Will ESG Reform Capitalism—or Destroy It?

What “stakeholder capitalism” really means for the world.

Stakeholder capitalism has taken the global economy by storm in recent years. Its champions proclaim that it will save—and remake—the world. Will it live up to its hype or will it destroy capitalism in the name of reforming it?

Proponents pitch stakeholder capitalism as an antidote to the excesses of “shareholder capitalism,” which they condemn as too narrowly focused on maximizing profits (especially short-term profits) for corporate shareholders. This, they argue, is socially irresponsible and destructive, because it disregards the interests of other stakeholders, including customers, suppliers, employees, local communities, and society in general.

Stakeholder capitalism is ostensibly about incentivizing business leaders to take these wider considerations into account and thus make more “sustainable” decisions. This, it is argued, is also better in the long run for businesses’ bottom lines.

The Rise and Reign of ESG

Today’s dominant strain of stakeholder capitalism is the doctrine known as ESG, which stands for “environmental, social, and corporate governance.” The label was coined in the 2004 report of Who Cares Wins, a joint initiative of elite financial institutions invited by the United Nations “to develop guidelines and recommendations on how to better integrate environmental, social and corporate governance issues in asset management, securities brokerage services and associated research functions.”

Who Cares Wins operated under the auspices of the UN’s Global Compact, which, as the report states, “is a corporate responsibility initiative launched by Secretary-General Kofi Annan in 2000 with the primary goal of implementing universal principles in business.”

Much progress has been made toward that goal. Since 2004, ESG has evolved from “guidelines and recommendations” to explicit standards that hold sway over huge swaths of the global economy.

These standards are set by ESG rating agencies like the Sustainability Accounting Standards Board (SASB) and enforced by investment firms that manage ESG funds. One such firm is Blackrock, whose CEO Larry Fink is a leading champion of both ESG and SASB.

In December, Reuters published a report titled “How 2021 became the year of ESG investing” which stated that, “ESG funds now account for 10% of worldwide fund assets.”

And in April, Bloomberg reported that ESG, “by some estimates represents more than $40 trillion in assets. According to Morningstar, genuine ESG funds held about $2.7 trillion in managed assets at the end of the fourth quarter.”

To access any of that capital, it is no longer enough for a business to offer a good return on investment. It must also report “environmental” and “social” metrics that meet ESG standards.

Is that a welcome development? Will the general public as non-owning “stakeholders” of these businesses be better off thanks to the implementation of ESG standards? Is stakeholder capitalism beginning to reform shareholder capitalism by widening its perspective and curing it of its narrow-minded fixation on profit uber alles?

Capitalism Is for Consumers

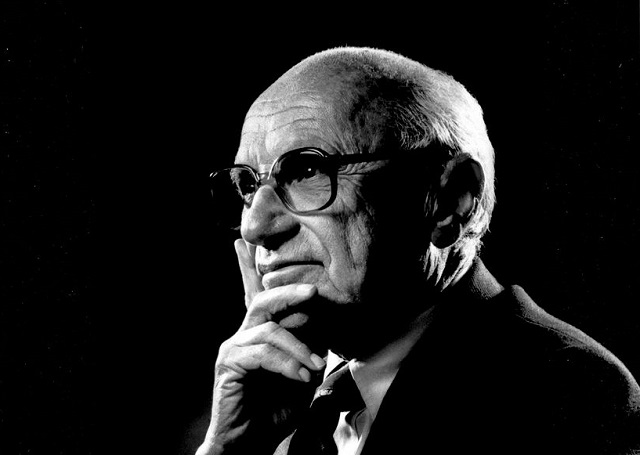

To answer that, some clarification is in order. First of all, “shareholder capitalism” is a misleading term for laissez faire capitalism. It is true that, as Milton Friedman wrote in his 1970 critique of the “social responsibility of business” rhetoric of the time:

“In a free‐enterprise, private‐property system, a corporate executive is an employee of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom.”

