‘Rather Despicable’: John Eastman Speaks Out After Bank Of America, USAA Shut Down His Accounts

One of the left’s biggest political targets recently found himself “de-banked” with no warning and little avenue for recourse, the Daily Caller has learned.

John Eastman, once an attorney for former President Donald Trump, was de-banked twice in the span of several months by two prominent financial institutions, Bank of America and USAA, he told the Daily Caller. His accounts were closed as he faced substantial backlash for his work advising Trump around the time of the 2020 election.

Eastman said he had switched most of his banking from Bank of America to USAA, a company that provides financial services exclusively to military veterans as well as their families, due to the former’s “wokeness.” Both corporations are federally insured, and Bank of America was bailed out with billions of dollars in taxpayer funds during the global financial crisis.

Bank of America alerted Eastman in September of 2023 that it would be closing his accounts, a letter obtained by the Daily Caller shows. Shortly thereafter, USAA notified Eastman in November that his two bank accounts with the company would be closed, a separate letter shows.

“And then two months later, we get a similar letter from USAA saying that they’ve decided that they’re going to close your account and they did like three weeks later,” Eastman told the Daily Caller. “And so that was where all of our automatic payments were coming out of, all our automatic deposits. So it was a real pain to shift everything. We had to get a new bank account opened and shift everything over.”

Eastman was notified of his USAA accounts being closed on Nov. 20, 2023. A few weeks prior, a California judge made a preliminary decision saying that Eastman was culpable of ethics violations in a state bar disciplinary case, CNN reported.

USAA claimed in its letter that it was “exercising its right to no longer do banking business” with Eastman per its “Depository Agreement.”

“We may close your account for any reason without advance notice. We may require you to give us a minimum of seven (7) calendar days advance written notice when you intend to close your account by withdrawing your funds,” a section of the agreement reads.

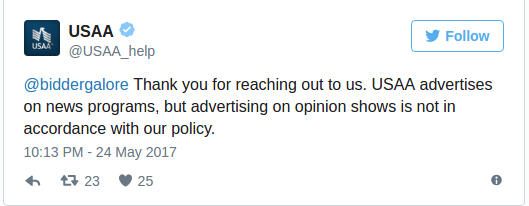

USAA did not respond to the Daily Caller’s multiple requests for comment.

When Eastman inquired about the closures, the banks said it was their policy to not provide any more information on the matter, he told the Daily Caller. An audio recording of Eastman’s call to Bank of America, provided to the Daily Caller, reflects as much.

LISTEN:

“De-banking” is a phenomenon in which financial institutions refuse financial service to the targets of political activism, who often end up being conservatives.

“What these banks are doing is they’re saying you’re either high risk, or we don’t want to do business with you, or whatever it is. There’s no methodology behind this. There’s no kind of reason that matches traditional indicators or traditional metrics that a bank would use to calculate your liquidity, your credit score, whatever it is. They’re using these non-financial factors, and then making these decisions and just like closing people’s accounts,” Eric Bledsoe, an expert on de-banking for the Foundation for Government Accountability, told the Daily Caller.

In typical de-banking situations, it is normal for the banks to withhold their reason for suddenly closing their clients’ accounts, Bledsoe added.

Eastman told the Daily Caller he was using the accounts he had set up with Bank of America and USAA for personal finances. He and his wife qualified for USAA bank accounts because his father-in-law served in the Navy in WWII and in the Marines in the Korean War, the attorney told the Daily Caller.

“We had Bank of America accounts for about 40 years. But just because of their wokeness we kind of quit a couple of years ago, using them much. They’ve got physical locations and therefore easy ATM, so we kept our accounts there, but we didn’t use much. And about four or five years ago, we opened USAA bank accounts and we were using those as our primaries,” Eastman said.

The Daily Caller reached out to the Bank of America for comment, giving the corporation multiple days to respond. Bank of America initially told the Caller it would answer, though about an hour before the deadline provided, the company decided not to comment.

