President Trump’s political adversaries and globalists, including the media pundits, are frantically yelping about how the President’s proposed tariffs against Chinese imports would spark a “Trade war.”

In point of fact, concerns about a trade war with China are late — very late — and have nothing to do with Trump’s proposed tariffs.

In reality China has, for decades, engaged in a one-sided “trade war” with the United States that doesn’t involve tariffs but wide-spread and wide-scale theft of intellectual property.

One-sided relationships are not relationships!

Foolishly, a succession of previous administrations have facilitated this outrageous situation.

My previous FrontPage Magazine article, Educating America’s Adversaries focused on the lunacy of the United States hundreds of thousands of Chinese students to study STEM (Science Technology, Engineering and Mathematics) disciplines and also providing them with optional practical training at U.S. corporations unwittingly providing them with the opportunity to engage in industrial espionage.

My article today is predicated on an April 4, 2018 Justice Department press release, Chinese Scientist Sentenced to Prison in Theft of Engineered Rice, that reported on the sentencing of a Chinese scientist, Weiqiang Zhang, for his crimes that, although not related to military concerns, are related to intellectual property theft (trade secrets), specifically genetically engineered rice seeds with potentially profound implications.

That press release begins with the following sentence:

A Chinese scientist was sentenced to 121 months in a federal prison for conspiring to steal samples of a variety of rice seeds from a Kansas biopharmaceutical research facility.

This excerpt from the press release provides the salient background information:

Weiqiang Zhang, 51, a Chinese national, and U.S. legal permanent resident residing in Manhattan, Kansas, was sentenced by U.S. District Court Judge Carlos Murguia in the District of Kansas. Zhang was convicted on Feb. 15, 2017 of one count of conspiracy to steal trade secrets, one count of conspiracy to commit interstate transportation of stolen property and one count of interstate transportation of stolen property.

Evidence at trial established that Zhang worked as a rice breeder for Ventria Bioscience in Junction City, Kansas. Ventria develops genetically programmed rice to express recombinant human proteins, which are then extracted for use in the therapeutic and medical fields. Zhang has a master’s degree in agriculture from Shengyang Agricultural University in China and a doctorate from Louisiana State University.

According to trial evidence, Zhang acquired without authorization hundreds of rice seeds produced by Ventria and stored them at his residence in Manhattan. The rice seeds have a wide variety of health research applications and were developed to produce either human serum albumin, contained in blood, or lactoferrin, an iron-binding protein found, for example, in human milk. Ventria spent millions of dollars and years of research developing its seeds and cost-effective methods to extract the proteins, which are used to develop lifesaving products for global markets. Ventria used locked doors with magnetic card readers to restrict access to the temperature-controlled environment where the seeds were stored and processed.

Zhang conspired with other citizens of China as noted in this paragraph:

Trial evidence demonstrated that in the summer of 2013, personnel from a crop research institute in China visited Zhang at his home in Manhattan. Zhang drove the visitors to tour facilities in Iowa, Missouri and Ohio. On Aug. 7, 2013, U.S. Customs and Border Protection officers found seeds belonging to Ventria in the luggage of Zhang’s visitors as they prepared to leave the United States for China.

This case is infuriating on a number of levels.

First of all, Zhang was provided lawful immigrant status, placing him, should he have so desired, on the pathway to United States citizenship.

He also obtained a first-rate education in the United States, having received his Phd from Louisiana State University.

America had opened its heart and doors to Zhang and an opportunity to live the “American Dream.”

Rather than express gratitude for America’s generosity, he betrayed America and the American company for which he worked.

Zhang and his Chinese cohorts saw in America’s kindness and generosity, weaknesses that could be easily exploited.

This specific case calls to mind the statements of Mitt Romney who, during his campaign for the presidency, repeatedly said that when the United States provides foreign students with an education, we should “staple Green Cards on their diplomas so that they don’t go half-way across the world when they graduate.”

Of course Mitt is hardly the only politician to urge the admission of huge numbers of foreign students and call for them to be granted lawful immigrant status upon their graduation from American universities.

