It’s time to call off the child care regulators by JEFFREY A. TUCKER:

Social democrats want to nationalize childhood by having government fund and manage universal day care. Social conservatives want the family to be the day care, which is a lovely idea when it’s affordable. Libertarians don’t seem much interested in the subject at all. That leaves virtually no one to tell the truth about the only solution to the shortage and high price of day care: complete deregulation.

Let’s start the discussion right now.

The Obama administration has the idea to model a new program for national day care on a policy from World War II that lasted from 1944 to 1946 in which a mere 130,000 children had their day care covered by the federal government. Here’s what’s strange: right now, the feds (really, taxpayers) pay for 1.3 million kids to be in day care, which means that there are 10 times as many children in such programs now as then. The equivalent of the wartime program is already in place now, and then some. The shortages for those who need the service continue to worsen.

How did this wartime program come about? The federal government had drafted men to march off to foreign lands to kill and be killed. On the home front, wives and moms were drafted into service in factories to cover the country’s productive needs while the men were gone. That left the problem of children. Back in the day, most people lived in close proximity to extended family, and that helped. But for a few working parents, that wasn’t enough.

Tax-funded day care

Tax-funded day care became part of the Community Facilities Act of 1941 (popularly known as the Lanham Act). The Federal Works Agency built centers that became daytime housing for the kids while their moms served the war effort. Regulation was also part of the mix. The federal Office of Education’s Children’s Bureau had a plan: children under the age of 3 were to remain at home; children from 2 to 5 years of age would be in centers with a ratio of 1 adult to 10 children. The standards were never enforced — there was a war on, after all — and the Lanham Act was a dead letter after 1946.

The program was a reproduction of another program that had begun in the New Deal as a job creation measure (part of the Works Project Administration and the Federal Economic Recovery Act, both passed in 1933). It was later suspended when the New Deal fell apart. Neither effort was about children. The rhetoric surrounding these programs was about adults and their jobs: the need to make jobs for nurses, cooks, clerical workers, and teachers.

Obama’s day care solution

Obama wants not only to resurrect this old policy but to make it universal, because day care is way too expensive for families with two working parents. This proposal is piling intervention on intervention; it is not a solution. Do parents really want kids cared for in institutions run the same way as the US Postal Service, the TSA, and the DMV? Parents know how little control they have over local public schools. Do we really want that model expanded to preschoolers?

Still, for all the problems with the Obama proposal, its crafters acknowledge a very real problem: two parents are working in most households today. This reality emerged some 30 years ago after the late 1970s inflation wrecked household income and high taxes robbed wage earners. Two incomes became necessary to maintain living standards, which created a problem with respect to children. Demand for daytime child care skyrocketed.

The shortage of providers is most often described as “acute.” Child care is indeed expensive, if you can find it at all. It averages $1,000 per month in the United States, and in many cities, it’s far pricier. That’s an annual salary on the minimum wage, which is why many people in larger cities find that nearly the whole of the second paycheck is consumed in day care costs — and that’s for just one child. Your net gains are marginal at best. If you have two children, you can forget about it.

Perhaps this is why Pew Research also reports a recent rise in the number of stay-at-home moms. It’s not a cultural change. It’s a matter of economics. And the trends are happening because the options are thinning. Parents are being forced to pick their poison: lower standard of living with only one working spouse, or a lower standard of living with two working spouses. This is a terrible bind for any family with kids.

The reason behind the day care shortage

The real question is one few seem to ask. Why is there a shortage? Why is day care so expensive? We get tennis shoes, carrots, gasoline, dry cleaning, haircuts, manicures, and most other things with no problem. There are infinite options at a range of prices, and they are all affordable. There is no national crisis, for example, about a shortage of gyms. If we are going to find a solution, surely there is a point to understanding the source of the problem.

Here is a principle to use in all aspects of economic policy:

When you find a good or service that is in huge demand, but the supply is so limited to the point that the price goes up and up, look for the regulation that is causing the high price.

This principle applies regardless of the sector, whether transportation, gas, education, food, beer, or day care.

Child care is one of the most regulated industries in the country. The regulatory structures began in 1962 with legislation that required child care facilities to be state-licensed in order to get federal funding grants. As one might expect, 40 percent of the money allocated toward this purpose was spent on establishing licensing procedures rather than funding the actual care, with the result that child care services actually declined after the legislation.

