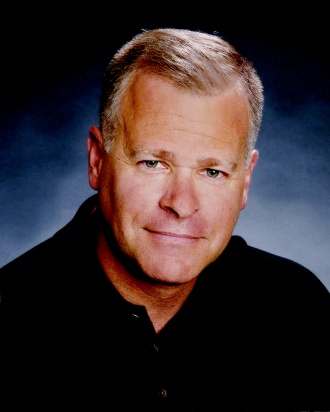

David Merrill, businessman and the former Mayor of the City of Sarasota, Florida, sent the below email to all Sarasota County School Board members.

School Board Members,

I urge you to reject the proposed increase in property taxes for schools. You can eliminate the need for the extra taxes by cutting wasteful policies and programs, and you have failed to make the case that the money will actually improve the education of our children.

Instead of looking to more taxes, you can find more than enough savings to eliminate the need for the taxes by replacing your credential-based compensation system for teachers. Arne Duncan, the Secretary of Education, and Bill Gates have said we need to find the money to improve our schools by eliminating the waste and inefficiency from the type of compensation system that you use. Yet, other than perhaps for some new-hires, Sarasota’s teachers’ salaries are set from a salary table with two variables: advanced degrees and years of teaching.

In 2010 Arne Duncan said, ”There is little evidence teachers with masters degrees improve student achievement more than other teachers.” Despite this information, Sarasota pays for more advanced and special degrees than any other district in Florida. A full 67% of Sarasota’s teachers have a degree above a bachelor’s degree. While some advanced degrees may be appropriate, does giving two-thirds of the teachers at Phillipi Shores Elementary School higher salaries because they have advanced degrees really do anything to help our children learn the alphabet and the multiplication tables?

When it comes to teacher longevity, Sarasota’s teachers have the 7th highest average longevity out of the state’s 67 school districts. However Harvard Professor Paul E Peterson’s study titled “It’s Easier to Pick a Good Teacher than to Train One: Familiar and New Results on the Correlates on Teacher Effectiveness” reports that there is little increase in a teacher’s effectiveness after the first three years of teaching. But you continue to increase teachers’ salaries based solely upon the number of years that they’ve been teaching, when, instead, we should pay them based on a performance evaluation like other professionals.

Some of you may say that you know these arguments, but politically you can’t cut teachers’ pay. Therefore, in the absence of courage to confront the teachers union, your argument is that you have no choice but to increase taxes. But, based on FCAT and EOC Assessment scores, you can’t show that you have been good stewards of the half-billion dollars you have collected from the referendum-initiated school tax since 2002.

Looking at our FCAT history, Sarasota’s ranking among Florida’s school districts on the high-school Reading FCAT and Math FCAT are lower today than they were a dozen years ago. For the first three years of the high-school Math FCAT back in 2000, 2001, and 2002, Sarasota’s score was either the second or the third highest in the state. Likewise, for the first two years of the high school Reading FCAT in 2000 and 2001, Sarasota’s scores were either second or third in the state. When the school-tax referendum passed in 2002, everyone looked forward to new and innovative educational strategies to build on our excellent school district, but, instead, the school district immediately went into an inexplicable funk, from which you’ve not yet recovered.

(I use the FCAT scores from the highest grade in high school that the test is given because they include the cumulative learning from lower grades, and they are the closest measure of the performance of your finished product, the high school graduate.)

Sarasota’s Ranking on High School FCAT among 67 Districts

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

|

Math

|

3

|

2

|

3

|

10

|

11

|

12

|

9

|

10

|

11

|

12

|

6

|

6

|

|

Reading

|

2

|

3

|

6

|

16

|

12

|

16

|

9

|

13

|

12

|

12

|

6

|

9

|

|

Science

|

n.a.

|

n.a.

|

n.a.

|

n.a.

|

n.a.

|

11

|

8

|

11

|

12

|

10

|

11

|

9

|

Fortunately, we’ve begun to regain some of our former glory. On the recent Algebra EOC Assessment, Sarasota had the second highest score, which may be the beginning of getting back to where we were 11 years ago.

