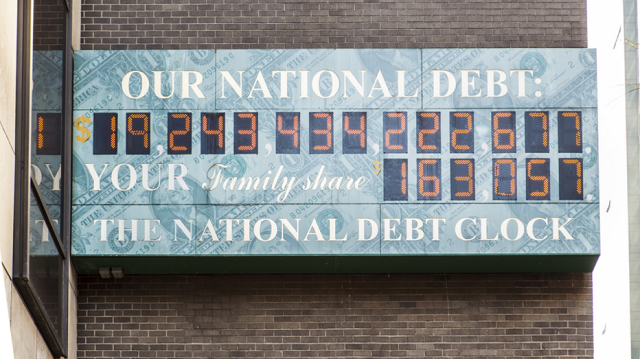

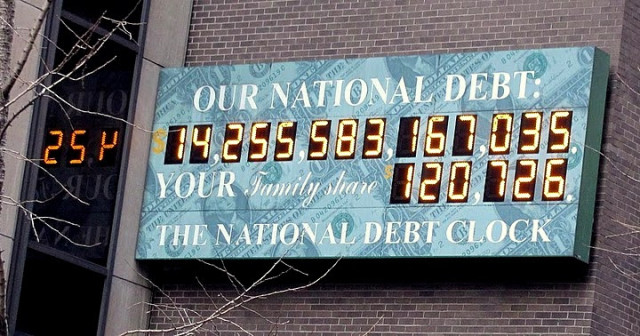

Report: True National Debt Exceeds $123 Trillion, or Nearly $800,000 per Taxpayer

The Democrat-CCP continues to impose more crushing debt on the American people, kill businesses, lockdown whole cities throw millions of out work.

China is taking over. Note what’s important and prioritized in their strategy for world domination – debt and spending. Balanced against the value of its commercial assets, the federal government had a combined total of $103.7 trillion in debts, liabilities, and unfunded obligations.

COVID was an act of war by China– launched during a US presidential election exploited and weaponized by the party of treason.

True National Debt Exceeds $123 Trillion, or Nearly $800,000 per Taxpayer, Report

By Mark Tapscott, The Epoch Times, April 19, 2021:

America’s national debt now exceeds $123 trillion, according to a new report, or more than four times the official figure of $28 trillion, as calculated by the U.S. Treasury Department at the end of March.

Federal spending related to the CCP virus pandemic and economic lockdown added nearly $10 trillion to the total in 2020, according to the latest edition of the “Financial State of the Union 2021” report, compiled and published annually by Chicago-based nonprofit Truth in Accounting (TIA).

But spending amid the pandemic represents only a small portion of the total difference between the official government figure and TIA’s calculation.

“Our measure of the government’s financial condition includes reported federal assets and liabilities, as well as promised, but not funded, Social Security and Medicare benefits,” the report stated.

“Elected and non-elected officials have made repeated financial decisions that have left the federal government with a debt burden of $123.11 trillion, including unfunded Social Security and Medicare promises.”

The TIA report includes in its total debt calculation $55.12 trillion in unfunded Medicare benefits and $41.20 trillion in unfunded Social Security benefits.

Treasury officials don’t include unfunded benefits because they claim recipients have no right to future payments, only to those under current entitlement laws.

The total debt, according to the report, “equates to a $796,000 burden for every federal taxpayer. Because the federal government would need such a vast amount of money from taxpayers to cover this debt, it received an ‘F’ grade for its financial condition.”

Unlike many state governments, the federal government doesn’t maintain a cash reserve to deal with spending necessitated by unexpected crises such as a virus pandemic.

“The coronavirus pandemic and related stimulus packages have caused some of the deterioration because the government had to borrow money to weather the pandemic. If the federal government was properly prepared for a crisis with a true rainy-day fund, it would not have had to borrow money,” TIA stated.

Defense and veterans’ benefits accounted for the largest share of federal spending in 2020 at 23 percent, followed by health and human services with 19 percent, Social Security with 16 percent, interest on the debt at 5 percent, and 2 percent on education. Fully a third (35 percent) of the spending went to what TIA described as “Other.”