This was an early but obvious case study in how regulation actually reduces access. But the lesson wasn’t learned and regulation intensified as the welfare state grew. Today it is difficult to get over the regulatory barriers to become a provider in the first place. You can’t do it from your home unless you are willing to enter into the gray/black market and accept only cash for your business. Zoning laws prevent residential areas from serving as business locations. Babysitting one or two kids, sure, you can do that and not get caught. But expanding into a public business puts your own life and liberty in danger.

Too many regulations

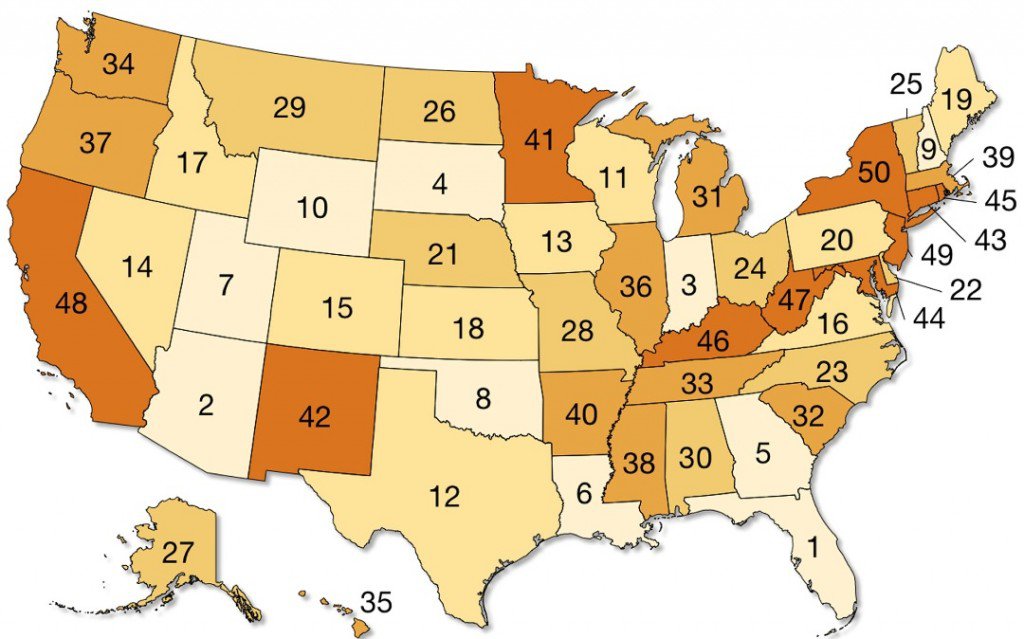

Beyond that, the piles of regulations extend from the central government to state governments to local governments, coast to coast. It’s a wonder any day cares stay in business at all. As a matter of fact, these regulations have cartelized the industry in ways that would be otherwise unattainable through purely market means. In effect, the child care industry is not competitive; it increasingly tends toward monopoly due to the low numbers of entrants who can scale the regulatory barriers.

There is a book-length set of regulations at the federal level. All workers are required to receive health and safety training in specific areas. The feds mandate adherence to all building, fire, and health codes. All workers have to get comprehensive background checks, including fingerprinting. There are strict and complex rules about the ratio of workers per child, in effect preventing economies of scale from driving down the price. Child labor laws limit the labor pool. And everyone has to agree to constant and random monitoring by bureaucrats from many agencies. Finally, there are all the rules concerning immigration, tax withholding, minimum wages, maximum working hours, health benefits, and vacation times.

All of these regulations have become far worse under the Obama administration — all in the name of helping children. The newest proposal would require college degrees from every day care provider.

And that’s at the federal level. States impose a slew of other regulations that govern the size of playgrounds, the kind of equipment they can have, the depth of the mulch underneath the play equipment, the kinds of medical services for emergencies that have to be on hand, insurance mandates that go way beyond what insurers themselves require, and so much more. The regulations grow more intense as the number of children in the program expands, so that all providers are essentially punished for being successful.

Just as a sample, check out Pennsylvania’s day care regulations. Ask yourself if you would ever become a provider under these conditions.

A couple of years ago, I saw some workers digging around a playground at a local day care and I made an inquiry. It turned out that the day care, just to stay in business, was forced by state regulations to completely reformat its drains, dig new ones, reshape the yard, change the kind of mulch it used, spread out the climbing toys, and add some more foam here and there. I can’t even imagine how much the contractors were paid to do all this, and how much the changes cost overall.

And this was for a well-established, large day care in a commercial district that was already in compliance. Imagine how daunting it would be for anyone who had a perfectly reasonable idea of providing a quality day care service from home or renting out some space to make a happy place to care for kids during the day. It’s nearly unattainable. You set out to serve kids and families but you quickly find that you are serving bureaucrats and law-enforcement agencies.

