When Will the Presidential Candidates Debate America’s Energy Opportunity?

Presidential debates are supposed to cover the issues that will most affect voters.

In this respect, every Presidential debate so far has failed, because none have discussed America’s single greatest opportunity, an opportunity that can help solve 8 of our toughest challenges and “make America great again.” This is America’s energy opportunity.

America has a once-in-a-generation opportunity to combine American innovation, American resources, and American freedom to create American energy abundance and become the world’s energy superpower, overtaking Russia and the Middle East.

The question is: Will we seize this opportunity or will we squander it?

You’ve heard the expression “there’s no silver bullet” for our problems but America’s energy opportunity is a silver bullet.

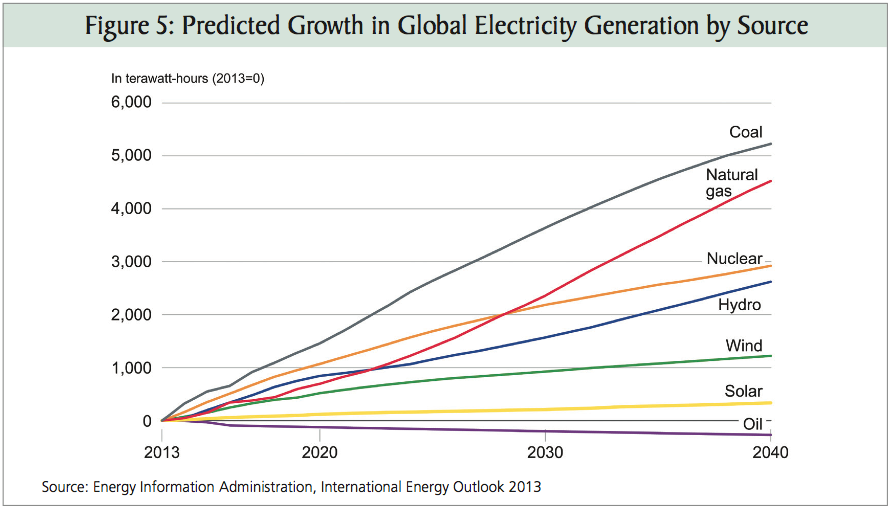

Energy is a uniquely consequential issue because the energy industry is the industry that powers every other industry. By creating American energy abundance and becoming the world’s energy superpower we can tackle eight key challenges at once.

- Jump-start the American economy

Our challenge: We have been mired in recession or near-recession for a decade—and without the energy industry it would be much, much worse.

Our opportunity: The same industry that has kept us out of desperate trouble can bring us to new heights, by producing and selling energy around the world. - Create millions of well-paying job opportunities

Our challenge: It is difficult for many Americans to find jobs, in large part thanks to onerous restrictions on industry that have shut down many companies.

Our opportunity: A ramp-up in the US energy industry would create millions of productive, well-paying jobs. - Lower your cost of living

Our challenge: The US cost of living has been going up for decades, and when the prices of energy goes up, transportation, heating, and electric bills place a large burden on American business.

Our opportunity: Energy affordability can lower the cost of our direct energy bills, saving thousands of dollars a year—and, because energy is part of every industry, it can lower the cost of everything we buy and do. - Increase our industrial competitiveness

Our challenge: Due largely to onerous government policies, American manufacturing has declined for decades, leaving far worse employment opportunities for those trained for industrial jobs.

Our opportunity: Energy affordability dramatically lowers one of the largest manufacturing costs, and combined with liberating industry from irrational costs, it can make America a manufacturing hub. - Shrink the deficit

Our challenge: America has a massive, ever-growing deficit and debt, caused by a combination of reckless spending and a sluggish economy.

Our opportunity: Doubling American energy production is our easiest path to economic growth and increased tax revenues without tax increases; coupled with a commitment to cutting spending we can finally be on a path to solvency. - Increase national security

Our challenge: Nations around the world threaten us, and one major difficulty we have in dealing with them is their enormous influence in world energy markets, particularly oil and gas.

Our opportunity: America’s energy leadership will give America and her allies energy security from Russia and the Middle East, protecting both economic stability and foreign policy leverage. - Fight global poverty

Our challenge: Much of the world is still massively impoverished.

Our opportunity: Energy abundance will make it more affordable for countries to industrialize and in particular to alleviate one of the most crucial aspects of poverty: energy poverty. - Improve environmental quality worldwide

Our challenge: Environmental concerns are always crucial—we want to be as productive as we can be but also have a clean, healthy environment, which many say is impossible with fossil fuels, nuclear, and hydro.

Our opportunity: Contrary to popular belief, the freedom to develop these sources won’t make our environment dirtier and our climate more dangerous, they will make our environment cleaner and our climate safer—because energy abundance dramatically improves environmental quality and climate safety.

Our politicians should be seizing all 8 of these opportunities. Instead, they are squandering them.

We can only create American energy abundance if we are free to choose, produce, transport the most abundant, affordable, reliable forms of energy—including hydrocarbons, nuclear, and hydro power.

Unfortunately, the Washington establishment has attacked every single one of these sources of energy abundance.

Instead of protecting the freedom to choose the best forms of energy, they are anti-choice and pro-subsidy.

Instead of protecting the freedom to produce the best forms of energy, they are anti-drilling and anti-mining.

Instead of protecting the freedom to transport energy where it is needed, they are anti-pipeline and anti-export terminals for coal, oil, and gas.

Instead of protecting the freedom to innovate in energy, they are anti-innovation in the most promising types of energy technologies, such as nuclear and fracking.

Washington could be making us into an energy superpower. Instead it is making us into an energy pawn.

How can we change course? We need to give our politicians an ultimatum: seize America’s energy opportunity—or lose our vote. That’s why I created a simple website, America’s Energy Opportunity, with an ultimatum you can sign and send to your elected officials.

If we do this together—by the hundreds, by the thousands, and ultimately by the millions—then our politicians and candidates will no longer be able to ignore America’s energy opportunity. And they just might seize it. Let’s demand that they do.

Disclosure: America’s Energy Opportunity has no affiliation with or funding from any party, industry, campaign, PAC, or other special interest. Its (very small) budget is entirely financed by my organization, the Center for Industrial Progress.

As always, if you’d like to suggest a new guest for Power Hour, or have me appear on your show, you can send me an email at support@industrialprogress.net

RELATED ARTICLE: “The Economic Effects of Immediately Opening Federal Lands to Oil, Gas, and Coal Leasing,”

Thus, our number one recommendation is to read and/or assign

Thus, our number one recommendation is to read and/or assign