Why Cuomo’s Latest Tax Hike Proposal Would Accelerate New York’s Decline

New Yorkers had a rough, rough 2020. Governor Andrew Cuomo’s latest proposal would make 2021 even worse.

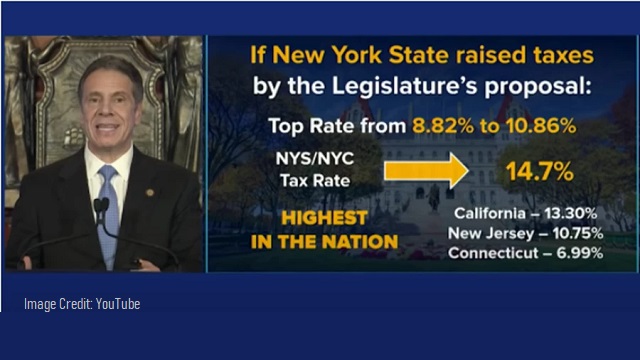

“New York Gov. Andrew Cuomo proposed raising taxes on the wealthy to a combined level of 14.7%, which would be the highest state-and-local tax rate in the nation,” CNBC reports. “The tax increase would raise $1.5 billion for the state, Cuomo said Tuesday in an address unveiling his 2022 budget proposal.”

Gov. Cuomo plan would raise tax for wealthiest New Yorkers to 14.7%, highest combined rate in nation https://t.co/7Uwv2OhyG3

— CNBC (@CNBC) January 19, 2021

The tax increases would apply to those who earn more than $5 million a year. If implemented, New Yorkers would officially beat California for the top state and local tax rate in the nation; the Golden State currently comes in at 13.3 percent.

Governor Cuomo says the tax increases are necessary because unless the federal government passes a full bailout for the $15 billion state budget hole New York has created, it will have a large deficit to plug.

“New York cannot manage a $15 billion deficit,” Cuomo said. “It’s beyond what we can do.”

The governor favors hiking taxes on “the rich” rather than closing the budget gap solely by cutting spending.

People and Wealth are Already Fleeing New York

Even before these proposed hikes, the Empire State already has the highest overall tax burden—beyond just income taxes—nationwide and one of the highest costs of living. The situation has only worsened during the COVID-19 crisis, with huge losses of life, in part due to the governor’s mandate forcing nursing homes to accept COVID-19-positive patients. And, drastic lockdowns imposed irrespective of actual pandemic data have ruined New York City’s economy and the cultural vibrancy that made it so appealing pre-pandemic.

So it shouldn’t come as a surprise that people are fleeing in droves.

More than 300,000 people have left the city, according to official filings. Informal measures like U-Haul data similarly show New Yorkers moving elsewhere en masse. An astounding $34 billion in income left the area in 2020.

Over the summer, Governor Cuomo was literally reduced to calling up wealthy residents who’d fled and begging them to come back to New York City—even offering to cook for them and buy them drinks.

Further Hiking Taxes Will Chase More Wealth Out of New York

New York state officials should be doing everything they can to reverse this troubling trend; cutting taxes; removing regulations; expanding education options. If Cuomo successfully implements his tax hikes, though, it will only result in more people leaving the Empire State.

Why? It’s simple.

A tax proposal cannot be evaluated simply on its raw numbers. One must also take into account how it would change people’s behavior.

Successful people are not automatons; if anything, they are the most responsive and mobile members of society. And other thriving states like Florida and Texas offer not just warmer weather than New York, but zero state income taxes. It’s only natural that increased tax rates will prompt more people to leave the Empire State; nobody likes paying taxes or wants to have more of their money taken away. Even the super rich.

This will hurt the entire state, which will lose not only residents, but also their wealth, spending, investment, and businesses (aka jobs).

Ironically, the tax increase may not even raise the $1.5 billion in revenue that Cuomo hopes. Sometimes, an increase in income tax rates can actually decrease income-generating activity so much that overall tax revenues fall. This was the famous insight of economist Art Laffer, who served on Ronald Reagan’s board of economic advisors. We can’t know for sure whether it would apply here—taxes always disincentivize income earning, but only sometimes result in less tax revenue—but it’s certainly cause to be skeptical of Governor Cuomo’s revenue projections.

The Big Picture: Incentives Matter

However, Governor Cuomo’s backward policy proposal has implications that reach much wider than just New York state and its most successful citizens. It’s another reminder that when it comes to government policy, incentives matter.

“Our economic verities have remained forever,” Laffer once explained. “They go back to caveman, pre-cavemen. Incentives matter: If you reward an activity, then people do more of it. If you punish an activity, people do less of it.”

This is why progressives often promote cigarette taxes or carbon taxes. They, at least in this setting, acknowledge that taxing something naturally discourages its consumption and production—you get less of it. Why does anyone want to do that for income?

The timeless economic reality of incentives doesn’t just call Cuomo’s tax hike on high earners into question. It ought to make us reconsider whether we should be punishing wealth-creation through taxing income at all.

COLUMN BY

Brad Polumbo

Brad Polumbo (@Brad_Polumbo) is a libertarian-conservative journalist and Opinion Editor at the Foundation for Economic Education.

EDITORS NOTE: This FEE column is republished with permission. ©All rights reserved.

RELATED TWEET:

We always assumed he didn’t care about the deaths of our loved ones. And today’s heartless comment confirms it. “Who cares. They died.” pic.twitter.com/O9LLz76PQB

— Janice Dean (@JaniceDean) January 29, 2021

RELATED VIDEO: Covid and Many Humans’ Yearning to be Slaves.

Ah, yes, our old friend, the

Ah, yes, our old friend, the