these confrontations over Greece and Cyprus, Turkey and Turkish Cyprus concluded an agreement delimiting maritime boundaries in the eastern Mediterranean. Agreements that conflict with the Republic of Cyprus-Israel EEZ. Turkey declared that it would protect its sole research vessel with warships. These actions raised the prospect of possible armed conflict.

Turkey’s posturing in 2011 was based on its seizure of an enclave, the rump Turkish Northern Cypriot ‘Republic’ carved out by a Turkish invasion in 1974. An opportunistic invasion contrived by the Turkish government at the time to counter the Greek military coup of the Archbishop Makarios government of Cyprus. All of Cyprus is recognized by the EU. The Island’s offshore EEZs are divided among the Republic, the North Turkish “Republic” and two British bases on the Island.

Machinations over the Turkish Northern Cypriot Republic’s stake hold in the Cypriot EEZ gas field surfaced in an embarrassing episode at an international energy conference in Tel Aviv on November 6, 2014. That was the surprise address by Özdil Nami, the foreign minister of the self-declared Turkish Republic of Northern Cyprus (TRNC) at an Energy and Business Conference. Turkey is the only country that recognizes the TRNC enclase it seized from Cyprus in 1974. The Jerusalem Post noted these remarks of Nami that drew the ire of Cypriot businessmen at the conference and an official involved with pursuit of joint development of the proposed Eastern Mediterranean Pipeline:

Natural resources of Cyprus belong to all Cypriots and must benefit all Cypriots.

Nami called for a united Cyprus comprised of Cyprus and Turkish federations, with cooperation fueled by the offshore natural gas discoveries. Dealing with a united Cyprus expands the options available.

That led to this comment in a press release from Prof. Toula Onoufriou, president of the Cyprus Hydrocarbons Company:

The invitation of Mr. [Özdil] Nami to this conference and his appearance in the opening session without any mention in the conference program is unacceptable and is not in the spirit of collaboration that has been developed between our countries.

Earlier in 2014, there was an abortive round of Turkish negotiations with Cyprus over “unification” of the Republic of Cyprus. Meanwhile Turkey was pressing for a lucrative share of the gas development offshore Cyprus and transmission to EU markets via its network of pipelines.

Erdogan threatened to bring Israel before the International Criminal Courts over the deaths of Turkish nationals in an Israeli naval commando raid on the Turkish ferry vessel, the Mavi Marmarathat pierced the enforced blockade during the May 2010, Free Gaza flotilla. The dispute threatened a diplomatic impasse between the two countries until the March 2013 trip by President Obama to Jerusalem. He prevailed upon Israeli PM Netanyahu to call then PM Erdogan and apologize. Israel offered compensation to the Turkish victims in the Mavi Marmara incident. That cleared the way for bi-lateral discussions for possible transmission of gas via a submarine pipeline from the Leviathan field to on-shore Turkish receiving facilities at Ceyhan on the Mediterreanean coast with its network of pipelines servicing the EU. Today’s Zaman in February 2014 reported the burgeoning commercial rapprochement with the Consortium over a possible gas pipeline deal:

Turkey’s Vatan daily said that representatives from US-based Noble Energy and Israel’s Delek Group, two of Leviathan’s largest stakeholders, are in talks with four Turkish energy firms for a possible deal in the construction of a natural gas pipeline via Turkey to Europe. Vatan said the Leviathan shareholders are in negotiations with Turkey’s Turcas, Zorlu, Çalık and Enka Enerji for a pipeline that would carry 8 billion cubic meters (bcm) of Israeli gas via Turkey starting in 2017, the year Israel expects to start extracting gas.

Globes Israel Business reported:

In March 2014 “that two Turkish companies, Zorlu Holding and Turcas Petrol, had participated in a tender for the possible construction of a 7-10 bcm/y gas pipeline to link Leviathan with the Turkish mainland. The proposed 500 kilometer pipeline would cost about $3.5 billion. Zorlu Holding has stakes in several power plants in Israel and its chairman, Ahmet Nazif Zorlu, is known to have close links with the governing Justice and Freedom Party (AKP) in Turkey.

Then, Israel’s 50 day summer 2014 war with Hamas erupted, that virtually ended these discussions. In early August Turkish Energy Minister, Taner Yildiz announced that a deal was unlikely until a cease fire was concluded between Israel and Hamas. The Jerusalem Post noted:

Calling for “an end to the cruelty in Palestine,” Yıldız said that his country’s “door will be closed,” until calm has been attained, the Hurriyet added.

