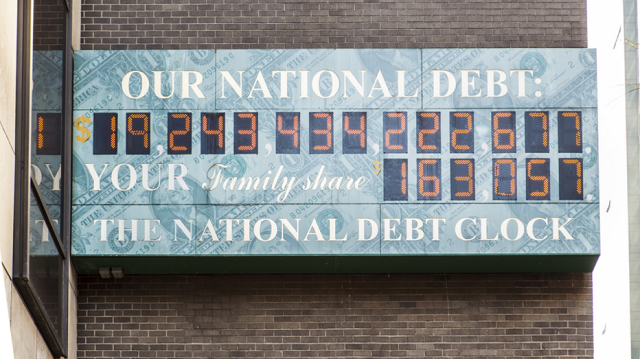

Here’s one ballooning problem the military can’t simply knock out of the sky: net interest payments on the U.S. government’s debt are projected to triple over the next 10 years, totaling 300% of 2022 outlays in 2033, according to a new report published this week by the Congressional Budget Office (CBO).

According to CBO projections, interest on the debt (which claimed 7.5% of federal government spending in 2022) will rise sharply to 10.3% of spending in 2023 and then continue rising steadily, surpassing defense spending (11.9% of spending in 2022) in 2028 and reaching 14.4% of spending by 2033.

This bad news on rising interest costs comes amid another, short-term crisis regarding the debt ceiling. The U.S. government hit its statutory debt limit of $31.4 trillion on January 19 of this year. Treasury Secretary Janet Yellen has resorted to “extraordinary measures” to “borrow additional funds without breaching the debt ceiling,” the CBO explained, but they estimate that “the Treasury would exhaust those measures and run out of cash sometime between July and September of this year” unless Congress acts to raise the debt ceiling. For every penny Congress raises the debt ceiling, it will only aggravate the interest problem more.

The increase in net interest payments has two primary causes: interest rates and deficit spending.

First, the Federal Reserve’s interest rate hikes to fight inflation contribute to higher interest rates the U.S. must pay on preexisting debt, with a small lag in time. The Federal Reserve has raised the federal funds interest rate eight times in the past 12 months, from a targetrange between 0.25%-0.00% in January 2022 to a range between 4.50%-4.25% today.

“Net outlays for interest, which rose by 35 percent last year, are projected to increase by 35 percent again this year,” said the CBO. “The projected increase in 2023 occurs primarily because the average interest rate that the Treasury pays on its debt has risen sharply this year and is expected to rise further as maturing securities are refinanced at rates that are higher than those that prevailed when they were initially issued. For example, the interest rate on 10-year Treasury notes averaged 1.3 percent in 2021 and 2.4 percent in 2022; that rate averages 3.8 percent in 2023 in CBO’s current economic forecast.”

Second, continued deficit spending increases the volume of debt on which the U.S. government must pay interest. (To clarify, “debt” is the total, cumulative amount owed, while “deficit” is the difference between expenditures and revenues over a given period of time.) “Debt held by the public (in nominal terms) is on track to increase by 6 percent from 2022 to 2023,” said the CBO, which “projects a federal budget deficit of $1.4 trillion for 2023.”

In fact, the CBO projects the federal government will run an annual deficit of $1.4 trillion-$2.8 trillion (amounting to 5.4%-7.3% of estimated Gross Domestic Product [GDP]) for every year, 2023-2033. In their February report, the CBO added 20% to their projected deficit over the next 10 years, due to changing economic and legislative factors.

Assuming that “current laws governing taxes and spending generally remained unchanged,” CBO projects that “federal debt held by the public is projected to increase in each year of the projection period and to reach 118 percent of GDP in 2033 — higher than it has ever been.”

Rising interest payments will only exacerbate the U.S. government’s budget shortfalls. According to the CBO project, the percentage of the budget devoted to paying interest will nearly double from 2022-2033. Other slices of the pie must get smaller as a result. But, as Figure 1 shows, the decreases won’t come from mandatory spending (it’s mandatory, after all), which is already a majority of federal spending. Instead, the increasing interest payments mean a smaller slice of the pie is left over for discretionary spending — including a vital subset, defense spending. The CBO estimates that defense spending will decline from 13.2% of federal expenditures in 2024 to 11.1% in 2033 (with nondefense spending declining proportionally), as interest payments increase from 11.5% to 14.4% over the same period.

VIEW: Figure 1: CBO Projection – Spending by Category (in Pct.)

Of course, one often overlooked feature of the spending “pie” analogy is that the pie can grow in size — through either expanding revenues or assuming additional debt. As Figure 2 makes clear, the CBO doesn’t predict that discretionary spending — either for defense or nondefense purposes will shrink in absolute terms. Rather, it will grow more slowly than interest payments, mandatory spending (mostly Social Security, Medicaid, and Medicare), and by implication, the whole economy as well.

