California Restaurants Closing Fast — Communism Does Not Work!

The Communist government operating out of Sacramento California is following the Hugo Chavez/Maduro playbook the former and current installed presidents of Communist controlled Venezuela.

My beautiful Venezuelan wife left Venezuela and was granted asylum in Colombia before relocating to the United States as a permanent legal resident.

She has watched her former country slowly succumb to the intentional collapse of its once thriving capitalist free market economy.

She commented to me that the Government of California and the current installed Marxist occupying the White House are no different in ideology than that of Maduro and Chavez.

She warns all freedom loving Americans to pay close attention to the unconstitutional Marxist actions of Governor Newson and his intentional destruction of free markets in California.

First the restaurants in Caracas Venezuela went out of business after government interference in the wages and Venezuelan labor market.

In Los Angeles and Beverly Hills like Caracas Venezuela restaurants are closing and laying off its workers. As 2023 ended and 2024 commenced the following restaurants went out of business.

West Third Street gastropub and wine bar 3rd Stop in Los Angeles closed its doors after 29 years in business.

The famous music venue Conga Room closed after 25 years in business in Los Angeles due to massive inflation and government interference in running its operation.

The famous restaurant El Torito’s in Santa Monica frequented by Hollywood movie stars closed permanently on March 9th 2024.

A popular daytime restaurant the Farm Of Beverly Hills closed on March 3 2024 after 26 years of business.

The Mezcal bar and taco cantina Mezcalero closed permanently on Broadway in Downtown Los Angeles in early March 2024.

Nic’s on Beverly a plant based restaurant closed permanently on March 31st due to massive inflation on the rent and the mandatory $20 an hour minimum wage unconstitutional mandated by Governor Newsom’s Marxist government.

The Culver City bar closed permanently on March 16 2024 after 18 years of operation due to razor thin operating costs created by Governor Newsom’s anti capitalist idealism.

Ten Seven rolls a Vietnamese eatery in San Gabriel California that served delicious food like chả giò, bánh xèo, rice rolls, and smoked brisket pho went out of business on March 17th 2024.

Western City Bagel in Redondo Beach California closed permanently on March 31st 2024 in order to protect itself from the $20 an hour minimum wage debacle. It was in business for 30 years.

All of the following restaurants have also permanently closed in response to the Marxist ideology of Governor Newsom.

Josiah Citrin’s West Hollywood location of restaurant Charcoal permanently on February 17th 2024.

All the restaurants inside Downtown’s historic Hotel Figueroa closed permanently in February 2024 including Bar Magnolia, Cafe Fig, the Cafeteria, La Casita at Driftwood, and Sparrow Italia.

For 45 years, Caffe Roma has been a go to place for Italian food and coffee in the Golden Triangle of Beverly Hills.

It was frequently patronized by Sylvester Stallone and Arnold Schwarzenegger. The restaurant announced its closure on January 1, 2024.

My friend, an immigrant from Germany moved to Venice California 30 years ago and he made his fortune there.

He walked around Beverly Hills yesterday April 2nd 2024 and he commented to me the town is slowly becoming an empty “For lease” town going bankrupt.

Beverly Hills Stores are closing and some entrepreneurs posted notices on doors and windows stating they have relocated to Nevada and Texas or they have permanently closed.

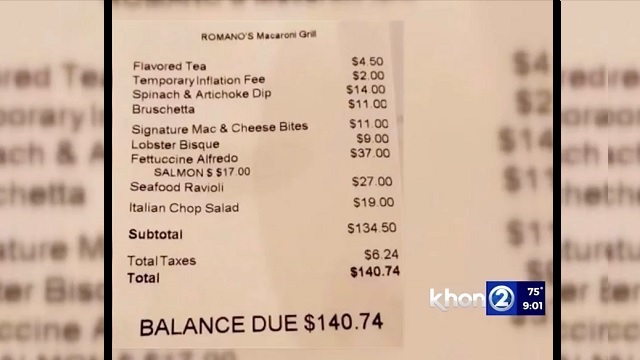

LA Eater’s , , and reported, “Los Angeles’s restaurants continue to face difficult headwinds that picked up in the second half of 2023 and led to an industry-wide slowdown. From the lingering impacts of the Hollywood strikes to adverse weather and increased costs (labor, rent, ingredients, etc.), a plethora of variables continue to batter restaurant owners who operate on razor-thin margins.”