Unfortunately, despite the hundreds of millions of dollars of supplemental taxes that taxpayers have given you since 2002, Sarasota’s high school student’s FCAT scores are still determined more by Sarasota’s favorable demographics than the school district’s extra efforts. As you know, demographic factors such as adult personal income, percentage of free and reduced lunch, adult educational levels, and student racial composition are good predictors of a district’s FCAT scores when considered together. In fact, there is a good argument that our county and city commissioners are more responsible for Sarasota’s FCAT scores than the school board since the commissioners’ policies have had the most influence on our demographics.

If you were to chart these demographic factors for Florida’s school districts, most school districts’ FCAT scores would fall within a narrow band of where one would expect to find them based on their demographics. However, when districts deviate from their demographic prediction, it’s possible that their school district is doing something different from the other districts.

Accordingly, there are three districts on the high school FCATs who have challenged Sarasota’s scores, but who shouldn’t be able to based on their demographics alone. These districts, Sumter, Gilchrist, and Wakulla, all have less attractive demographics for adult income and educational levels compared to Sarasota, and their free and reduced lunch percentages are either similar to or higher than Sarasota’s. Even with these unfavorable demographic characteristics, and along with having less money per student, fewer teachers with advanced degrees, less teacher experience, and lower teacher pay than Sarasota, these lower-income districts have achieved some impressive FCAT scores. They are obviously doing something right given what they have to work with.

|

District

|

County Adult Data

|

2011 11th Grade Science FCAT Students

|

Teacher Data

|

2011 High School FCAT Scores

|

|

Personal Income

|

% College

|

% High School

|

% Free-Lunch

|

% White

|

Advanced Degrees

|

Median Salary

|

Science

|

Math

|

Reading

|

|

GILCHRIST

|

$29,682

|

15%

|

72%

|

48%

|

92%

|

33%

|

$42,829

|

322

|

339

|

324

|

|

SARASOTA

|

$52,331

|

34%

|

87%

|

38%

|

72%

|

67%

|

$55,264

|

317

|

339

|

322

|

|

WAKULLA

|

$28,711

|

22%

|

78%

|

35%

|

82%

|

37%

|

$37,042

|

317

|

338

|

322

|

|

SUMTER

|

$24,836

|

17%

|

77%

|

45%

|

71%

|

33%

|

$42,365

|

320

|

334

|

317

|

|

FLORIDA

|

$38,210

|

23%

|

76%

|

45%

|

47%

|

41%

|

$45,723

|

307

|

329

|

309

|

If you could show a similar pattern of consistently having higher test scores than our demographics alone would predict, you could make an argument that you are efficiently and effectively using your resources, and that giving you more resources could lead to even higher test scores. However, you can’t make the argument because our high school students don’t consistently outscore the districts with similar or more favorable demographics.

On the 2011 FCAT tests, there were six districts that outscored Sarasota’s combined test scores and who also have demographics at least as favorable as Sarasota’s. (I’ve excluded Gilchrist, which is shown above.) The districts are St. Johns, Okaloosa, Brevard, Seminole, Martin, and Santa Rosa. Each district has its favorable and unfavorable demographic factors, but they would all be considered similar.

Some key characteristics for these districts are shown on the table below.

