America’s fiscal future is gloomy, according to the 10-year forecast released Wednesday by the economic meteorologists (accountants, really) at the Congressional Budget Office (CBO). The CBO projected that by 2034 the U.S. federal government will run a $2.6 trillion deficit, equivalent to 6.1% of GDP, while public-held debt would nearly double from $26 trillion to $48 trillion, reaching a record 116% of GDP. These numbers are “mind boggling” and “absolutely astounding,” said Heritage Foundation research fellow Jeffrey Griffith on “Washington Watch.”

Indeed, the historic nature of America’s irresponsible borrowing binge is so unprecedented that it earned multiple mentions in the CBO’s report summary. The CBO noted that a debt equivalent to 116% of GDP represents “an amount greater than at any point in the nation’s history.” That’s more debt — both in absolute terms, and as a percentage of GDP — than the U.S. accumulated during any war, including the Revolutionary War and World War II, during any economic crisis or peacetime spending binge, or even during the century and a half that the government survived without an income tax.

Regarding the deficit reaching 6.1% of GDP (the 50-year average is 3.7%), the report noted that “deficits have exceeded that level” only three times since the Great Depression: “During and shortly after World War II, the 2007-2009 financial crisis, and the coronavirus pandemic.” In other words, soon the U.S. federal government will be running up the credit card as fast as it did during America’s largest international war and the two worst economic crises of this millennium — for no discernable reason at all.

The problem, fundamentally, is too much spending. The CBO estimated government revenues to average 17.8% of GDP over the next 10 years, slightly above the 50-year average of 17.3%. That estimate was based on the assumption that the 2017 tax cuts will be allowed to expire in 2025. By contrast, the CBO estimated that government spending will average 23.5% over the next decade, topping out at 24.1%, far higher than the 50-year average of 21%.

Although the CBO’s statistics might be useful for comparisons over time, they fail to communicate the gravity of America’s current economic peril. Griffith bridged the gap by converting the trillions into numbers that can be brought home to each family. “We owe $400,000 per family in federal debt,” he said. “We’re expected to add another quarter million dollars per family over the next 10 years.” Who’s ready for a third mortgage?

Two types of spending were leading culprits in the CBO’s growing deficit projection: “Growth in spending on programs that benefit elderly people and rising net interest costs” — in other words, mandatory entitlement spending and servicing the debt. The CBO projected that mandatory spending will increase steadily to 15.1% of GDP, net interest payments will increase to 3.9%, while discretionary spending (both military and domestic) will actually decrease to 5.1% by 2034 — if you can believe it.

Forecasters have known for decades about the fiscal turbulence catalyzed by the rising longevity of America’s aging population. The relatively new factors are the recent arrival of a high interest system and its costly interaction with mountains of recently accrued debt.

According to the Committee for Responsible Budget, for the first time, net interest payments exceeded Medicaid spending in 2023 and will exceed defense spending and Medicare spending in 2024. “Starting next year,” wrote CBO, “net interest costs are greater in relation to GDP than at any point since at least 1940, the first year for which the Office of Management and Budget reports such data.”

Griffith translated, “We’re already paying around $10,000 per family per year, just on the interest on the federal debt. And that is going to nearly double to close to $20,000 per family per year.” Sorry, Jimmy, I know you wanted to go to college. But now your Uncle Sam needs that money to pay off his gambling debts.

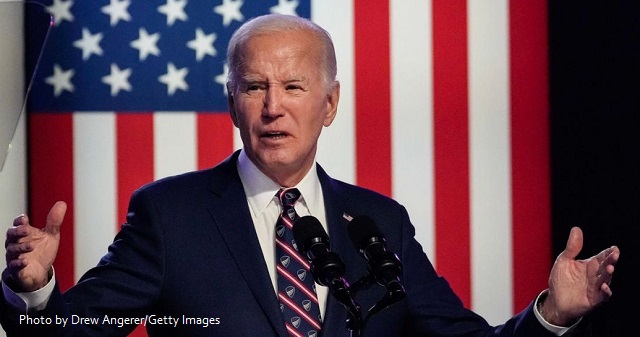

These factors, combined with sultry stagnation of Bidenomics, are cooking up the perfect fiscal storm. Americans can expect a “Poor Front” to follow. “Such soaring debt would slow economic growth, push up interest payments to foreign holders of U.S. debt, and pose significant risks to the fiscal and economic outlook,” analyzed the CBO. “It could also cause lawmakers to feel more constrained in their policy choices.” Coming from an agency that reports to Congress, that last sentence is the bureaucratic equivalent of, “Don’t say I didn’t warn you, boss.”

