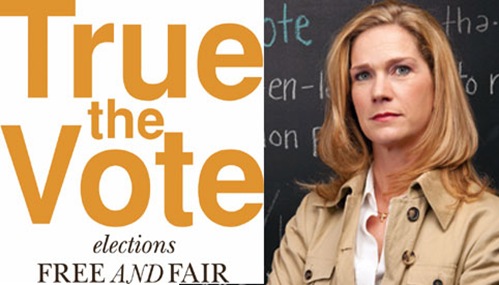

Catherine Engelbrecht v. United States

Catherine Engelbrecht’s testimony at House of Representatives hearing on the IRS targeting her and True the Vote.

[youtube]http://youtu.be/xxcMKtsm5BU[/youtube]

ABOUT TRUE THE VOTE:

Unfortunately, Americans have lost faith in the integrity of our nation’s election results and fraud and law-breaking has become all too common in our electoral system. We hope to change that perception. True the Vote is a citizen-led effort to restore truth, faith, and integrity to our elections.

True the Vote is an initiative developed by citizens for citizens, meant to inspire and equip volunteers for involvement at every stage of our electoral process. We promote ideas that actively protect the rights of legitimate voters, regardless of their political party affiliation.

We are working to restore integrity to the American system of electing its leaders. With True the Vote, we have, “deconstructed the entire process, focusing on educating voters, examining the registry, recruiting, training and mobilizing election workers and poll watchers, training how to collect data all along the way, then use the data to shape government action and legislative agendas to support desperately needed election code reform.”

Our government was built upon the belief that election results represent the true will of the people and our election processes were always intended to be supported by citizen volunteers. We are helping stop corruption where it can start – at the polls.

Our initiatives include:

- Mobilizing and training volunteers who are willing to work as election monitors

- Aggressively pursuing fraud reports to ensure prosecution when appropriate

- Providing a support system for our volunteers that includes live and online training, quick reference guides, a call bank to phone in problem reports, information on videotaping at polling places, and security as necessary

- Creating documentaries and instructional videos for use in recruiting and training

- Raising awareness of the problem through strategic outreach efforts including advertising, social networking, media relations, and relational marketing

- Voter registration programs and efforts to validate existing registration lists, including the use of pattern recognition software to detect problem areas

Based in Houston, Texas and headed by Catherine Engelbrecht (President), True The Vote is staffed by volunteers all across the country. Essentially, True The Vote is you and me. Every day Americans interested in the integrity of the elections in the home district.