Here is LA Eater’s running list of restaurant closures beginning from the last days of 2023 to March 2024.

March

3rd Stop – Beverly Grove

West Third Street gastropub and wine bar 3rd Stop told its workers this past Monday that it would be closing at the end of the month. Originally opened in 2006, the all-day restaurant served an array of American food, like grilled chicken nachos, burgers, pizza, and sandwiches.

Conga Room – Downtown LA

Legendary music venue Conga Room, which was instrumental in bringing Latin music acts and other performers to L.A. Live, closed after 25 years. The venue was originally located in Mid-Wilshire but moved to Downtown in 2008. Founder Brad Gluckstein told Billboard that inflation, high interest rates, and a drop in Convention Center traffic led to a changing business model. March 27 was the club’s final night.

El Muelle 8 – Downey

Celebrated Sinaloan seafood spot El Muelle 8 opened last February with pristine shellfish, ceviches, and tacos in a small Downey strip mall. The restaurant quietly closed earlier this year, likely in late January, without much notice. However, its new owners have reached out to Eater and confirmed that El Muelle 8 is plotting a comeback.

El Torito – Santa Monica

El Torito’s expansive restaurant in Santa Monica, which was originally branded as Acapulco and operated by Xperience Restaurant Group, closed on March 9, reports the Santa Monica Sun. Santa Monica mayor Phil Brock said on social media that it had been operating month-to-month for a while and that the property had likely been leased to another operator.

The Farm of Beverly Hills

Daytime eatery the Farm of Beverly Hills closed on March 3 after 26 years of business. Founder and owner Kelli Cotton thanked customers and bid farewell in a note, recognizing past and present staff for their dedication and passion. The reliable breakfast and lunch spot was a reasonably-priced, family-friendly eatery in the heart of the Golden Triangle.

Mezcalero – Downtown

Mezcal bar and taco cantina Mezcalero closed on Broadway in Downtown Los Angeles in early March, with a simple announcement that it would be closed for the weekend. However, Mezcalero never reopened and a note on its Instagram profile confirms it is closed. Originally opened in December 2016, the restaurant was opened by Jay Krymis, who also owned Padre in Long Beach and Fubar in West Hollywood, according to DTLA Weekly.

A lush outdoor patio at Nic’s on Beverly.

The patio of Nic’s on Beverly, a plant-based restaurant that closes March 31, 2024. Nic’s on Beverly

Nic’s – Beverly Grove

Plant-based restaurant Nic’s on Beverly opened five years ago in the former Terrine space from restaurateur Nic Adler, who also owns Monty’s Good Burger. Nic’s was going to close last June, blaming increased rent, but was able to make an arrangement with the landlord to stay open for another year. Its last day will be March 31 for Easter brunch.

Mandrake – Culver City

Culver City bar Mandrake closed on March 16 after 18 years of operation, according to the Los Angeles Times. Owners Flora Wiegmann, Drew Heitzler and Justin Beal cited life changes as the reason for closing, with Beal and Wiegman moving out of the state and Heitzler becoming a recent father. Mandrake represented the art scene in Culver City and greater Los Angeles, with a famous art curator coming up with the name for the bar.

Tenseven Rolls – San Gabriel

Tenseven Rolls, a bánh cuốn specialist inside Blossom Market Hall in San Gabriel, announced it would close on March 17. The Vietnamese snack spot also served chả giò, bánh xèo, rice rolls, and smoked brisket pho in the mostly Asian American vendor food hall in the heart of SGV. The stall originally opened in December 2022. The Klaude family said on Instagram that it hopes to appear at another venue in the future, with plans to serve at community events in the meantime.

