Pavlovian Politics

We have all seen people on both sides of the political aisle use catch phrases routinely in response to political topics, but it seems the Democrats have honed this skill to razor sharpness. For example, in her recent “60 Minutes” interview, Rep. Alexandria Ocasio-Cortez (D-NY) was asked by Anderson Cooper if she thought President Trump was a racist, to which her reflexive response was,

“Yes, no question. When you look at the words that he uses, which are historic dog whistles of white supremacy, when you look at how he reacted to Charlottesville incident where neo-Nazis murdered a woman, versus how he manufactures crisis, like immigrants seeking legal refuge on our borders, it is night and day.”

Her response seemed almost robotic. I found her use of words like “dog whistles,” “white supremacy” and “manufactures crisis” illuminating as if she had been programmed to use such expressions on command, kind of like Pavlov’s dog. Say a certain word or ask a question, and the person begins to salivate automatically. Frankly, it’s kind of scary.

The expression “dog whistles” is particularly interesting as it is now commonly used by the Left to denote how they believe conservatives respond. Now I will admit I have seen Republicans use catch phrases, such as “Lock her up” and “CNN sucks,” but I have found conservatives more inclined to engage in honest debate as opposed to Democrats trained in Pavlovian responses.

Do you want to stop a left-wing Democrat in his/her tracks? Just tell them you have voted for a Democrat in the past, as you thought the person was the right candidate for the job, and then ask if they ever voted for a Republican. A wild-eyed expression comes over their face and they are at a loss for words.

I had a Democrat friend who recently told me point blank, “I will never go to any meeting where a Republican is speaking.” So much for open-mindedness. I also guess I will not see him in any of my audiences any time soon.

What I am finding with Democrats is there is less courteous debate and more conditioning in terms of talking points. Whenever I get in an argument with them, I feel I am dealing directly with MSNBC’s Rachel Maddow or CNN’s Don Lemon, et al. Interestingly, if you ask them to explain their rehearsed talking points, they are at a loss. This speaks volumes about the power of the main stream media. Further, they tend to turn up the volume as if you cannot hear them. I have found both young and older Democrats becoming excessively passionate and less inclined to hear opposing views, thereby emboldening them to attack their opponents.

Now there is a movement in the media to label Republicans as racist, hate-filled liars. This is all being done as a prelude to the 2020 elections to condition their constituents to believe Republicans are evil and must be eliminated. Through the use of identity politics, the media is creating stereotypes intended for character assassination. I don’t think Hitler could have done it any better.

As to racism, let us never forget not one Republican ever owned a slave. In fact, the Republican Party was created to abolish slavery (anyone remember a guy named Lincoln?). The Left conveniently overlooks the fact that the Ku Klux Klan and Jim Crow laws were all Democrat inventions, and somehow try to blame the Republicans for their creation. Nothing could be further from the truth. Nonetheless, by training people to repetitively chant “Racist, Racist, Racist,” they are hoping people will develop a reflexive action against the Republicans.

By religiously parroting the talking points of the Left, the Democrats have become a party of lemmings controlled by the news media who has plotted them on a course to tear their opponents apart. More likely though, they will end up in the abyss.

Keep the Faith!

RELATED VIDEO: Rep. Alexandria Ocasio-Cortez (D-NY) 60 Minutes interview with Anderson Cooper

EDITORS NOTE: This column with images is republished with permission. All trademarks both marked and unmarked belong to their respective companies. The featured photo is by Charles Deluvio 🇵🇭🇨🇦 on Unsplash.

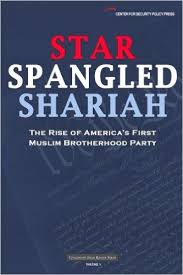

The wolves have been at work for a while preparing for such a time as now. These wolves are cunning, patient, low profile, and terribly focused like a laser beam on their target; only their target is not simply a herd of sheep but an entire country that daily becomes increasingly like a herd of sheep. The country is the United States, and the wolves that have been at work are members of the Muslim Brotherhood and affiliate Islamic groups sworn to fulfill the Quran’s commandment to establish a Caliphate; a One-World Muslim religion, culture, law, and maniacal allegiance to their Prophet Mohammed. Any obstacle standing in their way of total achievement and domination is to be fully and completely eliminated – not tampered with, coddled or made friends with, but eliminated.

The wolves have been at work for a while preparing for such a time as now. These wolves are cunning, patient, low profile, and terribly focused like a laser beam on their target; only their target is not simply a herd of sheep but an entire country that daily becomes increasingly like a herd of sheep. The country is the United States, and the wolves that have been at work are members of the Muslim Brotherhood and affiliate Islamic groups sworn to fulfill the Quran’s commandment to establish a Caliphate; a One-World Muslim religion, culture, law, and maniacal allegiance to their Prophet Mohammed. Any obstacle standing in their way of total achievement and domination is to be fully and completely eliminated – not tampered with, coddled or made friends with, but eliminated.

As shown by the

As shown by the

Too often, the message students get in college is that government is the answer to all social and economic problems. This happens in classes on history, sociology, politics, literature, and even in economics. You can graduate having heard only one narrative: the market has failed, so it must be replaced by all-controlling government bureaucracies.

Too often, the message students get in college is that government is the answer to all social and economic problems. This happens in classes on history, sociology, politics, literature, and even in economics. You can graduate having heard only one narrative: the market has failed, so it must be replaced by all-controlling government bureaucracies.

To paraphrase Winston Churchill, “Lebanon is a riddle wrapped in a mystery inside an enigma.” Unraveling the Lebanese enigma is the objective of a new book by Dr. Mordechai Nisan, Politics and War in Lebanon. Nisan is an accomplished Israeli political scientist and retired Hebrew University lecturer. His body of work covers Zionism, Islam, Arab history, minority peoples, Lebanon, U.S. Middle East policy and the Arab-Israeli conflict. It is rare that a book achieves its objective of unraveling the complex nuances of the Lebanon puzzle in both an astute and yet literate manner. Dr. Nisan has views on many issues including why the 80 year old confessional political system persists and has resilience. It has a lot to do with the adoption of the Maronite Christian independence ethos arising from the historic resistance against centuries of Muslim and later Ottoman rule under Islamic Sharia law.

To paraphrase Winston Churchill, “Lebanon is a riddle wrapped in a mystery inside an enigma.” Unraveling the Lebanese enigma is the objective of a new book by Dr. Mordechai Nisan, Politics and War in Lebanon. Nisan is an accomplished Israeli political scientist and retired Hebrew University lecturer. His body of work covers Zionism, Islam, Arab history, minority peoples, Lebanon, U.S. Middle East policy and the Arab-Israeli conflict. It is rare that a book achieves its objective of unraveling the complex nuances of the Lebanon puzzle in both an astute and yet literate manner. Dr. Nisan has views on many issues including why the 80 year old confessional political system persists and has resilience. It has a lot to do with the adoption of the Maronite Christian independence ethos arising from the historic resistance against centuries of Muslim and later Ottoman rule under Islamic Sharia law.