Meaningful border security and effective enforcement of our immigration laws are anathemas to globalists who see in America’s borders impediments to their wealth.

While U.S.-based globalists routinely spout globalist propaganda, often disguised as “news reports” by American journalists, comparable globalist propaganda spewed by foreign journalists is rarely reported in the United States.

On December 18, 2017, Quartz India published an article, under the category of Back In Limbo, “Under Trump, Indian H-1B wives fear becoming second-class citizens again.”

The title of the article was not only illogical but also apparently sought to blur the distinction between American citizens and aliens.

Beneath the title of that article was the image of the hands of a newly naturalized citizen holding an American flag, accompanied by a brief description of the naturalization ceremony where the photo was taken.

There was no explanation, however, as to why the photo taken of an American flag at a naturalization ceremony is somehow to be conflated with a report about nonimmigrant aliens working in the United States.

The obvious question, certainly not asked or answered in the article, is how could any alien, particularly a nonimmigrant alien, complain about “becoming a second-class citizen?”

Simply stated, aliens are not citizens — first-class, second-class, or any class at all.

In point of fact, aliens must be acquire lawful immigrant status in order to ultimately be eligible to come United States citizens provided that they meet a number of prerequisites. Nonimmigrant aliens, by definition, are aliens who are admitted into the United States for a temporary period of time and must, after the period of admission expires, return to their native countries.

H-1B and H-4 visas, the focus of the Quartz India grievance, are nonimmigrant visas.

Furthermore, it is a crime for an alien to claim to be a United States citizen. Under the law (18 U.S. Code § 911) any alien who makes a false claim to being a United States citizen is committing a felony that carries a maximum penalty of up to three years in prison.

Use of misleading language is a major element of the campaign waged by immigration anarchists and globalists who seek to eradicate America’s borders.

In the Orwellian world of immigration Newspeak, aliens who enter the United States without inspection are referred to as entering “undocumented” a fabricated term to obfuscate the truth that these aliens are illegally present in the United States.

By eliminating the term “alien” from the vernacular where any discussions or debates about immigration are concerned, a tactic initiated by President Jimmy Carter during his administration, set the stage for the bogus assertions that anyone who believes in securing our nation’s borders against the entry of criminals, terrorists, and other aliens who would pose a threat to best interests of America and Americans are deemed to be “anti-immigrant” when, in reality their position should be referred to as “pro-immigration law enforcement.”

This use of language to control the debate was the topic of my recent article, “Language Wars: The Road to Tyranny is Paved With Language Censorship.”

The article published by that publication, complaining that their citizens are not being treated in a manner equal to United States citizens, is simply yet another step along the path to immigration anarchy and the destruction of American sovereignty by confounding logic and reasoning in pursuit of a political agenda.

Bad as the title of that piece was, the article itself goes on to hammer the United States for its policies, and we have Obama’s anarchistic immigration policies to thank for this.

Consider the opening paragraph of the article:

Rashi Bhatnagar gave up her career as a journalist when she left India in 2009 and moved to the US on an H-4 dependent visa. For years, she struggled with frustration because her visa status did not allow her to work in the US. But in 2015, she saw a sliver of hope after the erstwhile Barack Obama administration allowed the spouses of H-1B workers awaiting green card approval to apply for work permits of their own.

The article then noted that on December 14 of this year the Trump administration announced that it would reconsider the Obama policy of permitting certain H-4 aliens to be granted employment authorization and how unfair this was.

The article went on to report:

Since 2015, over 104,000 spouses were granted EADs. A large number of these would likely be from the sub-continent as Indians receive a major chunk of the H-1B visas every year.

Let’s take a moment to consider the issues.

The alien referenced in the first paragraph of the article came to the United States voluntarily knowing full well, before she even set foot on U.S. soil, that she would not be permitted to work in the United States. Nevertheless, she willingly came here and found the conditions to be what she knew that they would be before she boarded the airliner.

