California Housing Market Bubble Set to Burst — Will America Be Next?

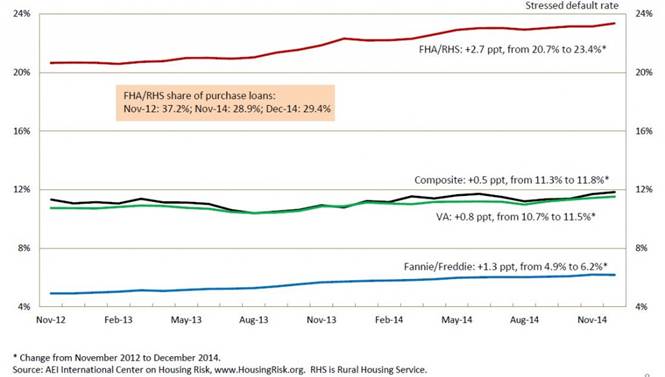

AEI’s National Mortgage Risk Index for Agency purchase loans hit a series high of 11.84% in December, with FHA and VA hitting their own series highs. The addition of about 215,000 loans brought the total number of risk-rated loans to 5.3 million.

Link to view the full January 2015 presentation. Below is a summary.

All of the indices except Fannie/Freddie rose in December and hit series highs. If FHA were to adopt VA’s risk management practices, the composite index would drop to about 9%.

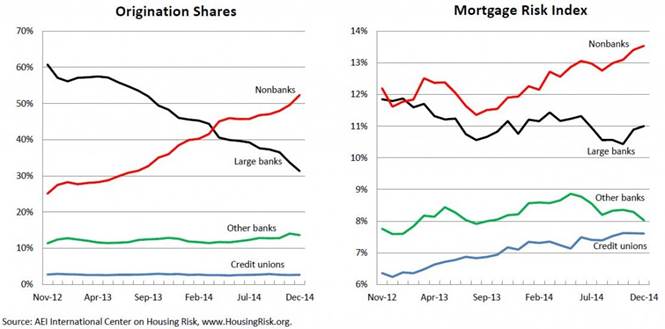

Origination Shares and MRIs by Lender Type

A dramatic decline in purchase loan market share for large banks continued in December, offset by an equally dramatic increase in the nonbank share. Large banks are the only lender type with net MRI decline since November 2012; hence, we must look beyond large banks to asses credit trends.

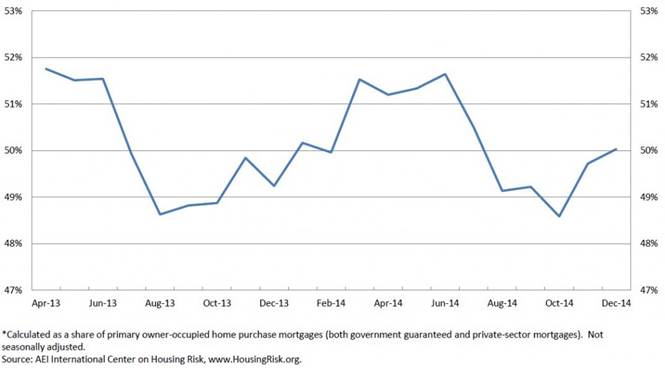

First-time Homebuyer Share of Purchase Loans*

The share for the combination of government-guaranteed and private-sector loans was estimated to be 50% in December, well above the comparable figure in the latest NAR survey of home buyers (36%).

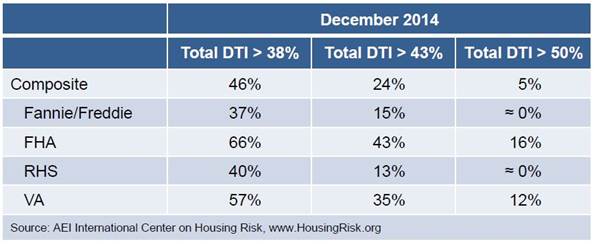

Additional Detail on Total DTIs

- 37% of Fannie/Freddie loans have total DTIs > 38%, up from 14% in 1990 (based on Fannie random sample).

- FHA and VA have a sizable share of loans with DTIs > 50%, an extremely high pre-tax payment burden. VA’s residual-income underwriting is key to limiting defaults.

- High total DTIs crowd out participation in defined contribution retirement plans such as 401(k)s, most of which come with employer match. These provide a reliable and attractive means for private wealth accumulation, particularly for lower-income families.

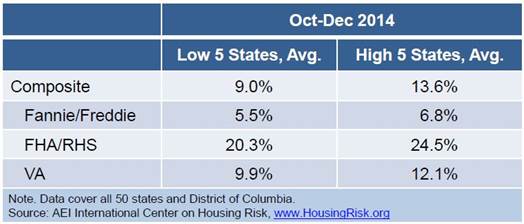

Range of SMRIs for Home Purchase Loans Across States

There is a wide range for the composite SMRI, and states at the extremes tend to have low or high concentrations of FHA/RHS loans. The variation across states for Fannie/Freddie SMRI is narrow. The SMRI for FHA/RHS loans is uniformly high – above 20% in 48 states—, while the SMRI for VA loans is roughly half that for FHA/RHS loans at both the low and high end.

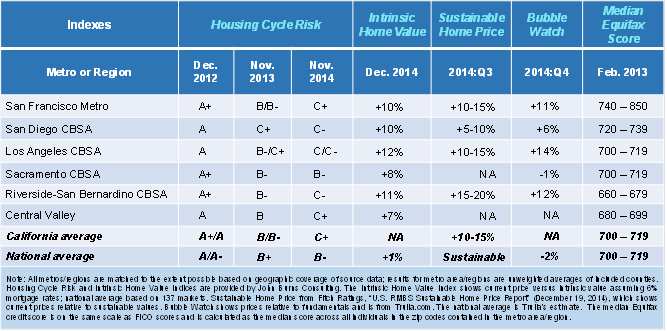

Housing Risk in Major California Metro Areas

House price risk in California is relatively high and has risen substantially since 2012.

Combination of elevated mortgage and housing cycle risk in historically volatile California market cause for concern, especially in lower income and minority areas such as Riverside-San Bernardino and Central Valley.

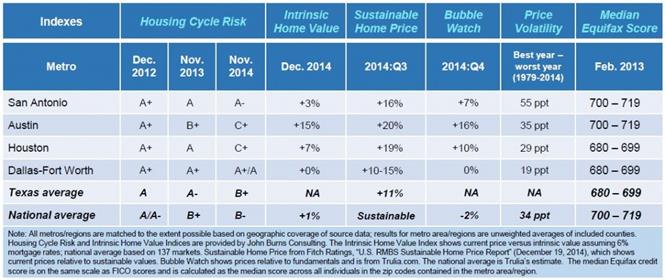

Housing Risk in Major Texas Metro Areas

While not as high as in California, house price risk in the top four metros in Texas is generally well above the national average and has risen since 2012. The plunge in oil prices will increase house price risk in Texas.

For more information, please view the full January 2015 presentation by clicking here.