Republican Amnesty: “In Lies We Trust”

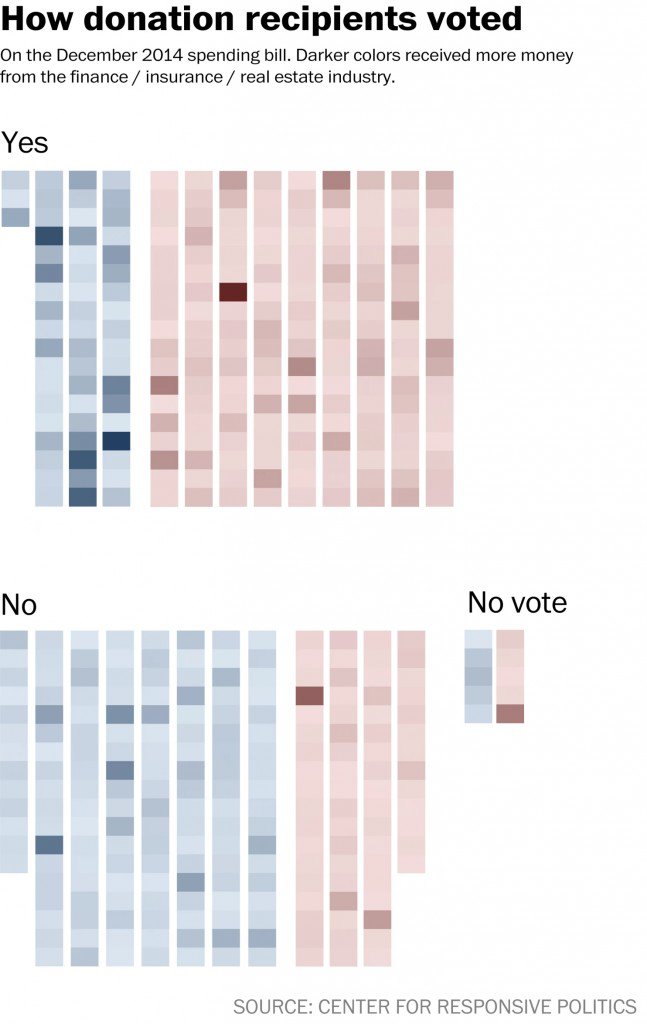

Something is terribly wrong with the ability of the Republican leadership in the House to think clearly or speak honestly. The Speaker authorized what will be a $1.43 trillion 12 month out of control omnibus spending bill. It is a 1600 page bill that had a massive amounts of pork in it, and is another bill that no one read before they voted for it. Pelosi never authorized such a large out of control spending bill when she was Speaker. This bill will contribute to the bankruptcy of the Republic.

That spending bill funded the the hiring of 1000 new federal employees, for 9 months. Those new employees will not have had the experience in immigration matters to interview each applicant, or the years of experience in national security to weed out criminals, terrorists, and fraudulent applicants. Yet those new employees will be issuing work permits and social security numbers to 5 million illegal immigrants. They will lack the experience to determine if the issuance of those work permits and social security numbers, to millions of illegal immigrant that apply have been residents in the US for 5 years, or if issuance of those permits will be in the best interest of the National Security of the Republic.

The American Chamber of Commerce and the Speaker know that issuing work permits and social security numbers to 5 million illegal immigration will depress wages for the 43 million unemplyed Americans seeking employment. The issuance of work permits and social security numbers to 5 million illegal immigrants was recently determined to be Unconstitutional by a US Federal Judge in Pennsylvania.

The American voters will hold the Speaker of the House responsible for ignoring the will of the American voters; he said he was opposed to Obama’s illegal Execitive Order on immigration, and for his outright support for the occupant in the Oval Office’s out of control spending. The omnibus spending bill was not what the voters were promised by the Republican leadership before the mid-term election. The American voters feel they were betrayed by the Speaker, and that he never intended to honor his pledges to the American people.

Please read the below listed article that is much more specific in details and includes quotes by the Speaker.

Republican Amnesty: In Lies We Trust

by LAWRENCE SELLIN, PHD December 16, 2014

It was a Republican electoral head fake.

They always favored amnesty, but prior to the mid-term elections, in order to mobilize their voter base, the Republican leadership pretended to oppose Barack Obama’s threat of executive amnesty.

