‘Economic Meltdown’ Looming On Monday, March 13th

Bill Ackman predicted the lack of government intervention to guarantee SVB FDIC insured deposits would lead to an ‘economic collapse.’

Risks include:

1. Depositors at small banks move to JP Morgan

2. Everyone moves from cash to treasuries & money markets

3. Bank assets are no longer backed by deposits

4. More runs on banks

5. Socialists cheer on demise of small banks

6. Execs at big banks get mega rich

‘Irreversible mistake’: Hedge fund manager Bill Ackman warns of ‘economic meltdown’ following Silicon Valley Bank collapse

By Jesse O’Neill, NY Post, March 12, 2023:

Hedge-fund manager Bill Ackman predicted that an “economic meltdown” was looming on Monday following Friday’s collapse of Silicon Valley Bank.

In a rambling, 649-word, one-paragraph tweet Saturday, the billionaire predicted that uninsured bank customers would rush to withdraw cash Monday unless the government steps in to guarantee their funds and “fix a-soon-to-be-irreversible mistake.”

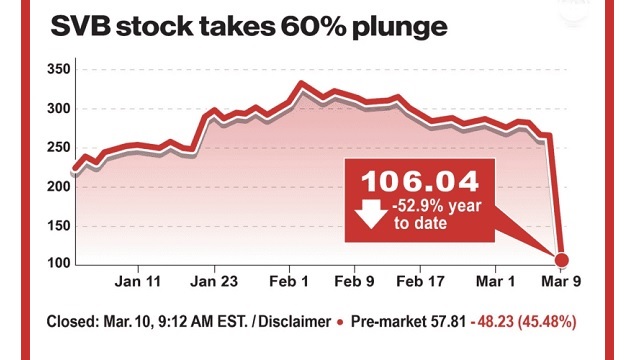

The 16th largest bank in the US, which provided financing for a large chunk of the country’s venture backed tech and health companies, was taken over by the Federal Deposit Insurance Corporation Friday as its stock plummeted due to liquidity concerns tied to rising interest rates.

It marked the largest bank collapse since the 2008 financial crisis, and it stranded billions of dollars belonging to companies and investors, whose deposits in excess of $250,000 are not covered by the FDIC.

Bill Ackman, the founder and CEO of Pershing Square Capital Management in Manhattan, predicted the lack of government intervention to guarantee SVB funds would lead to an ‘economic collapse.’

Bloomberg via Getty Images“Absent @jpmorgan@citi or @BankofAmerica acquiring SVB before the open on Monday, a prospect I believe to be unlikely, or the gov’t guaranteeing all of SVB’s deposits, the giant sucking sound you will hear will be the withdrawal of substantially all uninsured deposits from all but the ‘systemically important banks’ (SIBs),” Ackman wrote.

The FDIC was said to be looking to find a bank that would merge with the failed California institution over the weekend, as the US weight the creation of a fund that would allow regulators to reinforce deposits if other banks fail in the wake of the collapse, according to Bloomberg.

AUTHOR

Pamela Geller

RELATED ARTICLES:

Trump Curse? Signature Bank Fails Two Years After Bank Closed President Trump’s Accounts

America’s biggest banks lost more than $50 billion in a single day

America’s Biggest Banks Lost More Than 50 billion Dollars In A Single Day

RELATED TWEETS:

'De facto bailout of the banking system': Yellen says no bank bailouts, but Big Four reportedly set to grab $210 billion as tech elites get propped up https://t.co/uMcsdYlP33

— TheBlaze (@theblaze) March 13, 2023

So let's understand, the Biden regime is sending HUNDREDS OF BILLIONS to a corrupt dictatorship (that launders money for the Democrat criminal racket)

but they won't cover the failed FDIC bank deposits in a bank run caused by Biden's catastrophic economic polices. #SVBCollapse— 🇺🇸 Pamela Geller 🇺🇸 (@PamelaGeller) March 12, 2023

Hi, I’m Lindsey. A bit about me:

– Ohio mother of 4

– I employ a team of 15 as a start-up founder & CEO of Strongsuit

– drive a used Honda Odessey

– husband works in manufacturing

– The financial future of my company, team and family are at risk w/ the collapse of SVB (1/23)— Lindsey Michaelides (@lcmichaelides) March 11, 2023

EDITORS NOTE: This Geller Report is republished with permission. ©All rights reserved.

Leave a Reply

Want to join the discussion?Feel free to contribute!