“If we build a natural gas pipeline from Israel or the eastern Mediterranean under these circumstances, the blood of innocent infants and mothers, not natural gas, would flow through it,” Yıldız said, according to the Hurriyet report.

Turkish parliamentary opposition in Ankara and Israeli Consortium partner Delek Group optimistically suggested that there might be renewal of talks. Erdogan’s opposition over the 2014 IDF conflict with Hamas virtually ended the discussions. As we shall see the Consortium’s hopes for a means of transmitting Leviathan gas fields output the lay in the EU’s interest in the Eastern Mediterranean pipeline with Cyprus.

Russian President Putin and Turkish President Erdogan Ankara, December 1, 2014. Source: Turkish Presidential Photo Service.

Putin’s December 2014 “Surprise” Gas Deal with Turkey

Turkey’s President Erdogan a new card to play in the energy geo-politics of the region with Russia’s embattled President Putin. On December 1, 2014 at a meeting between the two heads of government in Ankara, Putin announced abandonment of the yet to be completed South Stream pipeline to the EU via Bulgaria. In its stead, Putin proposed a proposition to Erdogan that was hard to pass up despite Turkey’s increasingly being beholden to Russia as its principal gas supplier. As reported by Eurasia.net, the pact presented compelling opportunities for both countries:

Energy-poor Turkey stands to benefit from Moscow’s surprise decision to drop the $45-billion South Stream natural gas pipeline project. At the same time, it raises questions about whether Turkey will become a pawn in the broader energy contest between Russia and the EU.

Ankara has long been keen to wean itself off Russian energy, which currently accounts for an estimated 57 percent of its gas needs, according to the 2014 BP Statistical Review of World Energy. Both the Turkish government and the European Union had seen gas imports from Azerbaijan, a cultural cousin and close ally of Ankara’s, via the Trans-Anatolian Pipeline (TANAP) as the answer to decreasing their level of energy dependency on the Kremlin.

Eurasia.net detailed Putin’s deal noting:

He proposed a new, 63-billion-cubic-meter-per-year gas pipeline running under the Black Sea from Russia via Turkey to the Greek border, which would serve as a forwarding point to Europe. He pledged a 6 percent discount on the price of the 14 bcm of gas available for sale annually to Turkey from the pipeline.

The deal would increase Turkey’s reliance on Russia for supply of gas, while reducing the cost for its power and commercial requirements. However, it places Islamist President Erdogan in a diplomatic quandary given Putin’s support for the embattled Syrian regime of Bashar Assad. Erdogan has argued to the Obama Administration that the toppling of the Assad regime was the price of Turkey’s joining the US-led coalition seeking the “degrading and destruction” of the Islamic State occupying large swaths of both Syria and Iraq. The Putin Erdogan deal is presently embodied in a Memorandum of Understanding awaiting further negotiations. Given both US and EU sanctions against Russia over its takeover of the Crimea and support for the irredentist conflict in Eastern Ukraine, the deal between the two autocrats over gas deliveries to the EU market is problematic. Enter the Eastern Mediterranean Gas Pipeline involving Israel, Cyprus and Greece.

.jpg)

The Eastern Mediterranean Pipeline Project Rises to the Fore.

President Erdogan has been relentlessly pursuing a reckless geo-political strategy for several years disputing Cyprus’ sovereign right to exploration and development of offshore gas and oil in its EEZ. We saw that reflected in actions Erdogan directed in 2011 sending research vessels, Turkish air craft and naval vessels to violate the United National Convention of the Law of the Seas (UNCLOS). Turkey issued a NAVTEX (Navigation Telex) warning on October 3, 2014 that rattled the Cypriot Republic, EU and spurred Israel to suggest a counter proposal – The Eastern Mediterranean Pipeline. Moreover, as we saw on November 6, 2014 the sudden appearance of the foreign minister of the Turkish Northern Republic of Cyprus disrupted a Tel Aviv Energy conference. He conveyed less than subtle demands of Ankara for development of undersea resources benefitting “all Cypriots” and presumably Turkey. When Vice President Biden visited President Erdogan in Istanbul in November 2014, while primarily concerned about enlisting Turkey in the war against the Islamic state, he also expressed the Administration position on Cyprus. He suggested that moribund unification talks be resurrected and that both sides on the Island seek joint development of the EEZ energy resources.