On February 24, 2014, the US Chamber of Commerce, the heart and soul of the Republican establishment, laid the groundwork for Republican amnesty for illegal aliens:

“There will never be a perfect time for reform. The political landscape isn’t going to be any more conducive to reform in two years or four years,” wrote Chamber President Tom Donohue. “The case for immigration reform is clear. The need is undeniable. The time is now.”

Donohue had previously stated that they would “pull out all the stops” to get immigration reform in 2014. The group planned to spend $50 million to blunt the influence of the Tea Party, largely because it opposed amnesty, and millions more to push for immigration reform legislation that the Congressional Budget Office had said would lower the wages of American workers

Having received his marching orders, on March 4, 2014, House Speaker John Boehner (R-OH) said that he wanted to get amnesty legislation done before the end of the year, even as he insisted that the immigration reform he and President Barack Obama had discussed in their White House meeting was not “amnesty:”

“He wants to get it done. I want to get it done,” Boehner said. “But he’s going to have to help us in this process.”

Then came the head fake.

Knowing support for amnesty was a losing issue, the Republican establishment focused their opposition on executive amnesty hoping that, if it was presented forcefully, voters might also think that it included any form of amnesty.

During the run-up to the mid-term elections, Reince Priebus, the chairman of the Republican National Committee (RNC), called executive amnesty “un-American” and “unconstitutional, illegal, and we don’t support it.”

Priebus promised that, if the Republican Party takes the Senate, they will do everything in their power to stop Obama from proceeding on the executive amnesty.

Even after the election, while simultaneously criticizing executive amnesty and oozing hypocrisy, Boehner said:

“That is not how American democracy works,” he said. “By ignoring the will of the American people, President Obama has cemented his legacy of lawlessness and squandered what little credibility he had left.”

“Republicans are left with the serious responsibility of upholding our oath of office. We will not shrink from this duty, because our allegiance lies with the American people,” he said. “We will listen to them, work with our members, and protect the Constitution.”

Among voters, strong “majorities of men (75%), women (74%), whites (79%), blacks (59%), and Hispanics (54%),” in addition to tri-partisan majorities of “self-identified Republicans (92%), Independents (80%), and Democrats (51%)” did not want Obama to enact executive amnesty.

Yet, according to Reps. Michele Bachmann (R-MN) and Steve King (R-IA), the political establishment, both Republican and Democrats, made a decision months ago that they were going to approve amnesty.

