GOP Blocks $2,000 Stimulus Payments, House To Hold Roll Call Vote On Proposal Monday

“Congress found plenty of money for foreign countries, lobbyists and special interests while sending the bare minimum to the American people who need it. It was not their fault.” – President Donald J. Trump

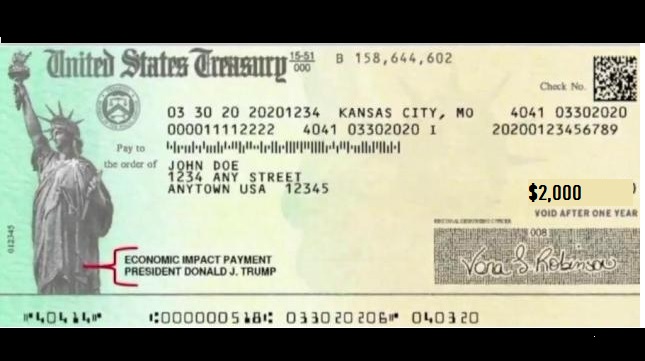

House Republicans blocked legislation Thursday that would have sent $2,000 in direct payments to Americans, House Speaker Nancy Pelosi said.

House Democratic and Republican leaders met early Thursday morning in a pro forma session and held a unanimous consent vote on the direct payments proposal, according to CNBC. Republican leadership voted the measure down, which required all lawmakers present to unanimously vote in favor for it to pass.

“Today, on Christmas Eve morning, House Republicans cruelly deprived the American people of the $2,000 that the President agreed to support,” House Speaker Nancy Pelosi said in a statement. “If the President is serious about the $2,000 direct payments, he must call on House Republicans to end their obstruction.”

A) Blockage of both the Dem proposal for $2,000 checks on the Hse flr & the GOP proposal to re-open the State/Foreign Ops appropriations bill was baked ahead of time.

— Chad Pergram (@ChadPergram) December 24, 2020

Pelosi said during a press conference that the House would hold a recorded roll call vote on the measure Monday, Fox News correspondent Chad Pergram reported. If succesful, the measure would alter the the omnibus bill Congress passed Monday night by changing stimulus checks sent to Americans from $600 to $2,000.

Virginia Republican Rep. Rob Wittman attempted to get the House to vote on reconsidering the much-criticized foreign aid included in the omnibus bill, according to CNBC. Democrats blocked that proposal.

“Speaker Pelosi tried to use the American people as leverage to make coronavirus relief contingent on government funding – which includes billions of foreign aid at a time when there are urgent needs at home,” House Minority Leader Kevin McCarthy said in a statement Wednesday night.

The coronavirus stimulus relief bill hangs in the balance after President Donald Trump announced Tuesday he wouldn’t sign the bill Congress passed. Trump criticized both the $600 direct payment, saying they were too small, and the foreign aid, saying it was wasteful.

“Congress found plenty of money for foreign countries, lobbyists and special interests while sending the bare minimum to the American people who need it. It was not their fault,” Trump said.

RELATED ARTICLES:

Trump Didn’t Make The Pardon A Political Tool, It Always Has Been

Trump Already Has A Successful Model For ‘MAGA TV’ — And It Might Give Him A Run For His Money

EDITORS NOTE: This Daily Caller column is republished with permission. ©All rights reserved. Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.