The economic solution to the day care shortage

Providing day care on a profitable basis is a profession that countless people could do, if only the regulations weren’t so absurdly strict. This whole industry, if deregulated, would be a wonderful enterprise. There really is no excuse for why child care opportunities wouldn’t exist within a few minutes’ drive of every house in the United States. It’s hard to imagine a better at-home business model.

What this industry needs is not subsidies but massive, dramatic, and immediate deregulation at all levels. Prices would fall dramatically. New options would be available for everyone. What is now a problem would vanish in a matter of weeks. It’s a guaranteed solution to a very real problem.

The current system is a problem for everyone, but it disproportionately affects women. It is truly an issue for genuine feminists who care about real freedom. The regulatory state as it stands is attacking the right to produce and consume a service that is important to women and absolutely affects their lives in every way. In the 19th century, these kinds of rules were considered to be a form of subjugation of women. Now we call it the welfare state.

From my reading of the literature on this subject, I’m startled at how small is the recognition of the causal relationship between the regulatory structure and the shortage of providers. It’s almost as if it had never occurred to the many specialists in this area that there might be some cost to forever increasing the mandates, intensifying the inspections, tightening the strictures, and so on.

A rare exception is a 2004 child care study by the Rand Corp. Researchers Randal Heeb and M. Rebecca Kilburn found what should be obvious to anyone who understands economics. “Relatively modest changes in regulations would have large and economically important consequences,” they argue, and “the overall effect of increased regulation might be counter to their advocates’ intentions. Our evidence indicates that state regulations influence parents’ child care decisions primarily through a price effect, which lowers use of regulated child care and discourages labor force participation. We find no evidence for a quality assurance effect.”

This is a mild statement that reinforces what all economic logic suggests. Every regulatory action diminishes market participation. It puts barriers to entry in front of producers and imposes unseen costs on consumers. Providers turn their attention away from pleasing customers and toward compliance. Regulations reduce competition and raise prices. They do not serve the stated objectives of policy makers, though they might serve the deeper interests of the industry’s larger players.

Creating a free market for child care

And so the politicians and activists look at the situation and say: we must do something. It’s true, we must. But we must do the right thing, which is not to create Orwellian, state-funded child care factories that parents cannot control. We must not turn child care into a labyrinthian confusion of thousands of pages of regulations.

We need to make a market for child care as with any other service. Open up, permit free entry and exit, and we’ll see the supposed problem vanish as millions of new providers and parents discover a glorious new opportunity for enterprise and mutual benefit.

But isn’t this laissez-faire solution dangerous for the children?

Reputation and market-based quality control govern so much of our lives today. A restaurant that serves one bad meal can face the crucible at the hands of Yelp reviewers, and one late shipment from an Amazon merchant can ruin a business model. Markets enable other active markets for accountability and intense focus on consumer satisfaction.

It’s even more true of child care. Even now, markets are absolutely scrupulous about accessing quality, as these Yelp reviews of day care in Atlanta, Georgia, show. As for safety, insurers are similarly scrupulous, just as they are with homes and office buildings. As with any market good, a range of quality is the norm, and people pick based on whatever standards they choose. Some parents might think that providers with undergraduate degrees essential, while others might find that qualification irrelevant.

In any case, markets and parents are the best sources for monitoring and judging quality; certainly they have a greater interest in quality assurance than politicians and bureaucrats. If any industry is an obvious case in which self-regulation is wholly viable, child care is it. Indeed, the first modern day care centers of the late 19th century were created by private philanthropists and market entrepreneurs as a better alternative to institutionalizing the children of the destitute and poor new immigrants.

The shortages in this industry are tragic and affect tens of millions of people. They have a cause (regulation) and a solution (deregulation). Before we plunge wholesale into nationalized babysitting, we ought to at least consider a better way.

The explicit 2 percent ACA surcharge at Buffalo Wild Wings may or may not have been intended as permanent. The restaurant chain’s executives have already cancelled the policy after customers reacted negatively. But there is a lesson to be learned from the surcharge. Government programs have the superficial appearance of being free, but they never are.

The explicit 2 percent ACA surcharge at Buffalo Wild Wings may or may not have been intended as permanent. The restaurant chain’s executives have already cancelled the policy after customers reacted negatively. But there is a lesson to be learned from the surcharge. Government programs have the superficial appearance of being free, but they never are.