In partial response, the European Parliament passed a resolution on November 5, 2014, titled, “European Parliament (EUP) resolution on Turkish actions creating tensions in the exclusive economic zone of Cyprus.” The EUP resolution underscored the illegal actions of the October 3, 2014 NAVTEX issued by Erdogan’s Turkey violating UNCLOS. Turkey was conducting seismic surveys in Cyprus’ sovereign EEZ over the period from October 30 to December 30, 2014. These illegal actions by Turkey violated Cyprus’ maritime border with Egypt. Moreover, it jeopardized exploration by Italy’s ENI and KOGAS in blocks of the Cypriot EEZ. The EUP resolution drew attention to Turkey’s 2005 accession filing to the EU, as it required approval of all EU members and poisoned prospects for unification discussions between the Republic of Cyprus and the Northern Turkish enclave on the Island. The resolution suggested that Turkish withdrawal of troops stationed in the enclave was a pre-condition for accession to the EU. It urged immediate revocation of the offending NAVTEX and negotiation of bilateral agreements with the Cypriot Republic covering exploration and developments of undersea resources to benefit all Cypriots. The EUP Resolution suggested that Turkey sign the UNCLOS and honor its provisions.

In late November 2014 Israel’s Energy Minister, Sylvan Shalom, raised the Eastern Mediterranean Pipeline project in meetings with the European Commission’s new energy chief Maros Sefcovic at a meeting hosted by the Italian EU President. An article in Natural Gas Europe reported, “The Cypriots also seem supportive of such an endeavor, the Cypriot Foreign Minister receiving Israel’s suggestion positively and stating that a viability study was being conducted” for joint development of a submarine pipeline to Greece connecting the gas fields in the Israeli and Cypriot EEZs for delivery of gas to EU.

This was a geo-political gauntlet thrown down to counter the illegal moves of Turkish President Erdogan. It was an outgrowth of the bi-lateral agreement struck in November 2011 between Israel and Cyprus that would enable the Noble Energy-Delek Group to undertake exploration of the feasibility of the Eastern Mediterranean Pipeline. The announcement came just before the strategic December 1, 2014 meeting in Ankara between Putin and Erdogan during which the Russian President announced abandonment of the $45 Billion South Stream Pipeline that would deliver Russian gas to the EU. The Eastern Mediterranean Pipeline offered a secure means of transmitting gas through several EU members and associate member Israel.

On December 9th, Israel, Cyprus and Greece pitched the Eastern Mediterranean pipeline a day before a conference organized jointly by Natural Gas Europe, the Greek Energy Forum, ESCP Europe, RCEM and the European Economic and Social Committee (EESC). The conference was titled “2030 EU Energy Security, the Role of the Eastern Mediterranean Region” and took place at EESC headquarters in Brussels. Natural Gas Europe in an article on the EESC conference noted the comments of Greek Energy Minister, Ioannis Maniatis:

Europe will need an extra 100 bcm of natural gas in the next 15 years, and in light of Europe’s increasing dependence on imports to fulfill its energy needs, the EU must find a sustainable model to ensure it is a competitive economy.

The EU needs to reduce external dependence, increase efficiency, diversify its sources and routes of supply, and improve interconnectors, he added. Fully connected energy grids, greater transparency, good governance and a thorough understanding of global events should also be the focus of the EU according to Maniatis. He explained that Greece’s importance is growing. TheEast Med pipeline pitched by Israel, Cyprus and Greece would run from Israel and Cyprus via Greece to Italy and then to the rest of Europe is technically feasible and attached to attractive prospects said Maniatis. He told the audience that the results of a feasibility study on the East Med pipeline will be released next year and that the pipeline would serve as a new source and provider of natural gas comparable to the Southern Corridor. The attractiveness of the East Med Pipeline, said Maniatis, is that unlike the Southern Corridor, it would pass exclusively through four member states and hence deserves strong EU backing for its materialization.

The Eastern Mediterranean Pipeline had received the endorsement of the EC as a priority project for underwriting in November 2013. According to The Guardian that could provide the Eastern Mediterranean pipeline project “access to a €5.85bn fund, and preferential treatment from multilateral banks.”

Natural Gas Europe reported at the time the options under consideration:

The basic plan will see the pipeline stretch from the Leviathan field offshore Israel on to Cyprus ending in eastern part of the Island of Crete in Greece. Three alternate routes were discussed:

- To the Peloponnesus Peninsula joint via spur with the Trans-Adriatic Pipeline (TAP)

- From Crete to northern Greece where it would join the Interconnector Greece-Bulgaria (IGB)

- From Crete to the Revythousa LNG terminal close to Athens. The terminal would be significantly upgraded to accommodate large amounts of gas exports thereafter.

