Florida: Legislature wants to roll property taxes into state sales tax

Florida comes in at #25 for property taxes with a rate of 1.06%. New Jersey has the highest rate at 2.38 percent. Hawaii has the lowest rate at 0.28 percent.

There have been efforts to eliminate Florida’s property taxes and rolling it into the state sales tax. The Florida legislature will be looking into doing just that during the 2016 session, which starts in January.

CBS News Miami reports:

A House committee is looking at ways to replace property taxes with a higher state sales tax.

The House Finance & Tax Committee on Wednesday started to explore different scenarios that would shift the tax burden to shoppers by eliminating or reducing the number of Floridians paying property taxes.

Committee Chairman Matt Gaetz, R-Fort Walton Beach, said any scenarios will need “many hours to fine tune,” with economists expected to address the committee before anything is advanced for the 2016 legislative session.

We will see who comes out in opposition of this effort.

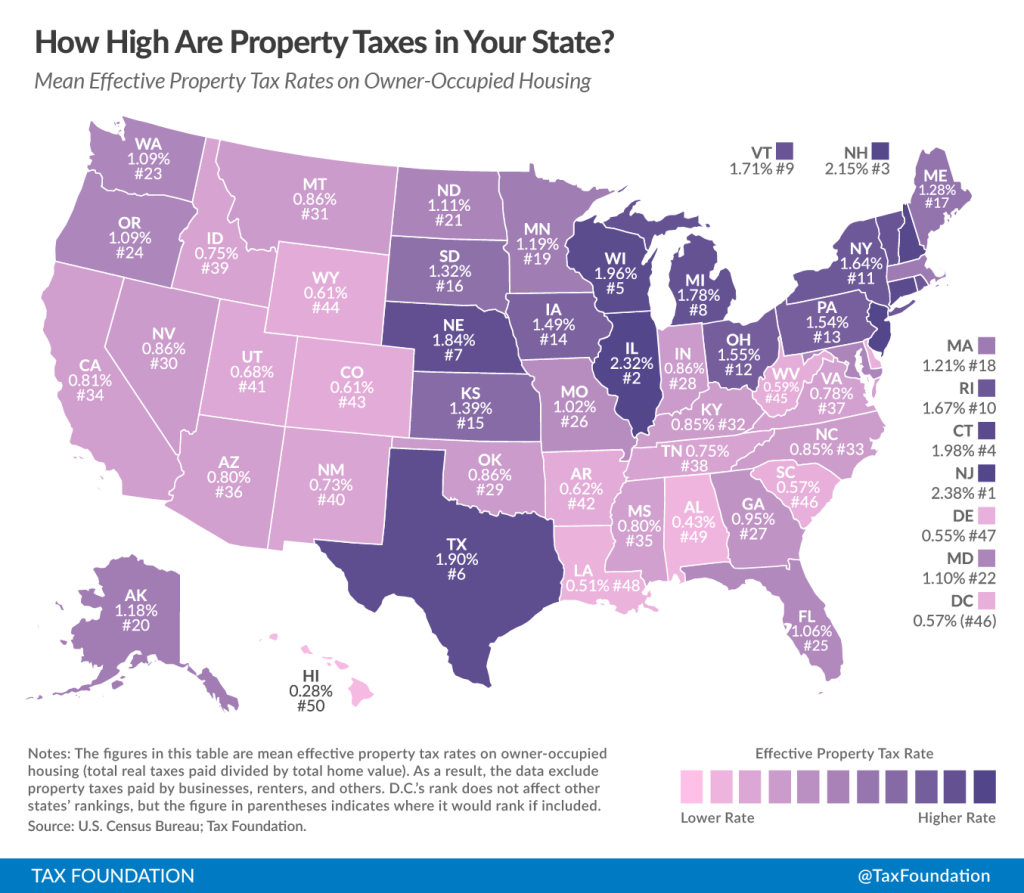

What is the property tax rate in your state? A new map from the Tax Foundation has the answer:

Kate Scanlon from The Daily Signal reports:

The Tax Foundation, a non-partisan research think-tank based in Washington, D.C., notes that states tax property in a variety of ways and that the rates listed are the “effective rate” paid by the taxpayer.

Jared Walczak, a policy analyst with the Center for State Tax Policy at the Tax Foundation, writes that the map “cuts through this clutter, presenting effective tax rates on owner-occupied housing.”

“This is the average amount of residential property tax actually paid, expressed as a percentage of home value,” Walczak wrote.

New Jersey has the highest rate at 2.38 percent.

Illinois has the second highest rate at 2.32 percent, followed by New Hampshire at 2.15 percent and Connecticut at 1.98 percent.

Hawaii has the lowest rate at 0.28 percent. Alabama has the second lowest rate at 0.43 percent, then Louisiana at 0.51 percent and Delaware at 0.55 percent.