Illegal Immigrants Continue to Commit Violent Crimes as Sanctuary Cities Reassess Policies

Violent crimes committed by illegal immigrants continue to rise throughout the country, resulting in American citizens being attacked, raped, and murdered. Experts are noting that these are the same migrants who receive taxpayer-funded health care, housing, education, food, and more.

The most high-profile story making news is last week’s murder of 22-year-old Laken Riley. She was a young nursing student at Augusta University who never returned from her jog Thursday morning because she was brutally murdered by who police believe to be a man named Jose Antonio Ibarra, who is also an illegal immigrant.

Not only does Ibarra have a criminal record in the U.S. since arriving illegally, but his brother does as well. Ibarra has been charged with theft, child endangerment, and murder, among other crimes. And his brother, Diego Ibarra, along with stealing, was recently caught giving police a fake green card with two different birth dates on it. This happened after he was stopped by police for driving while drinking beer — which the migrant told the officer was his seventh since he’d been behind the wheel.

On Monday, police in Maryland charged Nilson Trejo-Granados, one of five suspects, for the first and second-degree murder of two-year-old Jeremy Poou Caceres. Before being arrested for murder, Trejo-Granados was charged with theft in March 2023.

On February 20, Angel Matias Castellanos-Orellana allegedly raped a 14-year-old girl at knifepoint, and on February 25, he repeatedly stabbed a man in the face and back, demanding the man give him his property. According to The Post Millennial, “He was arrested and booked on armed robbery, aggravated battery, first-degree rape, and aggravated assault and a federal ‘ICE’ detainer was also issued for him.”

In addition, last month a group of alleged illegal immigrants viciously attacked New York City police officers in Times Square. As crimes committed by illegal immigrants skyrocket, some sanctuary cities are starting to reassess their policies. In fact, it was this beating in NYC that caused Mayor Eric Adams (D) to say during a townhall meeting, “Those who are committing crimes, we need to modify the sanctuary city law. If you commit a felony, a violent act, we should be able to turn you over to [Immigration and Customs Enforcement] ICE and have you deported.”

And the Big Apple isn’t the only city backtracking. According to The Daily Wire, “The city council of Aurora, which sits just east of Denver, approved a resolution in a 7-3 vote on Monday demanding that large groups of migrants not be transported there since it is unable to fund new services for migrants or homeless people.”

In addition to a call to “secure our nation’s border,” the resolution said: “The City Council affirms remaining a Non-Sanctuary City and asserts the City does not currently have the financial capacity to fund new services related to this crisis and demands that other municipalities and entities do not systematically transport migrants or people experiencing homelessness to the City.”

Family Research Council President Tony Perkins said on “Washington Watch” Wednesday that these harsh and dangerous circumstances only highlight “the damage inflicted by the Left’s public policy decisions [and] their open borders.” Congressman Rich McCormick (R-Ga.), who serves on the House Foreign Affairs Committee and the House Armed Services Committee, agreed, noting that these policies have allowed “some nefarious people … across the border.”

McCormick pointed out that Venezuela currently has a record low crime rate. “Why do you think it is?” he asked. It’s because Venezuela is “getting rid of their criminals” by sending them to the U.S. through the open border, he said. “Bad people are crossing the border. … We have record numbers of deaths from fentanyl. We have record amount of child trafficking, rape, [and] murder. … I’ve been talking about it for years. This is a significant problem.”

He added, “If you’re coming to this country and committing crimes, and then you continue to commit crimes and have been released, what are we doing?” A major issue facing America, McCormick shared, is that these illegal immigrants and violent criminals are being released as if they’re “regular citizens.” But “they’re not,” he said. “They’re here illegally. … This should be an ICE issue,” because when an illegal immigrant gets arrested, “they get sent back to their country. That’s the way it’s supposed to be. That’s the law. Imagine following the law.”

Perkins noted that the Left is notorious for also making claims that we shouldn’t “politicize the murder of a 22-year-old student” like Laken Riley by connecting it to illegal immigration. But, he wondered, “How else do we look at this? This is their policies. This is the outcome that we’re seeing from their open border policies. How else can you look at it?”

“There’s so many ramifications for lawlessness that we’ve allowed to take place at our southern border,” Perkins stated. And that will only end, McCormick concluded, if we continue to “fight the good fight.”

AUTHOR

Sarah Holliday

Sarah Holliday is a reporter at The Washington Stand.

RELATED ARTICLES:

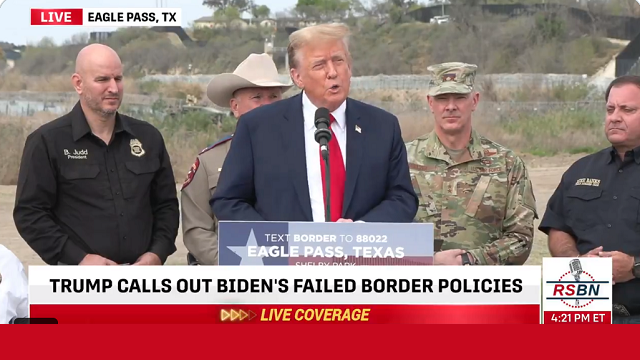

‘A Biden Invasion’: Trump and Biden’s Border Speeches Make ‘An Extraordinary Contrast’

EAGLE PASS, TEXAS: President Donald J. Trump ‘We’re going to take care’ of the dangerous border!

POSTS ON X:

President Trump: "Joe Biden is the most incompetent president we've ever had… He is a true threat to democracy because he's weaponized the FBI and the DOJ to go get his political opponent and many other people." pic.twitter.com/gt9XE4niao

— Trump War Room (@TrumpWarRoom) March 1, 2024

President Biden transferred more than $500 million that was earmarked for COVID relief into the pockets of illegal immigrants. This is outrageous. Read more:https://t.co/OUaQw7ynZZ

— Jay Sekulow (@JaySekulow) March 1, 2024

EDITORS NOTE: This Washington Stand column is republished with permission. All rights reserved. ©2024 Family Research Council.

The Washington Stand is Family Research Council’s outlet for news and commentary from a biblical worldview. The Washington Stand is based in Washington, D.C. and is published by FRC, whose mission is to advance faith, family, and freedom in public policy and the culture from a biblical worldview. We invite you to stand with us by partnering with FRC.