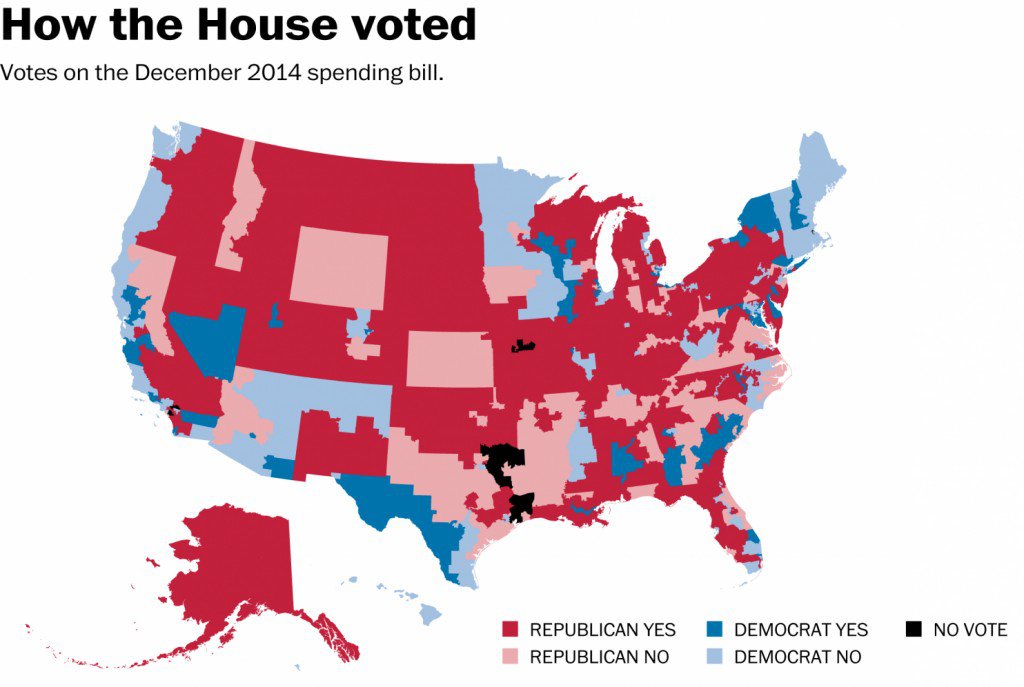

HR 83, a bill literally crafted behind closed doors in cigar smoke-filled rooms by a handful of legislators and staffers, endorses and fully funds Barack Obama’s unconstitutional executive actions granting amnesty to illegal aliens, including Social Security benefits to support them.

Despite the fact that the Republicans sailed to victory in one of the biggest election routs of the past century and grew to historic levels in the U.S. House, they never intended to honor their pledges to American voters.

They did so not out of weakness.

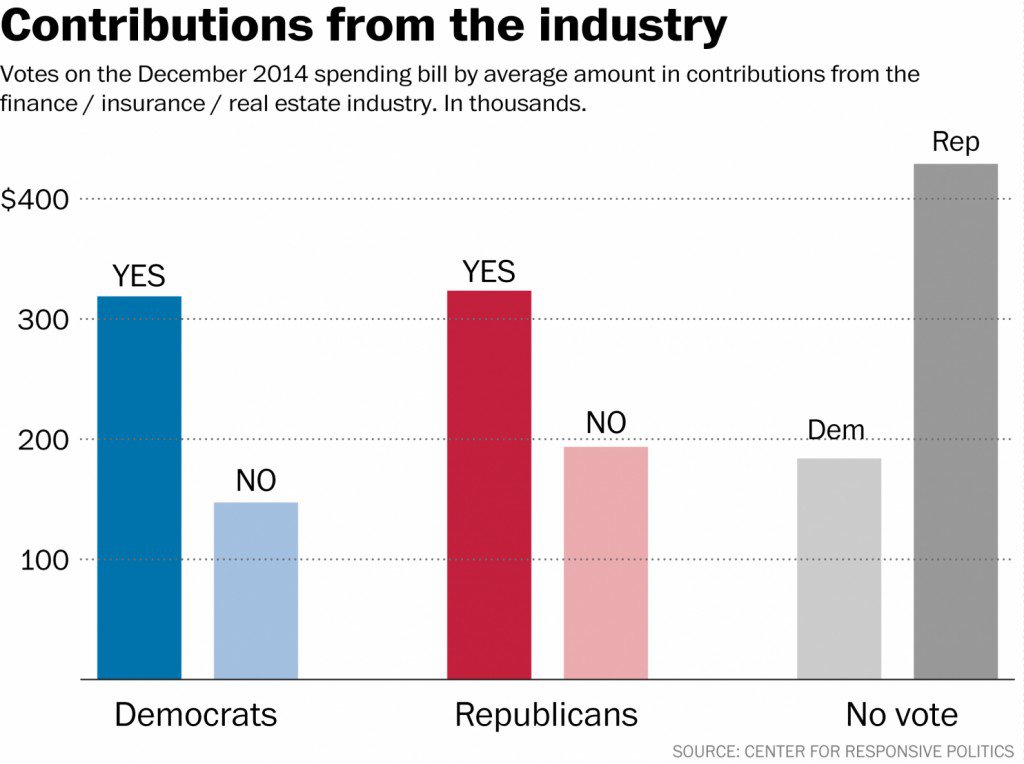

In order to preserve their fragment of the political landscape as junior partners in a corrupt status quo, it is a more defensible position for the Republican establishment to be deemed eunuchs and cowards rather than what they are; bold-faced liars who care little about the Constitution and represent only themselves and the interests of their wealthy financiers.

You see; that too is a head fake.

Lawrence Sellin, Ph.D. is a retired colonel with 29 years of service in the US Army Reserve and a veteran of Afghanistan and Iraq. Colonel Sellin is the author of “Restoring the Republic: Arguments for a Second American Revolution “. He receives email at lawrence.sellin@gmail.com.