Responses

Spokesmen for Sen. Bernie Sanders (I-Vt.) and Sen. Lindsey Graham (R-S.C.), respectively the chairman and ranking minority member of the Senate Budget Committee, didn’t respond to The Epoch Times request for comment.

Similarly, a spokesman for House Budget Committee Chairman Rep. John Yarmuth (D-Ky.), didn’t respond.

Mondays are typically “travel days” for senators returning from their states and representatives from the districts.

A spokesman for Rep. Jason Smith (R-Mo.), the budget panel’s ranking minority member, referred to a March 31 statement in which Smith criticized news spending proposals from President Joe Biden and congressional Democrats.

“Washington Democrats are embracing an historically disturbing appetite for spending. They just passed a nearly $2 Trillion bailout bill. President Biden is now proposing they turn right back around and cut a check for another $2 trillion to spend on a massive grab bag of policies all tied together with talking points,” Smith wrote.

“All the while, the President reportedly has yet another $2 trillion spending proposal in his back pocket awaiting its own news cycle.”

Consultants Agree

Campaign strategists and nonprofit activists interviewed by The Epoch Times about the TIA report expressed agreement that debt requires serious attention to get it under control.

Jim Manley, former communications director to Senate Majority Leader Harry Reid (D-Nev.), said “at some point, both parties are going to have to have a serious negotiation regarding the need to get our fiscal house in better order, and that includes both taxes and spending, but I don’t see that happening anytime soon because our politics are just too toxic.”

But, Manley said, “in the meantime interest rates are low and the economy is digging itself out of the hole the pandemic caused, but there is no reason for Democrats to be at all concerned about the Republicans’ new-found focus on cutting spending after everything the last administration did.”

He was referring, he said, to 2017 tax reform legislation enacted by Republican majorities in the House and Senate and signed into law by President Donald Trump.

Another Democratic campaign strategist, Kevin B. Chavous, told The Epoch Times: “This has been an issue that both parties have simply failed to address. It will not be fixed, though, by doing the same things.”

Chavous said he expects “the infrastructure bill will create jobs and grow the economy by investing in modern technology and cleaner energy sources. Things like a nationalized electric grid and expanded broadband access will make Americans more productive and more competitive in the years to come. It is an expense we have to make sooner than later.”

Taxpayers Protection Alliance (TPA) President David Williams pointed to the need to cut federal spending. “A debt of $123 trillion should be a wake-up call for the country. The bill is coming due very soon, which could have dire consequences for taxpayers and the country.”

Williams said Biden and congressional leaders “are seemingly oblivious to the stark fiscal crisis happening right under their noses. Worse yet, if they are aware of the deep financial issues, they are clearly not doing anything to fix the problem. Instead of finding ways to spend more money, Congress and the president need to find ways to cut spending.”

Citizens Against Government Waste (CAGW) President Tom Schatz noted that President Thomas Jefferson said the nation’s representatives shouldn’t accumulate debts that can’t be paid in their own time, and while this has been problematic for years, it has never been this significant.

Schatz said he believes “members of Congress have an obligation to attempt to bring spending under control and ensure that present and future taxpayers are not forced to fund any federal program that is duplicative, wasteful, and inefficient.”

When The Epoch Times asked TIA President Sheila Weinberg if it’s reasonable to depend upon future economic growth to solve the debt problem, she said no, and noted that the Treasury Department agrees.

“The authors of the Financial Report of the U.S. Government have deemed that under current law and policy, a massive implied increase in the ratio of reported debt to GDP—e.g. future debt will be growing faster than GDP—is simply unsustainable,” she said.

“In other words, under current law and policy, we can’t grow our way out of this, especially considering Medicare grows faster than inflation.”

RELATED ARTICLES:

Schweizer: China’s Influence on U.S. Government a ‘Massive Problem’

As a result, Athens has really and truly run out of money, and they will default on their debts starting tomorrow — and the European Central Bank has said

As a result, Athens has really and truly run out of money, and they will default on their debts starting tomorrow — and the European Central Bank has said