First-Time Buyer Mortgage Share and Mortgage Risk Indexes (FBMSI and FBMRI) for February 2015

SUMMARY:

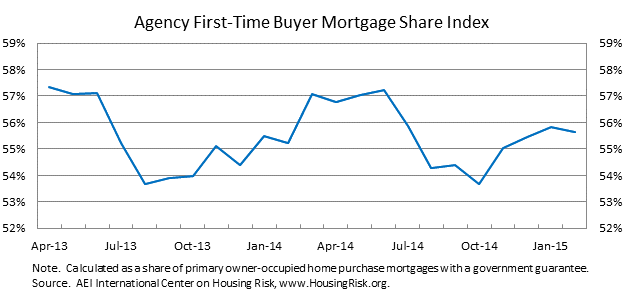

- First-time buyers accounted for nearly 56 percent of primary owner-occupied home purchase mortgages with a government guarantee, up slightly from the prior February.

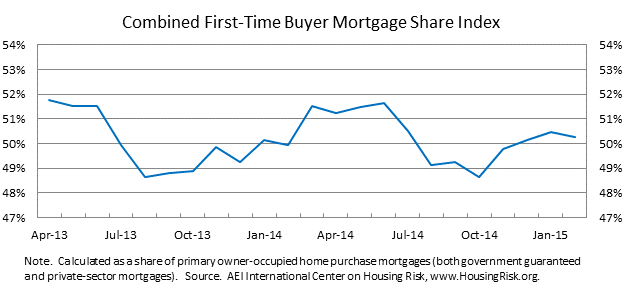

- The Combined FBMSI (which measures the share of first-time buyers for both government-guaranteed and private-sector mortgages) stood at an estimated 50 percent.

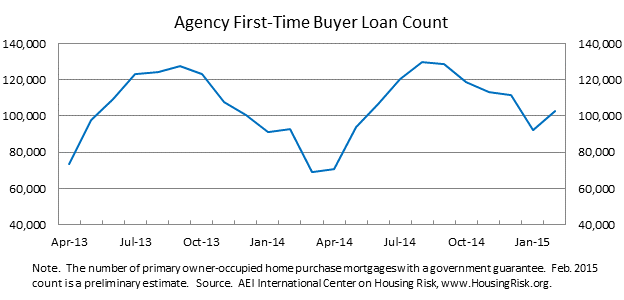

- The number of primary owner-occupied purchase mortgages going to first-time buyers over the 6-month period of September 2014-February 2015 totaled an estimated 667,000, up almost 4 percent from the 643,000 mortgages over the same 6-month period in 2013-2014.

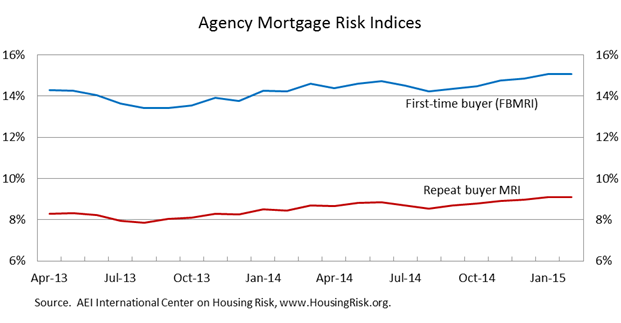

- The Agency FBMRI stood at 15.07 percent, up 0.2 percentage point from the average over the prior three months and up 0.8 percentage point from a year earlier. The Agency FBMRI is about 6 percentage points higher than the mortgage risk index for repeat home buyers.

The First-Time Buyer Mortgage Share and Mortgage Risk Indexes (FBMSI and FBMRI) are key housing market indicators based on monthly data for nearly all government-guaranteed home purchase loans, which greatly reduces the risk of sample error. By relying on millions of loans, this approach stands in contrast to traditional first-time buyer surveys based on small samples of home buyers or real estate agents.

