STEPHEN MOORE: Biden’s Killing the American Dream of Homeownership

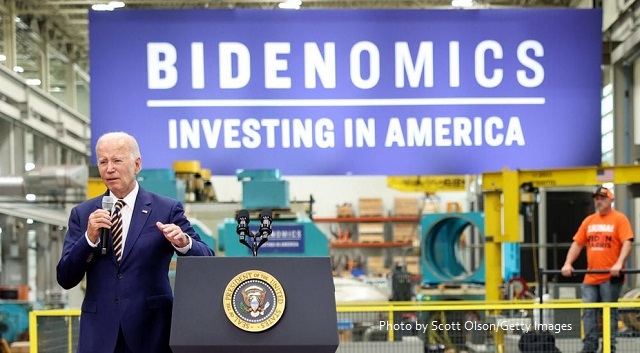

In boasting about Bidenomics two weeks ago in Milwaukee, President Joe Biden declared that his policies are “restoring the American dream.” Then he went into his creepy whispering mode and assured us “it’s working.”

Huh?

Isn’t a big aspiration of the American dream owning a home? Biden keeps making first-time homeownership harder for young families for two reasons. One is that the overall jump in inflation and the slower increase in wages and salaries means that homes are more expensive. High home prices benefit those who already own their homes, but much of the increased value is due to general inflation, which reached a high of 9% last year and hurts everyone.

A bigger killer for first-time homebuyers has been the steady rise in mortgage rates under Biden. When he came into office, the mortgage rate was 2.9% nationally. Now it is 7.1%, thanks in no small part to the Federal Reserve’s 11 interest rate increases prompted by the $6 trillion Biden spending and borrowing spree in 2021 and 2022.

So now, according to the mortgage company Redfin, just the increase in interest rates on a 30-year mortgage from 5% to 7% means that a middle-income family that could once afford a median-value home of $500,000 can only afford a home worth $429,000. Great, spend more and you get less house. Or instead of a single-family home, you can only afford a three-room condo or a townhouse. If we compare the rates today versus when Donald Trump was president, the typical homebuyer can only afford a house with a price tag more than $100,000 less than three years ago.

What a deal? Maybe this is one reason the size of a new home is smaller than in the past.

Here’s another way to think about the damage done by Biden policies: If you want to buy a $500,000 home today, which is close to the median price in many desirable locations, your total interest payments will be at least $800 more per month. That means over three decades of payments totaling at least $250,000.

Of course, rents are up nearly 20% as well, so for many 20-somethings, this means sleeping in the parents’ basement.

Biden talks a lot about bridging gaps between rich and poor and blacks and whites. But the group that is most handicapped by these interest rate shocks is minorities. Black homeownership is still less than 50% for black households. The Washington Post calls this “heartbreaking,” but they blame racism, not bad government policies.

There’s one other impediment to homeownership for Generation X and millennials. Many 30- and 40-somethings are hamstrung by their existing and expanding debt. Credit card debt is now $1.03 trillion. Half of all families are expected to have problems paying off this debt each month. Delinquencies are rising, which can mean penalty rates of 20% to 25%.

So, if families can’t afford their existing debt, how will they get a bank to approve a $400,000 or more mortgage loan?

An even bigger question is how in the world can Biden call his economic policies a success?

Perhaps Biden has a secret plan to “forgive” trillions of dollars of mortgage debt, as he has already attempted to do with student loans. But that just shifts the debt burden to taxpayers — hardly a solution.

The Biden administration’s assault on homeownership isn’t just harmful to the families that are being priced out of the market. It’s bad for communities and cities around the country. When families become homeowners and set roots in a town, they are much more prone to care about not just improving their own house and maintaining the upkeep and mowing the lawn and trimming the hedges, but it gives them a stake in the schools and children in the neighborhood and the quality of the public services. In other words, homeownership gives Americans a sense of Tocquevillian civic pride.

Crime is lower, neighbors are friendlier and everyone’s property values rise when they live in a community of owners, not renters.

There is one reason to feel today’s downward spiral can be reversed. Back in 1980 when Jimmy Carter was president, mortgage rates weren’t 7%; they reached above 17%. Voters rebelled against the economic mayhem and chased Carter out of office. Ronald Reagan came into the White House, and with wiser economic fiscal policies, mortgage rates quickly fell in half and then lower still. It can happen again.

Stephen Moore is a senior fellow at the Heritage Foundation and a chief economist at FreedomWorks. He is the co-author of the “Trumponomics: Inside the America First Plan to Revive Our Economy.”

COPYRIGHT 2023 CREATORS.COM

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

AUTHOR

STEPHEN MOORE

Contributor.

RELATED ARTICLES:

STEPHEN MOORE: Don’t Let The Lockdown Artists Bring COVID Hysteria Back

Author Of Tell-All Book Says Joe Biden Is Insecure About Being ‘Perceived As Stupid’

RELATED VIDEO: Less than 35% of Americans think Joe Biden is doing a good job. Bidenomics is a farce.

EDITORS NOTE: This Daily Caller is republished with permission. ©All rights reserved.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.