Trump: Immigration Deal Has ‘Got to Include the Wall’

President Donald Trump said Wednesday that he would not sign an immigration bill without funding for a border wall—clarifying some doubt left over from a bipartisan meeting with members of Congress a day earlier about reaching a deal on the policy for the Deferred Action on Childhood Arrivals, or DACA.

Asked during a joint White House press conference with Norwegian Prime Minister Erna Solberg if he would sign a deal that didn’t include the wall, Trump responded, “No, no.”

“It’s got to include the wall. We need the wall for security,” the president said. “We need the wall for safety. We need the wall for stopping the drugs from pouring in. I would imagine that the people in the room — both Democrat and Republican —I really believe they’re going to come up with a solution to the DACA problems.”

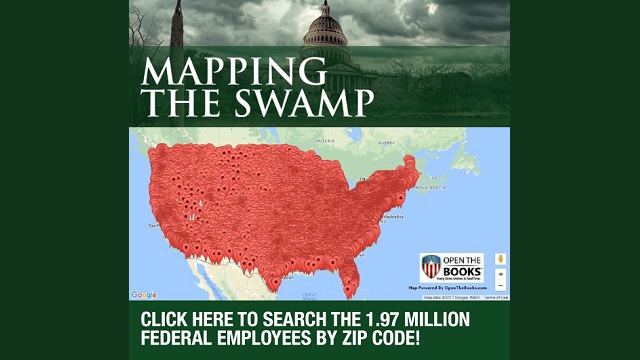

House Judiciary Chairman Bob Goodlatte, R-Va., and House Homeland Security Chairman Michael McCaul, R-Texas, proposed legislation Wednesday to allow illegal immigrants brought to the country as minors receive protection from deportation to get a three-year renewal; to provide $30 billion for construction of the wall, adding 5,000 Border Patrol agents, and another 5,000 Customs and Border Protection officers; defund sanctuary cities; and require employers to use E-Verify to ensure the legal status of workers. Co-authors of the legislation are Reps. Raúl Labrador, R-Idaho, and Martha McSally, R-Ariz.