VIEW: Figure 2: CBO Projection – Spending by Category (in $Billions)

One major asterisk to CBO estimates is their assumption that “current laws governing taxes and spending generally remained unchanged.” There’s nothing wrong with projecting from that assumption — it’s their job at the Congressional Budget Office, actually. But a lot can change over 10 years. For one thing, “forecasting interest rates is particularly challenging,” the CBO admitted in 2020. Three presidential elections and two midterm elections give plenty of time for political coalitions to change “current laws.”

It’s not implausible that America might experience a recession, or even two, over a 10-year period; this, too, could radically alter taxation and spending priorities. Foreign events may also interject themselves; a foreign conflict with, say, China could substantially increase military spending. All these plausible variables could dramatically alter the shape of actual government spending, 10 years down the road.

What the CBO projection can tell us is that our current policies are needlessly backing us into a corner. Just paying the interest on our current national debt will cost more and more, and the government continues to overspend its revenues to the tune of trillions (with a “T”) per year. Meanwhile, the CBO predicts mandatory spending will increase by 60% from 2023 to 2033, primarily due to the population aging into Social Security benefits. The combined pressure of these factors will reduce the federal government’s freedom to spend discretionary funds (on everything else), trimming them from 26.5% of total spending in 2022 (and somehow 29.1% in 2024) to 23.9% of total spending in 2033.

If the CBO’s projection is accurate, when Congress gets around to allocating funds in 2033, they will have less than a quarter to work with out of every dollar that they spend. That quarter must cover all discretionary spending, including defense spending.

Net interest payments are far from the most expensive category of federal spending, as Figures 1 and 2 illustrate, so why do they matter so much? One reason is that they perpetuate the deficit spiral. The CBO called the “net interest outlays increase … a major contributor to the growth of total deficits.” These deficits add to the debt, which then increases the interest the U.S. government must pay even further.

Another reason is the irresponsible folly it implies. The U.S. government is in the situation of a person who has gotten up to their eyeballs in credit card debt. Yet the government not only continues to finance purchases with credit, but only ever pays the interest that comes due, and never pays down the ever-growing principal. Sooner or later, those chickens will come home to roost, and, when they do, everything will smell like chicken houses.

A third reason to worry about the growing interest payments is that it complicates the math for any plan to reach a balanced budget. “Opportunities to trim costs are limited, with only about one-third of federal spending labeled as discretionary,” wrote analysts at The Wall Street Journal. Those opportunities shrink further as discretionary spending is crowded out by interest payments.

A fourth, and related, reason is it leaves us less prepared for any crisis. Apart from possible military crises, the CBO forecasted last month that Social Security will become insolvent in 2033, 10 years away. Analysists have recognized for decades that the entitlements time bomb is most likely to kill us when it finally detonates, but America lacks the political will to address that issue yet.

Still, the U.S. government can be better or worse prepared when that time comes. Our best escape route is to free up some funds to deal with the ultimate insolvency of Social Security. Instead, we continue to spend money we don’t have. It’s as if we are trapped in a corral with a deadly bull lying fast asleep. We could choose to flee before the bull awakes. Yet America has not only remained in the ring, but we have backed ourselves into a corner, limiting our chances to dodge its gory horns. And, on top of that, we occupy ourselves by stringing barbed wire across our best escape route. When the bull finally awakes, we will deserve all the consequences of our folly.

If America’s fiscal situation is dangerous, even desperate, why haven’t we confronted our fiscal irresponsibility yet? One reason is that historically depressed interest rates kept legislators from feeling the consequences of their actions. For 11 out 14 years from 2008-2020, the federal funds effective rate lay under 1% (and most of that time it was under 0.2%). In 2015, the interest rate on a three-month Treasury bill, which averaged almost 5% in 2007, had dropped to 0.03%. This created an era of cheap debt, where Congress could overspend with hardly any consequences. Now, as interest rates rise, as we always knew they would, the U.S. government not only has to shoulder an interest burden to which it is unaccustomed, but it has also lost the habit — or even the façade — of fiscal restraint.

According to the latest CBO report, 2028 represents a shocking threshold: the year when the U.S. government will have to spend more paying the interest on our $31.4 trillion of debt than it will spend on national defense. Whether we reach this landmark a few years early or late, the point is that our profligate legislature is spending our country into a pointless crisis.

Just as no one wants to be the team down by three touchdowns at the two-minute warning, no country should willingly bury itself under so much debt that it’s mathematically impossible to escape. Alas, the only similarity between wisdom and Washington is that both begin with “W.”

AUTHOR

Joshua Arnold is a staff writer at The Washington Stand.

EDITORS NOTE: This Washington Stand column is republished with permission. ©All rights reserved.

The Washington Stand is Family Research Council’s outlet for news and commentary from a biblical worldview. The Washington Stand is based in Washington, D.C. and is published by FRC, whose mission is to advance faith, family, and freedom in public policy and the culture from a biblical worldview. We invite you to stand with us by partnering with FRC.

John H. Ramsey has published “

John H. Ramsey has published “