Western City Bagel – Redondo Beach

Not to be confused with the much larger and still-in-operation Western Bagel, Western City Bagel in Redondo Beach announced that it will close on March 31 after 30 years. “While this chapter may be coming to a close, the memories we’ve shared and the connections we’ve made will forever remain close to our hearts,” the shop wrote on Instagram.

Bicyclette and Manzke – Pico Robertson

Manzke and its sister restaurant Bicyclette will close on March 1. Manzke opened in 2022 as a bastion for fine dining in the former Picca space serving a $225 10-course tasting menu and earning a Michelin star; Bicyclette transformed Sotto into a French bistro in 2021. With these latest closures, acclaimed chefs Walter and Margarita Manzke operate only one LA restaurant: the powerhouse République. Previously, the Manzkes closed Petty Cash Taquería after 10 years in October 2023, followed by the abrupt shutter of Sari Sari Store after seven years of business inside Grand Central Market in December 2023.

Banh Oui – Hollywood

Hollywood banh mi spot, Banh Oui, closed on February 13. The restaurant, which started as a pop-up, moved into the space in 2018. Over the years, it was known for its non-traditional takes on the Vietnamese sandwich, as well as its burger, fried chicken sandwich, and more.

Charcoal Sunset – West Hollywood

Josiah Citrin’s West Hollywood location of Charcoal suddenly closed on February 17 after less than a year in operation. Citrin attributed the closure to a rise in the costs of business in the neighborhood, and in a statement to Eater said that it was “a real bummer, to say the least.”

Flore – Silver Lake

Silver Lake’s 16-year-old plant-based restaurant Flore closed for good in late December and announced the closure via Instagram. Owner Miranda Megill opened the restaurant when Silver Lake’s was full of mostly independent businesses. After facing eviction from its original location in Sunset Junction in 2019, Megill moved the business into the shuttered Local space in 2020. Flore’s original location now houses mostly retail shops including clothing brand Maison Kitsune.

Hotel Figueroa (restaurants and bar) – Downtown

All the restaurants and bar inside Downtown’s historic Hotel Figueroa will close in February including Bar Magnolia, Cafe Fig, the Cafeteria, La Casita at Driftwood, and Sparrow Italia. The Los Angeles Times reported that Noble 33 (Casa Madera, Taco Madera), the third-party restaurant group that operates the hotel’s bar and restaurants, announced the closures in December, six days after its workers notified management that they intended to form a union.

Hyperion Public – Silver Lake

Silver Lake pub Hyperion Public closed on January 26. The owners shared via an Instagram post that the California Department of Alcoholic Beverage Control shut down the bar on January 16 and that they were unaware that the business was operating illegally.

Pearl River Deli – Chinatown

Chinatown’s modern Cantonese spot Pearl River Deli is no longer serving its beloved Hainan chicken rice, char siu pork belly, and Macau pork-chop bun. After opening in January 2020 in Far East Plaza and relocating to Chinatown Central Plaza, chef and owner Johnny Lee announced that Pearl River Deli will be on hiatus indefinitely and possibly forever.

Sakai Ramen Bar – Central LA

After nearly five years in business, Sakai Ramen closed on February 19. The restaurant announced the closure in an Instagram post and shared that the owners would be taking a break for the time being.

Shin – Hollywood

Hollywood’s decade-old Shin restaurant closed on February 4. Though best known for its ramen, the restaurant also prepared sushi and yakitori, including a $175 omakase option with cocktails.

Tokki – Koreatown

After 15 months inside Koreatown’s Chapman Plaza, Tokki closed on February 18. The modern Korean tapas restaurant opened in 2021 with chef Sunny Chang (Quince SF) at the helm, but she departed after just a few months. A part of the team then went on to open Liu’s café, which will remain open.

