Diversity, Equity, Inclusion = Discrimination, Inequality, Exclusion

No matter what you say about DIE, the bottom line is, it’s Affirmative Action with new names. America is being run by Affirmative Action Gradates. The sad part is the actions of our legislators and their continued spending spree will make hitting the iceberg inevitable. With the poll numbers favoring Trump and MAGA, past experience indicates; depression, war, riots, Marshall Law and no election is on the horizon. I hope I am wrong but I can see these power hungry entities giving up power any time soon. Power corrupts and absolute power corrupts absolutely. They will lie, cheat and steal so you must be armed with the truth.

This week Tyson Foods, which includes Chicken, Hillshire, Sarah Lee and many more announced a layoff of 1200 Americans only to hire 5200 illegals. How did that happen? I thought we were safe after all we had E-Verify. Well OBiden allowed illegals to enter under the parole system. While they await their trial, they could work. In the meantime they got lots of free stuff paid for by the American taxpayer so the corporation could pay a reduced salary. But why does the corporation want to put Americans out of work if their money was paying for free stuff? Not to worry, the government would just print more money.

Since we are paying for all the illegal’s “free Stuff” the illegals can go on a spending spree and the economic indicators charting purchases will make the company look profitable and economy look strong. Then they can become a Tent Partner. What is Tent.org? Tent is an NGO that formed a public/private partnership with the U.S. State Department.

The purpose of Tent is to mobilize major businesses to connect refugees to work.

“Companies have a critical role to play in helping refugees – who have been forced to flee their home countries – integrate into their new communities. We focus on mobilizing leading businesses to connect refugees to work through hiring , training , and mentorship – because we know that securing a job is a critical milestone for a refugee building a new life.” Americans are paying for this. What about our jobs and our lives?

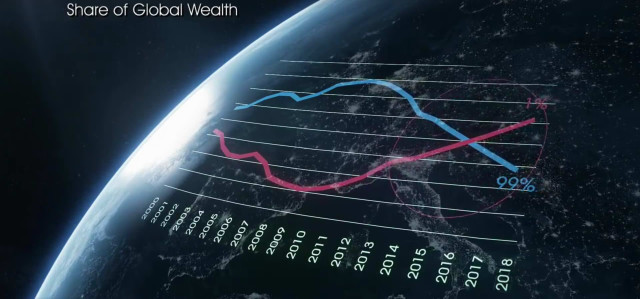

In reality we are printing money to give to illegals so they can spend the money buying stuff making the corporations lots of profit and the stock market goes up. In addition the corporations get so many subsidies that they are getting really cheap labor. Imagine $15,098 per American per year goes to the government to support the illegals OBiden has brought to America to replace you. Can you use an extra $15,000? Are you happy yet?

That takes care of the illegals, your replacement who gets hired, trained and mentored at our expense. . What happens to the corporation? How are they benefiting? Tax Subsidies

In addition to paying Tent to replace us, Corporations now qualify for WOTC

The WOTC, Work Opportunity Tax Credit, extended until 2025 is being used by corporations to hire people in certain categories. Once hired using DIE principal, the corporation gets a $10000 per person per year tax subsidy. Tyson is a perfect example. Tyson just fired 1200 Americans and will 5200 illegals. Hillshire, Jimmy Dean, Sarah Lee are part of the Tyson Family. Tyson needs a Boycott.

How many other companies will follow suit? Take a look at the Tent Membership list. Layoffs are coming. Remember 2006-8?

Put that together with the Workforce Housing Tax Credit and major corporations will be building low income housing in 15 Minute Cities for their workers while getting another tax subsidy on the back of the taxpayer. Everyone will be equitable You will live in a high-rise from 350-700 sq. ft. Stores down below and the factory on the next block. Everything you need will be in walking distance. Your government will provide what ever you need and if you have enough social credits you can make purchases.

In addition OBiden is printing $35 Billion to convert commercial building to rental units to house the illegals that are invading our country. The taxpayer is fleeced again and the U.S. House gives OBiden more money.

O’Biden’s policies are causing the U.S. treasury to print $1 Trillion every 90 days.

There no such thing as Cheap Labor.

Ask your candidates questions VET them carefully and hold them accountable.

WHEN THEY LIE TO US AND DON’T DO AS THEY SAY, REPLACE THEM ALL! Will they STOP THE SPENDING?

It seems as though the Blacks, Hispanics and LGBTQ+++, are no longer the favored chosen ones. Americans are being replaced by illegals for tax subsidies and votes.

You will not hear this on MSM. The unemployment numbers, job numbers and economic indicators are all lies. More illegals have gotten jobs under the OBiden regime than Americans. Those “great” job numbers you hear are jobs for illegals. Free speech is having its lights turned off. Although the Globalists yell constantly they are for free speech, they are only for the free speech that speech agrees with their vision… Yes sir, I believe it is a great idea to replace Americans and bring in foreign labor so the corporations can get rich and investors can make more money. I just love seeing veterans and Americans homeless living on the street. I think we should print more money so the debt and inflation can go higher. Then the Globalists will be happy and I will own nothing.

Nationalists will dream of their future, their life and set a plan to achieve that dream. Globalists will have a visions of life and demand you fit into their vision without deviation. If you disagree they will squash you.

All Globalists want is Money, Control and Power. They can only get Power if we give it to them. Don’t give them yours. Challenge them with the truth. Doing Nothing is Affirmation.

The Regime will not go quietly, Prepare. Share with your 5.

©2024. Karen Schoen. All rights reserved.

RELATED ARTICLE: Watch This Banned Film That Reveals How We’re Being Controlled by a ‘Shadow Government’

RELATED VIDEOS:

Deep State PLOT to REMOVE TRUMP Happening NOW

Andre’s Epic Response to Question About Border Crisis Impacting Black Americans

IN FOCUS: United Nations Agenda 2030 Sustainable Development Goals with Alex Newman – OAN