The technically difficult 1,880 kilometer long submarine pipeline project, reaching depths of more than 2,000 meters, would connect Leviathan and Aphrodite gas fields ultimately to Italy. Cost for the project was estimated at over $20 Billion and would likely not be concluded at the earliest until 2020, assuming that production of the Leviathan field in the Israeli EEZ begins in 2017. With the demise of both the Turkish Leviathan-Ceyhan pipeline and the Australian Woodside Pty. Ashdod LNG –Eilat pipeline for delivery of gas to the Asian markets, the Eastern Mediterranean pipeline project may have serious consideration. There is the alternative of the onshore LNG facility at Vassilikos on Cyprus’ south shore to be built by the Consortium at an estimated cost of $10 billion. A Memorandum of Understanding for planning the Vassilikos LNG complex was signed by Cyprus and the Consortium in June 2013. In the interim, offshore floating LNG processing platforms that might be leased to ship processed gas via pressured LNG vessels to receiving terminals in Greece and Italy. However, Noble Energy was not initially supportive of the Eastern Mediterranean pipeline option, instead concentrating on sales from Leviathan to regional users like Jordan and Egypt and building the proposed Cypriot LNG processing facility. As we will shortly see, as a result of regulatory actions by the independent Israeli Anti-Trust Authority (IAA), both Noble Energy and its Israeli consortium partner Delek Group plans for Leviathan as well as the Eastern Mediterranean Pipeline may be in jeopardy

Watch this CNBC video: Israel-Cypriot Pipeline: Game Changer for EU Energy?

Dr. David Gilo, Director Israel Anti-Trust Authority.

Could Regulatory Zeal and Politics Deprive Israel of its Offshore Energy Prize?

Israel’s pursuit of energy independence and potential gas exports may have been upended by a ruling regarding Israel’s Cartel Law by the head of the independent Israel Anti-trust Authority (IAA). Dr. David Gilo of the IAA effectively ruled that the Noble Energy – Delek consortium constituted a monopoly and would be forced to sell the Leviathan or Tamar fields in Israel’s offshore Exclusive Economic Zone. Gilo was cited by the New York Times saying, “The entry of Delek and Noble into Leviathan has created a situation in which these groups control all the gas reserves on the coast of the state of Israel.” Gilo’s rationale for his ruling was the prior agreed to sale of smaller gas fields Tanin and Karish owned by the Consortium “did not create a real competitive solution to solve the problem of a monopoly in the market.” Globes, Israel Business reported in an article, Regulator decides Tamar and Leviathan form monopoly:

[Gilo] is going back on his decision, subject to a hearing, to let the companies continue holding both the Tamar and Leviathan gas fields. The State will now require the companies to sell their holdings in one of the fields.

Sources in the energy market believe that such a step will delay development of the Leviathan field by several years and could see Israel dragged into the international court of arbitration by US company Noble Energy, which has been developing both fields.

The reaction from Noble Energy was swift:

Noble Energy Israel Country Manager Binyamin (Bini) Zomer said, “For 16 years, Noble Energy has invested in the exploration and development of Israel’s gas and oil resources. To date we have invested with our partners close to $6 billion in developing the country’s oil and gas sector. These investments contribute to the Israeli economy and environment, and at the same time grant Israel energy independence while providing an opportunity for regional cooperation and contributing to regional stability.”

[…]

He warned, “The antitrust regulator’s decision to go back on the agreement. casts a shadow over the future of Israel’s gas and oil sector and influences Noble Energy’s continued investment in the country.”

Zoma’s comments were mirrored in official statements from Houston-based Noble Energy’s Chairman in a news release:

Earlier today, Noble Energy, Inc. (NYSE: NBL) and its partners in the Leviathan field were advised by the Israel Anti-trust Authority of its decision to not submit the Consent Decree to the Anti-trust Tribunal for final approval. In response, Noble Energy and partners have requested a hearing on the topic with the Anti-trust Authority, which Noble Energy expects to occur in the next few weeks.

In March 2014, Noble Energy, its partners, and the Anti-trust Authority reached agreement for the Consent Decree that included the divestiture of the Tanin and Karish gas fields. This agreement is a key component for the final investment decision on the Leviathan development.

Charles D. Davidson, Noble Energy’s Chairman, commented, “The actions of the Anti-trust Authority are another disturbing example of the uncertain regulatory environment in Israel. Specifically, this is a matter that we believed was resolved some time ago and follows on recent assurances from the Anti-trust Authority that approval was forthcoming. We believe this is a harmful precedent for Israel to set and we will vigorously defend our rights relating to our assets.”