“Just as a general policy, we don’t comment on client matters. So I don’t have a comment at this point on the situation,” Bill Haldin, from Bank of America media relations, told the Daily Caller after asking if the focus of the story was solely on Eastman.

Bledsoe spoke to the political nature of de-banking and how it can make Americans’ lives harder.

“I’m gravely concerned. It really is the kind of next step in [Environmental, Social and Governance]. So ESG across the board, it really is about like, re-directing capital away from the politically disfavored and to the politically favored at the moment, without going through the political process at all,” Bledsoe said.

Neither bank specified to Eastman whether the closing of his accounts was for political reasons, though he has his suspicions.

“I’m 99.9% confident,” he said. “What I don’t know is whether they didn’t want to do business with me, or whether they didn’t want to continue to be hassled by federal regulators for doing business with me. I don’t know which of those two it is, either one of them is rather despicable.”

Eastman’s confidence could, in part, be attributed to the litany of challenges he has faced following the 2020 presidential election.

Since Eastman argued that Vice President Mike Pence had the power to help deliver Trump the 2020 presidential election, the attorney has seen his life be uprooted by his opponents. Just days after the Jan. 6, 2021, Capitol riot, Eastman resigned as a law professor from Fowler School of Law at Chapman University after the school faced pressure to oust him, Forbes reported. In a statement of his own, Eastman said he had “mixed feelings” about resigning, though the school said the pair had reached an agreement on the matter.

Then, at the end of that month, the University of Colorado’s Benson Center for Western Civilization banned Eastman from speaking at the institution despite being a visiting scholar, according to Forbes.

“The University of Colorado Boulder relieved John Eastman of duties related to outreach and speaking as a representative of the Benson Center for the Study of Western Civilization,” the institution said in a press release.

Nearly a year later, in June 2022, FBI agents seized Eastman’s phone as he was leaving a restaurant, the Associated Press reported. Eastman and his wife have also experienced death threats, graffiti threats in their neighborhood and have had spikes planted in their driveway, his friend Josh Hammer wrote in a column.

A number of red state attorneys general — including from Florida, Iowa, Missouri, Indiana and Montana — voiced their opposition to the de-banking trend after the Daily Caller laid out Eastman’s situation. Many of the state AGs pointed to politics as a potential reason Eastman’s accounts were closed.

“No American should lose their bank account because banks want to play politics. Time and time again, we are seeing banks target and cut off those they disagree with and refuse to explain why. That is unacceptable,” Iowa Attorney General Brenna Bird told the Daily Caller.

“De-banking contradicts the very character of our nation, as elites wrongfully use their power to punish their political opponents. Here’s the bottom line: If financial institutions are punishing consumers who don’t fall in line with their political beliefs, that could constitute a violation of both state and federal law,” Missouri Attorney General Andrew Bailey told the Daily Caller.

Now, Eastman is being prosecuted by Fulton County, Georgia, District Attorney Fani Willis as part of her case against Trump. On March 27, a California judge ruled that Eastman should be disbarred due to his legal advice in the wake of the 2020 election. The case will now move to the state Supreme Court for a final decision.

“I just think this is a terrible trend. I think it’s harmful. I think it prohibits people from bringing their values and the public square into the marketplace. And they have every constitutional right under the Free Exercise clause to bring their values into the marketplace. And I think this is also I think this is something we’re just gonna have to fight against,” Sam Brownback, an attorney and former U.S. Senator whose Christian non-profit was de-banked, told the Daily Caller.

AUTHOR

REAGAN REESE

White House correspondent. Follow Reagan on Twitter.

RELATED ARTICLES:

In Defense of Dr. John Eastman, Esq. Who Questioned the 2020 Election – Part 1

In Defense of Dr. John C. Eastman, Esq. Who Questioned the 2020 Election – Part 2

Defending John Eastman — Part 3

Judge Says Fani Willis Must Ditch Nathan Wade Or Step Aside From Trump Case

RELATED VIDEO: Trump Attorney Debanked by Bank of America & USAA with Dr. John Eastman – OAN

EDITORS NOTE: This Daily Caller column is republished with permission. ©All rights reserved.