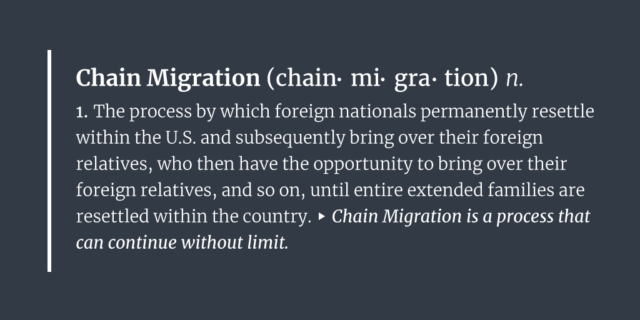

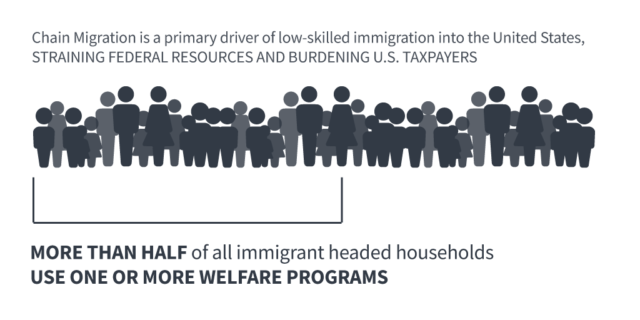

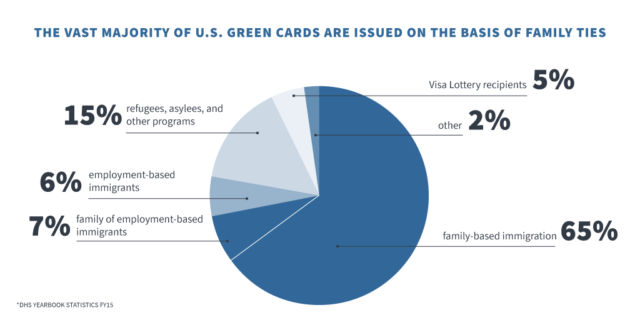

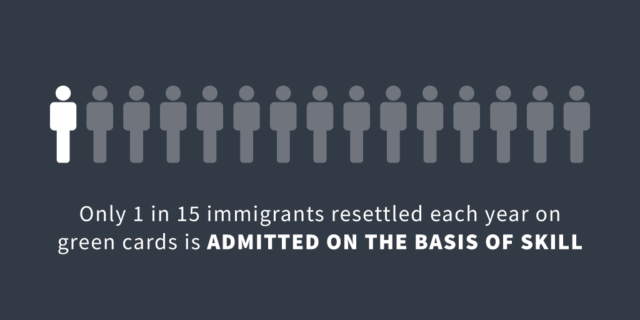

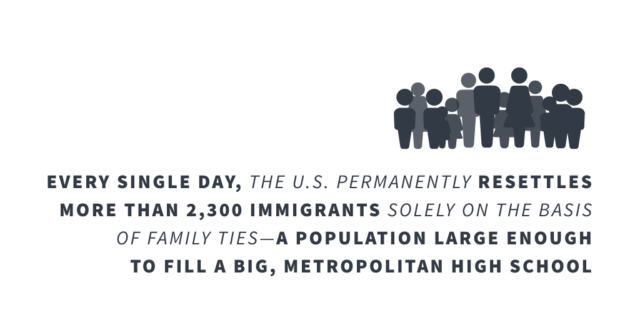

When meeting with members of Congress Tuesday, the bipartisan group decided to address four issues: DACA, border security, chain migration, and the visa lottery system.

During the meeting, Sen. Dianne Feinstein, D-Calif., asked the president about doing a “clean” DACA bill and saving the other issues for a second phase of a “comprehensive immigration reform.”

Trump, at first, seemed to be warm to the idea.

“We’re going to do DACA, and then we can start immediately on the phase two, which would be comprehensive,” Trump said in response to Feinstein. “I think a lot of people would like to see that. But we need to do DACA first.”

After that, House Majority Leader Kevin McCarthy, R-Calif., jumped into explain the need for border security.

Trump later said during the meeting: “To me, a ‘clean’ bill is a bill of DACA. We take care of them, and we also take care of security, and the Democrats want border security, too. … Then we go to comprehensive later on.”

DACA stemmed from President Barack Obama’s 2012 executive action that shielded an estimated 800,000 illegal immigrants from deportation brought to the country as minors. Comprehensive immigration reform has in past proposals included providing legal status to the more than 11 million illegal immigrants in the United States.

Last fall, the Justice Department announced it was reversing DACA, under threat of a lawsuit from 10 state attorneys general, giving Congress a deadline of March for legislating a replacement. However, on the same day as the bipartisan meeting, a federal judge in California ordered the Trump administration to maintain the program. The Justice Department announced it would appeal the ruling.

Trump also took questions about the possible interview with special counsel Robert Mueller, named to investigate possible collusion between the Trump presidential campaign and Russia.

“There is collusion, but it is really with the Democrats and the Russians far more than it is with the Republicans and Russians,” Trump said.

Many legal experts said they believe Mueller if focused less on Russia and more on building an obstruction of justice case against Trump or associates.

“When they have no collusion, and nobody’s found any collusion, at any level, it seems unlikely that you’d even have an interview,” Trump said.

COMMENTARY BY

Fred Lucas

Fred Lucas is the White House correspondent for The Daily Signal. Send an email to Fred. Twitter: @FredLucasWH.

RELATED ARTICLE: Trump: Judge’s move to protect DACA shows court system is ‘broken and unfair’

RELATED VIDEO: President Trump and Prime Minister Solberg of Norway hold joint news conference

A Note for our Readers:

Trust in the mainstream media is at a historic low—and rightfully so given the behavior of many journalists in Washington, D.C.

Ever since Donald Trump was elected president, it is painfully clear that the mainstream media covers liberals glowingly and conservatives critically.

Now journalists spread false, negative rumors about President Trump before any evidence is even produced.

Americans need an alternative to the mainstream media. That’s why The Daily Signal exists.

The Daily Signal’s mission is to give Americans the real, unvarnished truth about what is happening in Washington and what must be done to save our country.

Our dedicated team of more than 100 journalists and policy experts rely on the financial support of patriots like you.

Your donation helps us fight for access to our nation’s leaders and report the facts.

You deserve the truth about what’s going on in Washington.

Please make a gift to support The Daily Signal.

EDITORS NOTE: The featured image is of President Donald Trump answering questions from reporters during a joint news conference with Prime Minister Erna Solberg of Norway Wednesday in the East Room of the White House. (Photo: Olivier Douliery/Abaca Press/Newscom)