In February 2015, first-time buyers accounted for nearly 56 percent of primary owner-occupied home purchase mortgages with a government guarantee, according to the Agency First-Time Buyer Mortgage Share Index (FBMSI). The February share was slightly lower than the revised share for January and slightly above the February 2014 share. As indicated in the chart below, the first-time buyer share has displayed no trend over its 23-month history apart from seasonal variation.

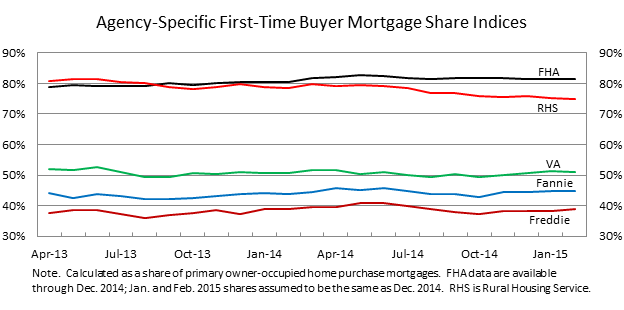

The chart below displays the monthly first-time home buyer percentage by agency. As shown, the share varies widely across agencies. FHA is at the high end with a share consistently around 80 percent, while Freddie Mac is at the low end with a share generally below 40 percent.

The Combined FBMSI (which measures the share of first-time buyers for both government-guaranteed and private-sector mortgages) stood at an estimated 50 percent in February 2015. Consistent with the agency series, the broader combined share has varied seasonally but has displayed no trend over its 23-month history (see chart below).

The monthly count of agency first-time buyer mortgages (the Agency FTB Loan Count) is presented in the chart below. The number of primary owner-occupied purchase mortgages going to first-time buyers over the 6-month period of September 2014-February 2015 totaled an estimated 667,000, up almost 4 percent from the 643,000 mortgages over the same 6-month period in 2013-2014. This increase in the Agency FTB Loan Count outpaced the 2½ percent rise in total agency purchase loan volume over the same period.

The Agency FBMSI is calculated, as noted above, from a nearly complete dataset of government-guaranteed home purchase loans, which greatly reduces the risk of sample error. The near-universe of included loans stands in contrast to the 2014 survey of home buyers and sellers conducted by the National Association of Realtors (NAR), which was based on responses constituting only 0.2 percent of all purchase loans originated during the 12-month survey period and was voluntary, with responses received from only 9 percent of those mailed the 127-question survey.[1] Data on the importance of first-time home buyers for non-agency loans are not available to our knowledge from any source. The Combined FBMSI is calculated from the loan-level data in the Agency FBMSI, along with assumptions for the non-agency loans that we believe to be reasonable.

The Combined FBMSI percentage of first-time buyers is much higher than that estimated by the NAR. For the July 2013-June 2014 period covered by the NAR’s 2014 survey of home buyers and sellers, the Combined FBMSI showed an average share of 50 percent, substantially higher than the NAR’s survey of home buyers finding that first-time home buyers took out 36 percent of the mortgages used to buy a primary residence.[2]

“February’s results show that first-time buyer volume and share remain strong,” said Edward Pinto, co-director of the American Enterprise Institute’s (AEI’s) International Center on Housing Risk.

“We calculate first-time buyer shares from comprehensive data provided directly by the federal housing agencies, making our indices the most complete measures currently available,” said Stephen Oliner, co-director of AEI’s International Center on Housing Risk.

AEI’s Agency First-Time Buyer Mortgage Risk Index (FBMRI) estimates the share of first-time buyer mortgages that would default in a stress event comparable to the 2007-08 financial crisis based on the actual performance of loans originated in 2007. The Agency FBMRI stood at 15.0710 percent in February, up 0.2 percentage point from the average over the prior three months and up 0.8 percentage point from a year earlier. As indicated in the chart below, the Agency FBMRI is about 6 percentage points higher than the mortgage risk index for repeat home buyers.