Since the owners of a publicly traded corporation are its shareholders, it is true that they are and ought to be the “bosses” of a corporation’s employees—including its management. It is also true that corporate executives properly have a fiduciary responsibility to maximize profits for their shareholders.

But that does not mean that shareholders reign supreme under capitalism. As the great economist Ludwig von Mises explained in his book Human Action:

“The direction of all economic affairs is in the market society a task of the entrepreneurs [which, according to Mises’s technical definition includes shareholding investors]. Theirs is the control of production. They are at the helm and steer the ship. A superficial observer would believe that they are supreme. But they are not. They are bound to obey unconditionally the captain’s orders. The captain is the consumer.”

The “sovereign consumers,” as Mises calls them, issue their orders through “their buying and their abstention from buying.” Those orders are transmitted throughout the entire economy via the price system. Entrepreneurs and investors who correctly anticipate those orders and direct production accordingly are rewarded with profits. But if one, as Mises says, “does not strictly obey the orders of the public as they are conveyed to him by the structure of market prices, he suffers losses, he goes bankrupt, and is thus removed from his eminent position at the helm. Other men who did better in satisfying the demand of the consumers replace him.”

Under laissez faire capitalism, consumers, not shareholders, are the principal stakeholders whose preferences reign supreme. And shareholder profit is a measure of—and motivating reward for—success “in adjusting the course of production activities to the most urgent demand of the consumers,” as Mises wrote in his paper “Profit and Loss.”

This is highly relevant to the “stakeholder capitalism” discussion, because it means that, to the extent that the profit-and-loss metric is discounted for the sake of competing objectives (like serving other “stakeholders,” the sovereign consumers are dethroned, disregarded, and relatively impoverished.

Now it’s at least conceivable that ESG standards are not competing, but rather complementary to the profit-and-loss metric and thus serving consumers. In fact, that’s a big part of the ESG sales pitch: that corporations who adopt and adhere to ESG standards will enjoy higher long-term profits, because breaking free of their fixation on short-term shareholder returns will enable them to embrace more “sustainable” business practices.

In a free market, whether that promise would be fulfilled or not would be for the sovereign consumers to decide, and ESG would rise or fall on its own merits.

Who Complies Wins

Unfortunately, our market economy is far from free. The State has rigged capital markets for the benefit of its elite lackeys in the financial industry: like the “Who Cares Wins” fat cats who started the ESG ball rolling in 2004 under the auspices of the United Nations.

One of the prime ways the State rigs markets is through central bank policy.

The prodigious amount of newly created money that the Federal Reserve and other central banks have pumped into financial institutions in recent years has transferred vast amounts of real wealth to those institutions from the general public. As a result, those institutions—big banks and investment companies—are now much more beholden to the State and much less beholden to consumers for their wealth.

As they say, “he who pays the piper calls the tune.” So it’s no surprise that these institutions are stumbling over themselves to get on board the State’s ESG bandwagon.

And that means that non-financial corporations also have to get with the ESG program if they want access to the Fed’s money tap and thus to capital. Especially as the average consumer becomes increasingly impoverished by disastrous economic policies, the incentive for corporations to earn market profit by pleasing consumers is being progressively superseded by the incentive to gain access to the Fed’s flow of loot by meeting the State’s “social” standards.

By increasingly controlling capital flows, the State is gaining ever more control over the entire economy.

This may explain the recent willingness of so many corporations to alienate customers and sacrifice profits on the altar of “green” and “woke” politics.

It is no coincidence that Klaus Schaub, the preeminent champion of the “Great Reset” also co-authored a book titled Stakeholder Capitalism. The upshot of stakeholder capitalism is that the State supplants the consumer as the supreme stakeholder in the economy. The sick joke of stakeholder capitalism is that it “reforms” capitalism by transforming it into a form of socialism.

Dan Sanchez

Dan Sanchez is the Director of Content at the Foundation for Economic Education (FEE) and the editor-in chief of FEE.org.

In 1962 Milton Friedman, with his wife Rose, wrote

In 1962 Milton Friedman, with his wife Rose, wrote