Florida Report Outlines Lasting Property Insurance Market Reform Recommendations

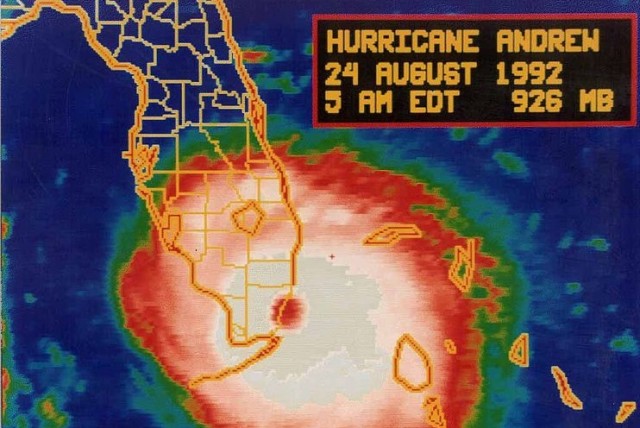

Unprecedented hurricane landfall inactivity in Florida presents opportunity for policymakers to help shield Florida’s economy from inevitable, storm-related threats report states.

Unprecedented hurricane landfall inactivity in Florida presents opportunity for policymakers to help shield Florida’s economy from inevitable, storm-related threats report states.

A hurricane has not made landfall in Florida for nine years; however, a new report from The James Madison Institute (JMI) warns this nearly decade long respite should not be considered the norm, but rather a fortuitous anomaly.

In it Backgrounder: “Lasting Reforms for Florida’s Property Insurance Market,” JMI adjunct scholar and R Street co-founder, R.J. Lehmann explores solutions that could reasonably be considered during the 2015 legislative session to shield Florida from economic hardship in the event of a major storm or series of storms.

The report states that because of the last few years of hurricane landfall inactivity, Citizens Property Insurance Corp., the Florida Hurricane Catastrophe Fund (Cat Fund) and the state’s private insurance sector are all in ideal financial positions to absorb reforms without undue adverse impacts on taxpayers, ratepayers or the state’s economy.

“Florida has been struck by the most hurricanes of any U.S. state, including the most powerful hurricane on records and seven of the 10 costliest hurricanes to have affected the nation. Unfortunately, this lull of dormancy has resulted in a misplaced public policy goal of insurance rate suppression leading to a dysfunctional property insurance system,” said Lehmann. “What happens when a storm finally arrives? Although no set of reforms can make Florida entirely immune to all of the problems that it could face, a sensible approach that recognizes the state’s role in Florida’s property insurance system, but trusts the market to solve many problems, will work best and bring the greatest sustainability.”

Recommendations include:

Citizens Reduction and Reform

- Continue incremental reduction of Citizens coverage limits for two additional years to $500,000;

- Remove non-primary residences from Citizens, with exceptions;

- Implement incremental Citizens eligibility reform with a “circuit-breaker” ensuring Citizens shrinks slowly, but steadily

- Allow excess and surplus lines carriers to take out policies from Citizens, with conditions; and

- Establish stricter notification requirements for future depopulation initiatives.

Cat Fund Reduction and Reform

- Gradually decrease the Cat Fund’s statutory capacity from $17 billion to $14 billion, with an emergency “override;”

- Gradually increase the Cat Fund’s statutory “deductible” from $7 billion to $8 billion;

- Ensure surplus protection mechanisms cover second-year claims;

- Explicitly authorize (but not require) Cat Fund managers to negotiate the purchase of private risk transfer;

- Allow flexibility to primary insurers in years when the Cat Fund is projected to experience a shortfall;

- Include taxpayer protection in the Cat Fund’s mission statement;

- Require reports from financial advisors to explicitly discuss second event and second season claims-paying capacity;

- Redefine “funds” or “cash balance” as any money that does not have to be repaid; and

- Include taxpayer protection efforts in bi-annual reports.

Claims-Paying Estimate and Conflict-of-Interest Reform

- Require an annual report on the combined post-storm bonding capacity of Citizens, the Cat Fund and the Florida Insurance Guaranty Association, assuming all three may attempt to issue bonds simultaneously after a significant hurricane event or season; and

- Enact conflict-of-interest rules to preclude financial advisers from deriving financial gain from bond issuances.

Providing background on state-run Citizens and the Cat Fund, the report also establishes how these state-run entities are both “one-hit wonders” designed to cover just one adverse hurricane season with no practical means to cover a second or third season without economically devastating consequences.

Although legislation has enabled a “glidepath” that allows yearly rate increases for Citizen’s policies, and some areas of the state now pay actuarially adequate rates, Citizens coverage remains significantly underpriced in much of the state’s coastal and other high-risk regions. Such underpricing would mean that if disaster strikes and Citizens were to run a deficit, it must first impose surcharges on its own policyholders, but may subsequently impose so-called “emergency assessments” on policies issued in Florida in nearly every property and casualty line of business.

“These assessments could amount to a “hurricane tax” that could add up to 30 percent to the cost of each insurance policy paid by the roughly 78 percent of homeowners, renters, drivers, boaters, businesses, charities and civic organizations statewide who derive no benefit from Citizen’s subsidized, underpriced rates,” describes Lehmann. “With its imposing size and its power to levy assessments, Citizens has the potential to place Floridians on the hook for billions of dollars if a sufficiently bad hurricane season wipes out the surplus it has slowly accumulated over the past nine years.”

Further complicating this serious threat, Citizens relies on another taxpayer-backed entity, the Cat Fund, to provide roughly $4.63 billion in reinsurance, which accounts for the majority of Citizen’s reinsurance support following a catastrophe. The Cat Fund covers a portion of the risk when insurers’ total losses exceed certain levels. However, unlike private reinsurers, it keeps no funds on-hand to pay the promised claims. The Cat Fun instead has the authority to issue bonds, which it repays by imposing assessments on policies in a way similar to Citizens.

“By relying on post-event financing, the Cat Fund charges substantially lower rates than the private sector for comparable coverage. To pay off the Cat Fund’s bond debts, dating back to the 2004 and 2005 hurricane seasons, Floridians were forced to pay 1.3 percent assessments on their homeowners, auto, renters and other insurance policies until Jan. 1, 2015,” continued Lehmann. “The Cat Fund turns the principles of diversification on its head by concentrating Florida’s peak hurricane risk within the state, rather than spreading it around the world, as private reinsurers do.”

Diving deeper into the explanation of the report’s solutions, the JMI backgrounder offers a comprehensive look into opportunity that Florida’s lawmakers have during the 2015 legislative session. The report concludes lawmakers should continue to shrink Citizens, reduce the size of the Cat Fund, and promote reforms that would result in a surge of capital to the state after a storm to help it quickly recover both physically and economically, rather than saddle it with debt.

“Florida surpassing New York to become the third most populous state should be another wake-up call for policymakers that the resulting risk of a major storm or a very active hurricane season is greater than ever. As our scholar has said, our coastal exposure alone has increased to more than 2.9 trillion,” said Dr. Bob McClure, president and CEO of The James Madison Institute. “Instead of worrying about a hurricane trajectory when it’s too late, Florida leaders should take action now on property insurance reforms to better ensure an economic trajectory that bounces back quickly into the positive after an inevitably active hurricane season.”

Read the full report by clicking here.