The higher risk for the mortgages taken out by first-time buyers is largely due to risk layering. As shown in the table below, in February 2015, 68 percent of first-time buyer mortgages had a combined loan-to-value ratio (CLTV) of 95 percent or higher, and 96 percent had a 30-year term. Given the combination of little money down and slow amortization, these buyers will have very little home equity for a number of years unless their house appreciates substantially. In addition, about one-fifth of first-time buyers taking out mortgages had a FICO score below 660, the traditional definition of subprime mortgages, and one-quarter had total debt-to-income ratios above 43 percent, the limit set by the Qualified Mortgage rule. The mortgages taken out by repeat buyers are less risky along two dimensions in particular: a much smaller share had a CLTV of 95 percent or higher and a smaller share had a FICO score below 660.

Characteristics of Mortgages Taken Out by First-Time and Repeat Home buyers:

| February 2015 | ||||

| CLTV ≥ 95% | 30-year Term | FICO < 660 | DTI > 43% | |

| First-time Buyers | 68% | 96% | 21% | 26% |

| Repeat Buyers | 37% | 91% | 10% | 24% |

| Source. AEI International Center on Housing Risk, www.HousingRisk.org | ||||

This risk profile for first-time buyers implies that the supply of mortgage credit to this group is not tight. In February 2015, the median first-time buyer with an agency mortgage made a down payment of only 5 percent, or $7500 in dollar terms. For the large subset of first-time buyers who obtained mortgages with an FHA, VA, or RHS guarantee, the median down payment in February was even smaller ― 3 percent ($4100 in dollar terms). Moreover, the median FICO score in February for first-time buyers with agency mortgages was 705, slightly below the median of 713 for all individuals in the United States with a score.[3] For first-time buyers with FHA-insured loans, the median FICO score in February was only 673, well below the middle of the distribution for the U.S. as a whole. These data are a strong counterpoint to the NAR’s commentary that “interested first-time home buyers continue to find it challenging to obtaining [sic] financing because of weak credit and income credentials and inability to pay the required down payment.”[4]

“It is in the NAR’s financial interest to push for ever looser credit standards. But the facts demonstrate that down payments are already low and total debt ratios are high,” said Pinto.

“The FICO data undercut the argument that first-time buyers have limited access to mortgage debt. Many borrowers with weak credit profiles are buying homes.” said Oliner.

The FBMSI and FBMRI are objective and transparent measures of the first-time buyer share and the riskiness of first-time buyer mortgages, respectively, based on the millions of loans contained in National Mortgage Risk Index (NMRI) database developed by AEI’s International Center on Housing Risk. The FBMSI, FBMRI, and NMRI are updated monthly. For more information about these indexes and the work of the center, please visit HousingRisk.org.

[1] The NAR conducts a separate survey of realtors (http://www.realtor.org/reports/realtors-confidence-index) that also collects information on first-time homebuyers. Although this monthly survey is sent to more than 50,000 realtors (out of a total of 1.1 million members), the response rate is low; only 4,259 responses were received for the January 2015 survey and of these, only 1,979 realtors provided information based on the last sale they had closed in January. Thus, the results from both NAR surveys reflect very limited information with questionable reliability.

2 A small part of this gap could reflect a difference in the definition of first-time homebuyers. The various federal agencies use the Uniform Residential Loan Application (Form 1003), which asks the following questions: have you had an ownership interest in a property in the last three years and was it a principal residence? Applicants who have not owned a principal residence within the last three years are considered to be first-time homebuyers by these agencies. The NAR survey asks whether the purchaser is a first-time buyer, without further instruction, which likely results in a slightly narrower definition than the one used by federal agencies.

3 The national median score is from FICO; the other FICO scores cited here are from AEI’s International Center on Housing Risk.

4 Supra. NAR realtor confidence survey, p. 12.

Trackbacks & Pingbacks

[…] First-Time Buyer Mortgage Share and Mortgage Risk Indexes (FBMSI and FBMRI) for February 2015 […]

Comments are closed.