Former CIA Officer — Its the National Debt Stupid! Beware of the Bail-in!

“It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world.” – Thomas Jefferson, 3rd U.S. President

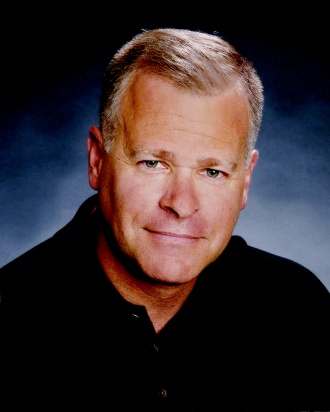

Decorated former Central Intelligence Agency (CIA) career officer who served in the Directorate of Operations between October 1982 and June 2005, Gary Berntsen was in Sarasota, Florida to talk about the greatest threat to the national security of the United States of America. Speaking at an event hosted by the Concerned Veterans for America, Berntsen said that the greatest national security threat to the U.S. is not the Russian incursion into Ukraine, the Chinese expansion into SE Asia, the threats from Middle Eastern terrorists, its the growing national debt.

Berntsen went on to say that the debt bubble is about to burst. It is when, not if, ordinary Americans will feel the impact of a weakened dollar and the failure of Congress to deal with the national debt and spending.

Berntsen quoted a number of recent books warning about the coming fiscal crisis, including The Death of Money: The Coming Collapse of the International Monetary System by James Rickards. Berntsen said that after reading Rickards book he understood how vulnerable Americans are to two fiscal bubbles – the dollar bubble and national debt bubble. Berntsen said that the pins that will burst these bubbles are: inflation and China stopping to buy U.S. Treasury Bonds.

Berntsen raised the specter of a new financial global paradigm called the “bail-in“. The Financial Times defines “bail-in” as, “[A] desire to make bondholders – who after all helped lend the money that allowed banks to lend imprudently – share the burden in future by making them forfeit part of their investment to “bail in” a bank before taxpayers are called up on to bail it out. In theory, this will force them to be more careful with their investments and protect the taxpayer from a re-run of the recent crisis.”

Berntsen noted that the bail-in paradigm was used in Cypress. In his article Bail-in vs. Bailout, David Kotok writes:

In the aftermath of the bungled Cyprus affair, we are now observing a major transition underway with regard to bank-deposit safety.

In the Eurozone and in Europe generally, the sacredness of an insured deposit was bludgeoned by the finance ministers in their botched attempt to impose a cost on insured deposits in Cyprus. The finance ministers were taken to task decisively by their political constituents. Imagine: it was the parliament of Cyprus that stood between the insured depositors in Eurozone banks and the outrageous attempt to breech the sacred promise that insurance entails.

One has to be thankful for the democratic political process that elects parliaments, even in Cyprus.

Now we are seeing a different form of attack on depositors. We are transitioning from a system of bank bailouts to “bail-ins.”

Berntsen said that Alan Greenspan in his book The Map and the Territory: Risk, Human Nature and the Future of Forecasting alluded to the new paradigm of the bail-in. The bail-in is available to President Obama and Congress as it was included in H.R. 4173: Dodd-Frank Wall Street Reform and Consumer Protection Act. The Financial Times in the definition of bail-in uses the Example of Dodd-Frank stating, “The US has already put in place bail-in-like powers as part of the Dodd-Frank financial reform act passed last year [2010]. The law includes a resolution scheme that gives regulators the ability to impose losses on bondholders while ensuring the critical parts of the bank can keep running. Employees would be paid, the lights would stay on and derivatives contracts would not have to be instantly unwound, one of the areas that caused market confusion when Lehman Brothers collapsed in September 2008.” [Emphasis added]

The danger is clear and present. The media is not covering this existential threat. Rather the news outlets are more interested in any issue other than the one most important to Main Street America.

Time will tell and time is running short according to Berntsen.

RELATED VIDEO:

[youtube]http://youtu.be/QTSvz__if2s[/youtube]