January

Atrium – Los Feliz

A dimly lit modern restaurant with pattered walls and dark green banquettes with some foliage.

Los Feliz restaurant Atrium, which opened in 2018 from Beau Laughlin and Jay Milliken, closed without warning on December 23, 2023. The stylish Los Feliz restaurant offered versatile dishes with international flavors in a high-ceiling space in a neighborhood that sorely lacks quality dining. Staff was notified of the closure just a few days before Christmas though outwardly Atrium hinted that it would reopen in the new year. Atrium has not reopened though its sister lounge space Pinky’s continues to operate.

Caffe Roma – Beverly Hills

For 45 years, Caffe Roma has been a streetside destination for Italian food and coffee in the Golden Triangle of Beverly Hills. The restaurant announced its closure on January 1, 2024, though its sister restaurant Café Amici will continue to operate, which means longtime fans will still have a place to get eggplant parmigiana and lasagna with beef ragu. Eater spoke with a representative from Caffe Roma who said the landlord had doubled the rent, which made it more challenging to operate despite nearly half a century of history in the neighborhood.

ETA – Highland Park

Jazz bar and cocktail lounge ETA, which is a sister restaurant to the Greyhound sports bar, closed on December 30, 2023 after initially opening in 2016. Owner Mateo Glassman said part of the reason for the closure was that his partners James and Ryan had moved farther away and that Glassman’s recent addition to the family had made it difficult to sustain operations. Glassman said the Highland Park and jazz community were a huge part of ETA’s success and was thankful for both.

Jeni’s Ice Cream – Venice

Rose Avenue ice cream parlor Jeni’s has closed since around the end of December, though word is that the artisan scoop shop has reopened as a stand on Windward Avenue closer to the Venice Boardwalk. Jeni’s still has locations in Larchmont, Beverly Hills, the Runway in Playa Vista, Calabasas, Los Feliz, and Highland Park within the LA area.

Skylight Gardens – Westwood

Westwood Italian restaurant Skylight Gardens had just celebrated its 12th anniversary when it quietly closed in recent weeks (it originally opened in 2012). A tipster says the signage was taken down and that multiple Yelpers have reported it closed, though the restaurant’s website — which announced the restaurant’s 10th anniversary — is still up at the time of publication.

Spartina LA – Melrose Avenue

A wood-burning grill at a LA restaurant. Spartina LA, which opened in 2015 by chef Stephen Kalt, announced on social media last week that it would close on January 28. Kalt has had a nearly four-decade-long career in restaurants spanning New York City, Atlantic City, and Las Vegas. Spartina was originally named for a restaurant he helped open in the early 1990s in Tribeca before that neighborhood had become one of the hottest in Manhattan.

Spartina in LA was his ode to California Italian food, preparing shareable pizzas, handmade pastas, and seasonal produce. Kalt told Eater that from Memorial Day onwards, sales had dropped off about 40 percent from expected, blaming the writer’s and actor’s strikes. “In 40 years in this business, I’ve never seen anything like it before,” said Kalt. The last day of operations will be this coming Sunday.

Wine House Kitchen — West LA

Located on a West LA rooftop blocks away from the bustling Sawtelle Japantown, Wine House Kitchen closed late last year after more than a year in business. Maiki Le’s Vietnamese French and California menu was a favorite among Eater’s editors with dishes like bún bò Huế spiced elk strip loin, which combines different meat with a central Vietnamese beef noodle soup.

When Governor Newsom and his Marxist thugs finally bankrupt California and collapse its economy as they grasp the handle of socialism and poverty perhaps then the citizens will remove this cockroach parasite from the state government and hire free market capitalists to save what’s left of this crumbling dumpster fire.

©2024. Geoff Ross. All rights reserved.

RELATED ARTICLE: California Ice Cream Parlor Forced to Close Over Minimum Wage Hike