“Green Banks” Will Drown in the Red by Jonathan Bydlak

Why does federal spending matter? There are many reasons, but perhaps the most fundamental is that free markets allocate resources better than governments because markets rely on price instead of politics. Many industries show this observation to be true, but the emerging field of “green banks” offers perhaps one of the clearest recent examples.

A green bank is a “public or quasi-public financing institution that provides low-cost, long-term financing support to clean, low-carbon projects by leveraging public funds…to attract private investment.” Right now, only a handful of green banks are scattered across Connecticut, California, New York, Rhode Island, and Hawaii.

Free marketers rightly doubt whether public funds should be used to finance private startups. But regardless of where one stands in that debate, the states’ struggles serve as a valuable testing ground for future investments.

The State of Connecticut operates under a fairly significant budget deficit. California has been calculating its budgets without taking unfunded pension liabilities into account, and it’s gambling with its ability to service its debt. New York continues to live beyond its means. Rhode Island’s newest budget does little to rehabilitate its deficit spending addiction, and, despite having a balanced budget clause in its state constitution, Hawaii has a pattern of operating at a deficit.

In fact, a state solvency report released by the Mercatus Center has each of these five states ranked in the bottom third of the country, with their solvency described as either “low” or “poor.”

This all raises the question of whether these governments are able to find sound investment opportunities in the first place. Rhode Island couldn’t even identify a bad investment when baseball legend Curt Schilling wanted $75 million to make video games about something other than baseball!

Recently, though, there have been calls to extend the struggling green banking system to the federal level. Mark Muro and Reed Hundt at the Brookings Institute argued in favor of federal action in support of green banks. Somewhat paradoxically, they assert that demand for green banking institutions and the types of companies they finance is so strong that the existing state-based green banks cannot muster enough capital to meet demand.

Wherever there is potential for profit and a sound business plan, lending institutions are likely to be found, willing to relinquish a little capital for a consistent and reasonable rate of return. So where are the private lenders and other investment firms who have taken notice and are competing for the opportunity to provide loans to such highly sought-after companies and products?

Even assuming that there is demand for green banking services, recent experience shows that a federally-subsidized system would likely lead to inefficiency, favor trading, and failure. For instance, the Department of Energy Loan Program is designed to facilitate and aid clean energy startup companies. Its portfolio exceeds $30 billion, but following a series of bad investments like Solyndra, Inc., new loan guarantees have been few and far between. The program has already lost over $700 million.

Even the rosiest measurements do not show particularly exciting returns from this system. The Department of Energy itself estimates that over the lifetime of the loans it’s guaranteed, there exists the potential to see $5 billion in profit. However, those estimates also depend on the peculiar accounting methods the DoE itself employs.

This problem is apparent in other government sectors. For instance, determining how much profit the federal government makes off of student loans depends on who is asked. Some say none, while others say it’s in the billions. Gauging the economic impact or solvency of government programs is notoriously difficult, and different methods can yield what look like very different results. Add to that the consistently uncertain nature of the energy market, and profits are hardly guaranteed.

Examples abound of wasteful federal spending, and the growing green technology and renewable energy industry is no exception. The DoE Loan Program has already faced issues that go well beyond Solyndra: Abound Solar, a Colorado-based solar panel manufacturer, was given a $400 million DoE loan guarantee, only to later file for bankruptcy, potentially costing taxpayers $60 million. The Ivanpah Solar Electric Generating System, a 175,000 unit heliostat array in California, received a $1.6 billion federal loan and, because it failed to produce the amount of power estimated, was forced to later request more than$500 million in federal grants from the Treasury Department. A recent Taxpayers Protection Alliance study showed that risky investments in heavily subsidized solar energy could even lead to a bubble similar to the disastrous 2008 housing bubble.

Those who want to expand the government’s role in green banking likely want to see more clean and renewable energy reach the consumer market, and a lot of people probably applaud that goal — but the real question is whether the proposed means can reliably achieve that end. A wise manager with a solid business plan can find investors who will willingly take a chance. Considering the struggles of several states, trusting the federal government to build an even bigger system would exponentially increase that risk.

In contrast, the market offers opportunity to entrepreneurs in the green technology and renewable energy industries. For instance, GreatPoint Energy, a company specializing in clean coal, successfully went the route that other companies do: Design a product or service, find investors, and compete in the marketplace.

SolarCity, a California-based and publicly traded corporation of over 2,500 employees, entered the industry before many government loan programs were established. Thanks to a sound business model and subsequent horizontal and vertical expansion, it has become a leader in the industry. SolarCity’s success, however, cannot be touted by the Department of Energy’s Loan Program, which declined to invest in the company, leading SolarCity to try — and succeed — in finding private investment.

If GreatPoint or SolarCity had failed, only those who willingly participated in the startup would suffer the consequences. The issue with green banking — and indeed government “investments” more generally — is that taxpayers are not party to the negotiations but are the ones ultimately on the hook for failures.

In absolute terms, these billions of dollars are a lot of money. But in the grand scheme of government spending, the amount of money invested in green banks and renewable energy production is relatively small. If Social Security is the Atlantic Ocean, and wasteful defense appropriations are the Mediterranean, then green energy investments fall somewhere in the range of the Y-40 pool: easily measurable but certainly not insignificant.

Your odds of drowning may be smaller in the pool than the ocean, but that doesn’t make the drowning itself any more pleasant. The federal government is already under water; adding new liabilities on the hope that politicians can guess the future of energy is merely a step towards the deep end, not the ladder out.

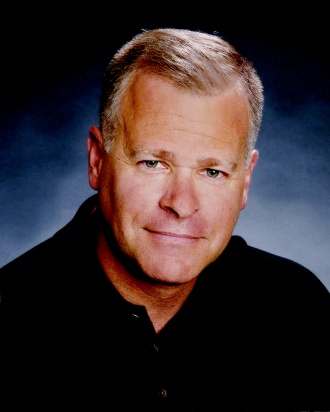

Jonathan Bydlak is the founder and president of the Institute to Reduce Spending and the Coalition to Reduce Spending.