|

District

|

County Adult Data

|

2011 11th Grade Science FCAT Students

|

District Data

|

2011 High School FCAT Scores

|

|

Personal Income

|

% College & Prof. Degree

|

% Free-Lunch

|

% White

|

Teacher Advanced Degrees

|

Teacher Median Salary

|

All Gov. Revenue Per Student

|

Science

|

Math

|

Reading

|

|

ST. JOHNS

|

$ 48,640

|

40%

|

13%

|

84%

|

41%

|

$44,370

|

$ 9,360

|

324

|

344

|

332

|

|

OKALOOSA

|

$ 41,024

|

33%

|

23%

|

74%

|

42%

|

$48,779

|

$ 9,245

|

328

|

342

|

330

|

|

BREVARD

|

$ 37,284

|

33%

|

25%

|

67%

|

43%

|

$42,421

|

$ 9,226

|

326

|

341

|

326

|

|

SEMINOLE

|

$ 40,133

|

40%

|

31%

|

60%

|

48%

|

$43,301

|

$ 8,910

|

318

|

343

|

327

|

|

MARTIN

|

$ 51,723

|

33%

|

25%

|

71%

|

41%

|

$43,677

|

$ 10,739

|

321

|

340

|

326

|

|

SANTA ROSA

|

$ 34,838

|

32%

|

28%

|

80%

|

37%

|

$42,729

|

$ 8,791

|

317

|

338

|

331

|

|

SARASOTA

|

$ 52,331

|

34%

|

38%

|

72%

|

67%

|

$55,264

|

$ 11,961

|

317

|

339

|

322

|

Although the demographics are similar, as the chart shows, the Sarasota’s median teacher pay is 25% higher than the average of the other districts, and Sarasota takes in 28% more tax revenue per student than the other districts on average, or about $2,500 per student. And, yet, with more lower-paid teachers and far fewer financial resources, these other districts have typically outscored us.

To put a better perspective on the magnitude of this disparity in revenues between districts, Sarasota has about 40,000 students, so a difference of $2,500 per student amounts to $100,000,000. That’s how much Sarasota could save each and every year if we matched the average budget of the other six districts above. Or, said another way, that’s how much money we could save if our school district were as efficient and effective in delivering high-scoring high-school graduates as other top districts – like we used to be a decade ago.

The table below summarizes the calculation for the extra tax burden that Sarasota taxpayers must fund annually above what the other top districts on average must pay.

|

Calculation of Sarasota’s Extra Tax Burden Relative to Top-Scoring Districts

|

|

Sarasota’s Per-Student Tax Revenues

|

Avg. Tax Revenue of 6 Higher-Scoring Districts

|

Higher Tax Burden for Sarasota Per Student

|

Sarasota’s Student Enrollment

|

Sarasota’s Total Extra Tax Burden

|

|

$11,961

|

$9,379

|

$2,583

|

41,076

|

$106,078,770

|

So, the questions before us are whether or not Sarasota has the potential to be the top school district in Florida, and whether we need to collect an extra $100,000,000 in taxes to do it. And I’ll answer the first question with an unequivocal “Yes!” And I’ll answer the second question with a “Hopefully not”.

The first question is easy to answer because we right there at the cusp a decade ago. Back then, before the extra taxes started gushing in, our high school kids were just shy of having the highest scores on the FCAT. In fact, it was the promise of being the top school district that got the voters to rally behind the property-tax increase in 2002 after having voted down a similar referendum in 2000. Our recent 2nd-place score on the Algebra EOCA shows that we still have the potential, and it’s not unusual in the lower grades for us to have top FCAT scores. By effectively using the financial resources that the public has given you, you can overcome any demographic advantages that even a district like St. Johns enjoys, and our high school students can be the very best in the state.

However, the reason I don’t support a continuation of the extra $100,000,000 in taxes is because the need for it is purely remedial. There are only two reasons that the extra taxes are needed. One possibility is that you have failed to develop a school district that is as efficient and effective the school districts that are currently at the top of the FCAT rankings. The other possibility is that our city and county commissioners have failed to create an economy that provides enough jobs for high income, college educated workers. After all, it’s their children who get the top scores.

But continuing the extra $100,000,000 in taxes drains our economy of productive resources and makes our community-development plans more difficult. Other districts that don’t have to pay it are gaining a competitive advantage over Sarasota. Over a decade, the cumulative impact of draining this much money from our economy is huge.

In less than two years you will have another vote to extend the property tax for schools. (It only provides about half of the extra $100,000,000 in taxes that you collect.) I predict that you will fail unless you do two things. First, you must develop a compensation system that rewards our many excellent teachers and eliminates the bad ones. (Ever read RateMyTeachers.com? We still have bad teachers. My 7th grade son just got one of the worst ones at his school. Why is Ms. Friedland still allowed to teach?) Secondly, you must restore Sarasota’s high-school test scores to their rightful place at the top of all districts. Unlike a decade ago when we were Number 2, with all your extra resources, we need to be Number 1.

Finally, with $100,000,000 more than the average of the other top districts, you don’t need more money. You need a better plan. Arne Duncan has said that schools need to do more with less. I suggest you show your understanding of the new reality by voting down your proposed tax increase.

Best regards,

David Merrill

Arox Land Development, Inc

700 Bell Road

Sarasota, Fl 34240