Many of Obama’s globalist policies ended the day that he left office and still more of his policies are under review by President Trump so that he can truly put America and Americans first, a clear and unequivocal element of his campaign for the presidency.

Providing tens of thousands of aliens, who were admitted with H-4 nonimmigrant visas, with employment authorization runs contrary to the best interests of American workers by enabling these nonimmigrant aliens to compete with American and lawful immigrants for jobs.

It is to be expected that President Trump would take a hard look at this program and, hopefully, terminate these policies.

Of course citizens of India and other countries could not care less about the well-being of America or Americans.

Incredibly, adding to this problem is the fact that for decades we have had a succession of administrations that apparently shared their disdain for Americans. Mr. Obama, undoubtedly led the charge creating policies that eroded American sovereignty that undermined national security and public safety.

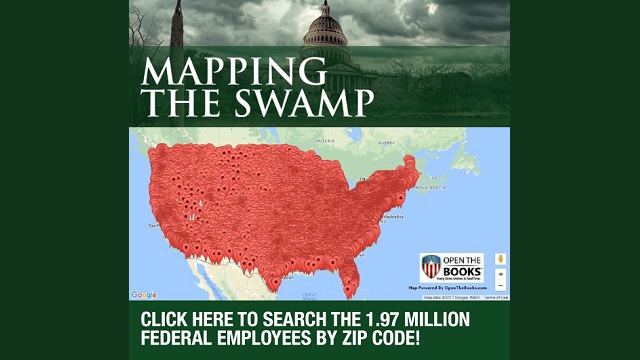

Furthermore, the problems with the employment of these nonimmigrant aliens also has an economic component. Money earned by aliens is wired out of the countries by foreign workers, whether they are legally or illegally working in the United States. That money is permanently lost to the U.S. economy and contributes to our national debt and to an adverse balance of trade.

On October 3, 2017, the World Bank issued a report, “Remittances to Recover Modestly After Two Years of Decline.” It included this paragraph:

Among major remittance recipients, India retains its top spot, with remittances expected to total $65 billion this year, followed by China ($63 billion), the Philippines ($33 billion), Mexico (a record $31 billion), and Nigeria ($22 billion).

India has been leading the charge of countries receiving remittances sent home by their citizens who are working in countries around the world. Of course, not all of the money remitted to these countries came from the United States, but America is a leading country where the flow of remittances is concerned.

The egregious article upon which my commentary today is predicated also addressed the issue of remittances and quoted Poorvi Chothani, managing partner at an immigration law firm LawQuest.

Chothani had the unmitigated chutzpah to whine that Trump policies would prevent these nonimmigrant aliens from realizing their “American Dream.”

The “American Dream” for nonimmigrant aliens?

Incredibly, the term “American Dream,” and one that has become over the past several decades, ever more elusive and indeed, illusory for American citizens, has been misappropriated by globalists to purportedly justify providing millions of illegal aliens with lawful status and a pathway to U.S. Citizenship under the failed “DREAM Act” and now apparently for nonimmigrant aliens who voluntarily enter the United States on nonimmigrant visas.

Additionally, the article makes a contrived claim that since, according to the article, 90 percent of the H-4 visa holders are women, the Trump policies are unfair to women. And while the H-1B visa holders may be sending remittances back to India, their wives who cannot work in the United States are unable to send money to support their families because the wages paid to the H-1B spouses are insufficient to meet all of their needs, in the United States and back home to help their families.

Of course the law firm is likely concerned that their profits will suffer if the number of aliens who would come to the United States is reduced because of President Trump’s policies of putting American workers first.

It’s easy to see the damage that has been done to America — just follow the money.

Because of the globalist policies of the Obama administration and previous administrations, the globalists have been literally and figuratively “making out like bandits.”

Thankfully, since the election of Donald Trump, there is truly a new sheriff in town.

EDITORS NOTE: This column originally appeared on NewsMax.com.