Based on historical precedents, Griffith described “multiple ways this can pan out.” Through Door Number One, America could fully embrace European socialism. We already have most of the social programs; now we just need the taxes to match. This solution could avoid the fiscal crisis at the cost of “a long-term relative decline in our prosperity,” said Griffith. Through Door Number Two lies the fate of Portugal, Italy, Greece, and Spain, who nearly went bankrupt during the Great Recession through extreme profligacy. To obtain the foreign loans they needed to stay afloat, they were forced to make deep spending cuts dictated by outside countries — which naturally caused massive social unrest. Through Door Number Three, Griffith described “very extreme examples” of hyperinflation, such as Argentina and Venezuela. “None of the scenarios are good,” he warned.

Predicting the future is notoriously impossible, and CBO budget forecasters are usually no more successful than weather meteorologists. If anything, however, the CBO’s debt estimate is a conservative, even “optimistic” one, as The Wall Street Journal editorial board remarked skeptically. “They assume no recession and that the 2017 individual tax cuts and Inflation Reduction Act’s sweetened ObamaCare subsidies expire in 2025. Oh, and that Congress doesn’t lather on more spending, and more student debt isn’t canceled by executive decree.” That’s four unsafe assumptions that each lower the CBO’s 10-year debt estimate.

Undeterred by the glowering forecast, the Biden administration has planned a weekend cook-out. “Over the past three years, the Biden administration has driven an historic recovery,” Treasury Secretary Janet Yellen declared during Thursday testimony before the Senate Banking Committee, with all the cheeriness of a turnip. She later conceded under questioning that “we need to reduce deficits and to stay on a fiscally sustainable path,” an answer as effective as a clogged culvert. “By suggesting that we need to stay on a sustainable path, she’s saying we’re on one right now,” Griffith responded. “We are already on the path to unsustainability.”

Yellen further argued that America’s current debt burden is nothing to worry about. “Thus far, in real terms, the interest burden of the debt has remained within or below historical norms,” she said. According to the CBO, the 50-year average of net interest expenditures is 2.1% of GDP; the U.S. government spent 2.4% of GDP servicing the debt in 2023 and will spend 3.1% of GDP servicing the debt in 2024. Coming from a current Treasury Secretary and former Federal Reserve chair, Yellen’s remark is akin to an air traffic controller arguing, “Thus far, in real terms, that jet airliner accelerating down the runway has not yet become airborne.”

In response to a question from Senator Mike Rounds (R-S.D.), Yellen said she had “seen no sign” of waning foreign interest in U.S. debt, an “absolutely ludicrous” remark in Griffith’s estimation. “Over the last two and a half years, foreign investors have only been willing to purchase about one penny of every new dollar of federal debt that we’ve taken on. In years past, foreign investors bought about one third of our federal debt,” Griffith explained. “With investor demand drying up for that debt, that means that the federal government has to pay more to those who will lend us money. … That trickles down directly to us as consumers.”

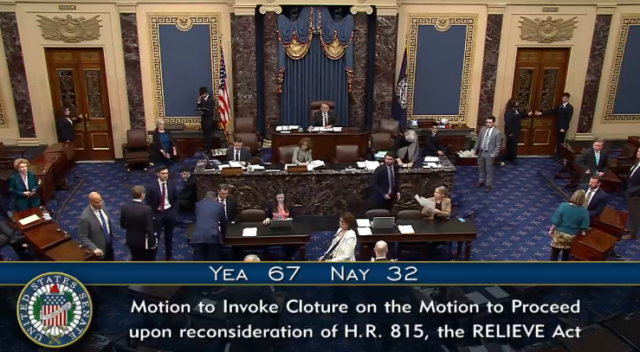

While the Biden administration may be unconcerned about the debt, at least some members of Congress have sought to restore sanity and accountability to the budgeting process. Thus far, their achievements have been flimsy at best. As a result of the spending cuts Republicans negotiated in the debt limit deal last summer, the CBO reduced their estimated deficit for 2024 by $0.1 trillion (4%) and their estimated cumulative deficit for 2024-2033 by $1.4 trillion (7%). You could as easily dig a trench with a teaspoon, or stop a locomotive’s momentum with a Q-tip, as resolve America’s budgetary crisis with such puny half-measures.

This situation illustrates the truth that elections have consequences. The reason why congressional budget hawks can’t achieve any significant savings is that there are too few of them, compared to their colleagues who want to keep spending money. At root, this is a problem that can only be solved when voters and candidates get serious about demanding and delivering fiscal sanity in Washington. America is barreling straight toward a fiscal cliff. Will anyone care enough to stop her?

AUTHOR

Joshua Arnold is a senior writer at The Washington Stand.

EDITORS NOTE: This Washington Stand column is republished with permission. All rights reserved. ©2024 Family Research Council.

The Washington Stand is Family Research Council’s outlet for news and commentary from a biblical worldview. The Washington Stand is based in Washington, D.C. and is published by FRC, whose mission is to advance faith, family, and freedom in public policy and the culture from a biblical worldview. We invite you to stand with us by partnering with FRC.