Any tax reforms passed by Congress should give relief to middle-class families and small businesses, bring jobs and capital back to the United States, and make the tax code more fair by ending loopholes and breaks for special interests, congressional Republicans said Wednesday in what they call a framework for debate.

The framework from House Speaker Paul Ryan, Senate Majority Leader Mitch McConnell, and other GOP leaders calls for creating a larger zero-tax bracket (an individual’s first $12,000 of income would become tax free, and the first $24,000 for married couples), roughly doubling taxpayers’ standard deduction, and condensing the current seven tax brackets to three.

“This is a historic day,” Ryan said at an afternoon press conference. “This is a day that is a long time in coming. In fact, it was on this day, under this dome, in 1986 that Congress took the final vote on the last overhaul of our tax code. That long. After that vote, President Reagan said Americans would ‘finally have a tax code that they can be proud of.’

“It was true then, but things look very very different today, don’t they?” Ryan added. “Instead of a source of pride, our tax code has become a constant source of frustration. It is too big. It is too complicated, it’s too expensive. Today, we are taking the next step to liberate Americans from our broken tax code.”

“Tax reform that follows the outline we heard today will deliver significant benefits for all Americans,” Adam Michel, a tax policy analyst at The Heritage Foundation, said in an email to The Daily Signal, adding:

The outlined tax reform will raise wages, increase job creation, and create untold additional opportunities. The plan goes a long way toward fixing our business tax system that makes it hard for businesses to invest in America.

Depending on their income, individual taxpayers currently may be taxed at one of these percentages: 10, 15, 25, 28, 33, 35, or 39.6.

The three brackets in Republicans’ proposed tax framework are 12 percent, 25 percent, and 35 percent.

The framework would end personal exemptions for dependents and increase the child tax credit.

President Donald Trump has made overhauling the tax code a major agenda item during his first year in office, and Treasury Secretary Steven Mnuchin has promised to deliver it by the end of 2017, now three months away.

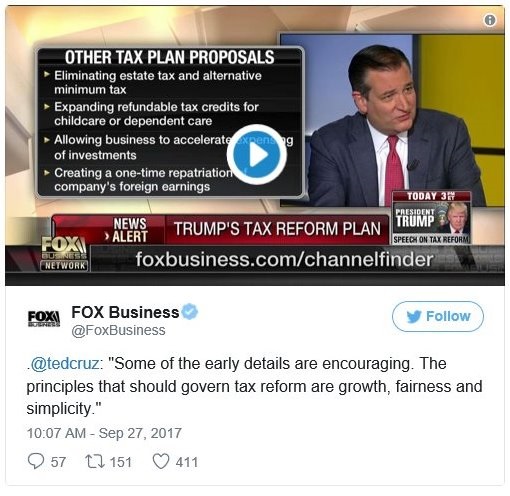

Republican lawmakers’ plan would repeal the alternative minimum tax, created in 1969 to ensure that more affluent taxpayers could lower their tax bill only via deductions a certain amount. Many lawmakers, including Sen. Ted Cruz, R-Texas, previously have called for an end to the alternative minimum tax.

The framework for tax reform would eliminate most itemized deductions, taken from a taxable adjusted gross income and “made up of deductions for money spent on certain goods and services throughout the year,” as Investopedia explains it.

The plan also calls for repeal of the estate tax—which opponents call the death tax—and the generation-skipping transfer tax, what the Tax Policy Center calls an “additional tax on a transfer of property.”

The plan includes tax benefits to incentivize work, higher education, and retirement security and promises to repeal many provisions “to make the system simpler and fairer for all families and individuals, and allow for lower tax rates.”

The framework also would:

- Limit the minimum tax rate for small businesses and sole proprietorships to 25 percent.

- Lower the corporate tax rate to 20 percent, “below the 22.5 percent average of the industrialized world.”

- Allow expensing of “new investments in depreciable assets other than structures made after Sept. 27, 2017, for at least five years.”

- Lower rates for domestic manufacturers and update rules for various industries and sectors “to ensure that the tax code better reflects economic reality and that such rules provide little opportunity for tax avoidance.”

The Republican plan also seeks to keep companies from moving overseas by taxing both businesses and foreign profits of U.S. corporations at a reduced rate.

Rep. Mark Walker, R-N.C., chairman of the Republican Study Committee, the largest GOP caucus in the House, praised the newly released details.

“At first glance, the policies released today are good news to the American people,” Walker said in a formal statement. “I am proud to see that a large part of the Republican Study Committee’s submission to the tax reform task force was incorporated into today’s framework. We need to begin acting on this framework legislatively as soon as possible.”

Rep. Diane Black, R-Tenn., chairwoman of the House Budget Committee, said the goals would put America at an advantage:

By simplifying the system and getting the government out of the way of our free-market economy, America is made more competitive on an international scale and the potential for unprecedented job creation is unleashed. We believe this will be a catalyst for more jobs, bigger paychecks and fairer taxes—this framework is pro-America. Plain and simple.

Alfredo Ortiz, president and CEO of the Job Creators Network, said the plan shows promise.

“I’m encouraged to see that the administration is moving forward with tax cuts for small business,” Ortiz said in a statement provided to The Daily Signal, adding:

While many details still need to be filled in, this is a crucial and positive step in the right direction. Make no mistake: the recent progress in the campaign for tax relief should bring optimism to the 29 million small business owners and the roughly 56 million people that depend on them for their livelihoods.

In a statement provided to The Daily Signal, David McIntosh, president of the Club for Growth, said the plan will foster economic development.

“Club for Growth is very encouraged and pleased with the long-awaited tax reform outline that the Big Six released today,” McIntosh said. “Fundamental tax reform comes around only once in a generation, and this is our chance. The outline is both aggressive and very pro-growth with its rate reductions.”

Mike Needham, chief executive officer of Heritage Action for America, the lobbying affiliate of The Heritage Foundation, said the plan is a call to action.

“While today’s announcement marks an important and encouraging first step, it is imperative the administration and congressional leaders work hand-in-hand with conservatives to push back against the radical left and the special interests that will pull out every stop to preserve the status quo,” Needham said.

This report was updated to include Ryan’s afternoon remarks.

Rachel del Guidice is a reporter for The Daily Signal. She is a graduate of Franciscan University of Steubenville, Forge Leadership Network, and The Heritage Foundation’s Young Leaders Program. Send an email to Rachel. Twitter: .

A Note for our Readers:

Trust in the mainstream media is at a historic low—and rightfully so given the behavior of many journalists in Washington, D.C.

Ever since Donald Trump was elected president, it is painfully clear that the mainstream media covers liberals glowingly and conservatives critically.

Now journalists spread false, negative rumors about President Trump before any evidence is even produced.

Americans need an alternative to the mainstream media. That’s why The Daily Signal exists.

The Daily Signal’s mission is to give Americans the real, unvarnished truth about what is happening in Washington and what must be done to save our country.

Our dedicated team of more than 100 journalists and policy experts rely on the financial support of patriots like you.

Your donation helps us fight for access to our nation’s leaders and report the facts.

You deserve the truth about what’s going on in Washington.

Please make a gift to support The Daily Signal.

SUPPORT THE DAILY SIGNAL