Ominously, the ruling may delay, if not stop, development of the significant Leviathan gas field with more than 21.9 TCF. Further, the IAA would significantly delay indefinitely the implementation of the Eastern Mediterranean Pipeline connecting Leviathan with the adjacent Cypriot Aphrodite gas field with 7 TCF via Greece and Italy to securely supply gas to the EU thereby stymieing geo resource hegemony by Russia and Turkey. The Noble-Delek Consortium had signed agreements with the Republic of Cyprus in 2011 for the joint development of Cyprus’ offshore gas fields, despite threats from Turkey and its enclave the Northern Turkish Cypriot Republic.

Billions of Israeli tax revenue, billions of returns to the Noble Energy–Delek consortium and billions in sales to Egypt, Jordan and other regional markets in signed agreements are now at risk. The effects on the trading values of the Noble Energy-Delek consortium stocks on the NYSE and Tel Aviv Stock Exchanges were immediate. Noble Energy stock (NBL-NYSE) plummeted by over 6.4 % from $50.97 at the market close on December 22nd to $ 47.73, currently. Globes reported the fall off in trading for the Delek and Tamar partners caused by the IAA announcement:

In the stock market, Delek Group Ltd. (TASE: DLEKG) fell 16.5% for the largest fall on the Tel Aviv 25 Index following the antitrust order to sell either its Leviathan or Tamar holdings. Delek’s energy exploration units Avner Oil and Gas LP (TASE: AVNR.L) and Delek Drilling Limited Partnership (TASE: DEDR.L) fell 11.75% and 12.73% respectively. Tamar partner Isramco Ltd. (Nasdaq: ISRL; TASE: ISRA.L) fell 7.44% on the day’s largest turnover, and Leviathan partner Ratio Oil Exploration (1992) LP (TASE:RATI.L) fell 16.9%.

This ruling comes amidst the snap election campaign triggered by a no-confidence vote confounding the ability of the Netanyahu caretaker government to seek possible redress via the Knesset. There are suspicions in Israel that the IAA ruling may have been politically motivated by Labor Party and Histadrut leaders, given the latter’s control over the Israel Electric Company, the national power authority.

These rapid fire developments brought troubling assessments from Gal Luft in an article in The Journal of Energy Security, “Israel’s Energy Dream- the End is Nigh”:

After years of delays and billions of dollars spent, a new and increasingly likely scenario should be considered – the premature – and tragic – death of the Israeli gas dream. I alluded to this option in an August 2013 article titled “Israel’s Zero Gas Game” in which I warned that Israel has become so busy dividing the pie that its leaders forgot it must first be baked and that due to the failure of the government to present a clear vision for the country’s energy sector, articulate the rights and responsibilities of foreign investors and most importantly set rules and stick to them.

[…]

There are very few oil and gas companies who have both the experience of drilling in deep waters and the willingness to associate themselves with Israel, especially in light of Noble’s experience. With falling energy prices worldwide, the chance of a Noble-like operator popping out of nowhere is slim. This means that in its desire to avoid the creation of a monopoly, Israel is taking the risk that Leviathan, the world’s largest offshore gas discovery of the past decade, will not be developed for many years to come – if ever.

Dr. Norman A. Bailey, former Reagan era National Security Advisor on national economic security, offered this assessment of the IAA ruling in a Globes Israel Business column, “Israel shoots itself in both knees”:

This is not Israel shooting itself in the foot, it is Israel shooting itself in both knees. This incredibly stupid, illegal and immoral decision will undoubtedly be reversed by the courts and/or international arbitral tribunals, but by the time that happens much of the damage will have been done and recovery will be difficult or perhaps impossible. Even if an accommodation is reached without legal action, the image of Israel as a reliable partner will have been severely degraded.

Echoing Dr. Bailey’s concerns, our NER colleague Dr. Richard L. Rubenstein commented:

The Israeli regulators are both insane and suicidal, but not that different than some U.S. regulators, save that America has a greater margin of error to protect it from comparable damage. Instead of being glad that an American firm has taken the huge risk in this investment, they prefer ideological rigidity to a quantum leap in Israel’s economic and political situation. Will petty little men who probably never managed anything approaching the magnitude of this project have the power to ruin it?

Given this maligned IAA ruling, will Israel in 2015 come to its senses, overcome misplaced regulatory zeal and re-gain the prospect of a promising economic future fueled by these important energy discoveries in the Levant Basin?

EDITORS NOTE: This column originally appeared in the New English Review.