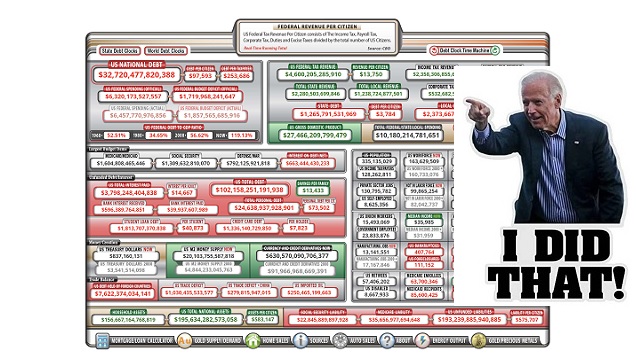

America on Brink of $1 TRILLION a Year in Interest Payments

In interest alone. This is the greatest fiscal plunder — the unimaginable transfer of wealth — for our own destruction.

The Red Line: America Is Headed Toward Annual Outlays in Interest Payments on Its Debts of $1 Trillion a Year

Can Congress muster the will to rein in outlays across the non-military budget? Go ahead, kid me.

By: Red Jahncke, NY Sun, August 22, 2023:m

After the downgrade of America’s debt by Fitch Ratings, a drumbeat of negative assessments has followed in respect of how deep in the hole our country has plunged. That’s a good thing, since net interest on the debt is escalating rapidly on a track to hit an unsustainable and crippling $1 trillion in fiscal 2025.

This fiscal year net interest is headed toward $700 billion, having already hit $561 billion in ten months, with $67 billion paid in July. Rates are at the highest levels in decades and likely to stay there, with the Federal Reserve saying it will hold rates “higher for longer.” Rates may climb further, as they have in recent days.

Most economic forecasters now see uninterrupted economic growth rather than a recession that might bring rates down. Monetary experts are considering whether current rates are a new normal and whether the neutral rate of interest and, or or, the real rate of return may be higher than previously thought.

All this implies steady or rising interest rates and increases the likelihood that net interest will hit the projected $1 trillion. The numbers bring home the reality — starting with the ongoing cost of the existing and staggering $25.8 trillion of publicly held debt that now saddles our economy.

According to the Treasury Department, the embedded interest rate on the debt at the end of July was 2.9 percent, which yields annual interest expense of $748 billion in fiscal 2024 and fiscal 2025. The next step is to calculate the increase in interest costs as existing below-market fixed-rate long-term debt matures and rolls over at prevailing rates.

In fiscal 2024, $2.7 trillion of long-term fixed-rate Treasuries will mature and roll over at current rates. Their weighted average original maturity is 4.5 years and their weighted average coupon interest rate is 1.5 percent. Rolled over at today’s 4.45 percent rate on 5-year Treasuries, they will produce in 2024 additional interest at an annual rate of $86 billion and actual interest cost of an additional $43 billion.

The third step is to calculate the cost of new debt required to fund fiscal 2024 and 2025 deficits at an assumed $2 trillion, the same as expected this fiscal year. According to the Congressional Budget Office, the deficit in the first ten months of this year, as adjusted by CBO, has surpassed $1.7 trillion, implying $2 trillion for the year.

The national debt clock is seen at midtown Manhattan on May 25, 2023.

AUTHOR

Pamela Geller

EDITORS NOTE: This Geller Report is republished with permission. ©All rights reserved.

Leave a Reply

Want to join the discussion?Feel free to contribute!