The best way of addressing concerns that foreign students will leave the United States upon graduation is to make certain that American students should fill those classrooms, lecture halls and laboratories. When American students graduate they are likely to go no further than half-way across town, or perhaps, half-way across the United States, but not half-way across the earth.

While it was not disclosed whether Zhang was granted lawful immigrant status before or after he secured his doctoral degree from Louisiana State University, we do know he conspired to send stolen intellectual property, that the genetically modified rice seeds represented, from his U.S. employer half-way around the world his native China, our Most Favored Nation trade “partner.”

Those rice seeds and the methodology used to create them, that Zhang stole, required years of hard work and an investment of millions of dollars. They can be used for wide-ranging health science applications and will likely generate huge profits in the global marketplace.

This case is, unfortunately, not an isolated case.

Understandably President Trump has decided that “enough is enough” and has proposed to impose tariffs on Chinese imports. However, the globalists such as the U.S. Chamber of Commerce have expressed their displeasure at the President’s actions, concerned about a possible “trade war” blithely ignoring that for decades, China’s trade policies and currency manipulation and increasing belligerent conduct is harmful and dangerous to America and Americans.

These globalists and prior administrations also know that China has engaged in massive industrial espionage in the United States and their computer programmers hack corporate and government computers thousands of times.

The ever-increasing scope, magnitude and sophistication of Chinese computer hacking and cyber-espionage are worrying, to say the least.

On October 5, 2017 Newsweek published an article, Cyberwar: How Chinese Hackers Became A Major Threat To The U.S. that paints a clear and extremely troubling picture about China’s increasing hacking activities that threaten U.S. national security.

Again, the question that must be asked is how many members of the Chinese “Hacking army” were educated in the United States?

Here is a brief excerpt from the Newsweek article:

In its 2015 Global Threat Report, the American cyberintelligence firm CrowdStrike identified dozens of Chinese adversaries targeting business sectors that are key to the Five-Year Plan. It found 28 groups going after defense and law enforcement systems alone. Other sectors victimized worldwide included energy, transportation, government, technology, health care, finance, telecommunications, media, manufacturing and agriculture.

China’s theft of military and trade secrets has been so rampant that editorial cartoonists Jeff Parker and Dave Granlund depicted it as “Chinese takeout.”

On November 27, 2017 the DOJ issued a press release, U.S. Charges Three Chinese Hackers Who Work at Internet Security Firm for Hacking Three Corporations for Commercial Advantage, that began with this statement:

An indictment was unsealed today against Wu Yingzhuo, Dong Hao and Xia Lei, all of whom are Chinese nationals and residents of China, for computer hacking, theft of trade secrets, conspiracy and identity theft directed at U.S. and foreign employees and computers of three corporate victims in the financial, engineering and technology industries between 2011 and May 2017. The three Chinese hackers work for the purported China-based Internet security firm Guangzhou Bo Yu Information Technology Company Limited (a/k/a “Boyusec”).

While those alleged computer hackers allegedly committed their crimes from China and without entering the United States, questions that were not addressed in the press release include whether any of the indicted alleged hackers were educated in the United States or if any other Chinese citizens may have worked for any of the companies that were targeted for the cyber attack to enable them to more easily gain access to the computer networks that were attacked.

My dad taught me that there are no mistakes in life, only lessons- provided that we learn from those instances when things go wrong.

He also taught me that we teach those with whom we interact as to how they should treat us be demonstrating what we will and won’t accept.

For far too long the United States has refused to stand up to nations such as China, that certainly do not have America’s best interests at heart.

In point of fact, Chinese intransigence has been unaffected by a succession of administrations that provided China with carrots such as conferring upon China Most Favored Nation status but few, if any “sticks.”

Trump’s policies are consistent with my dad’s sage advice and are a welcome change from the spineless approach of past administrations.

President Trump needs to take a hard look at the issuance of student visas to citizens of China, particularly where STEM courses of study are concerned.

RELATED ARTICLE: Progressive Dem: Trump ‘Right to Raise Tariffs’ as America’s China Policy Has Been ‘Schizophrenic’

According to its website:

According to its website:

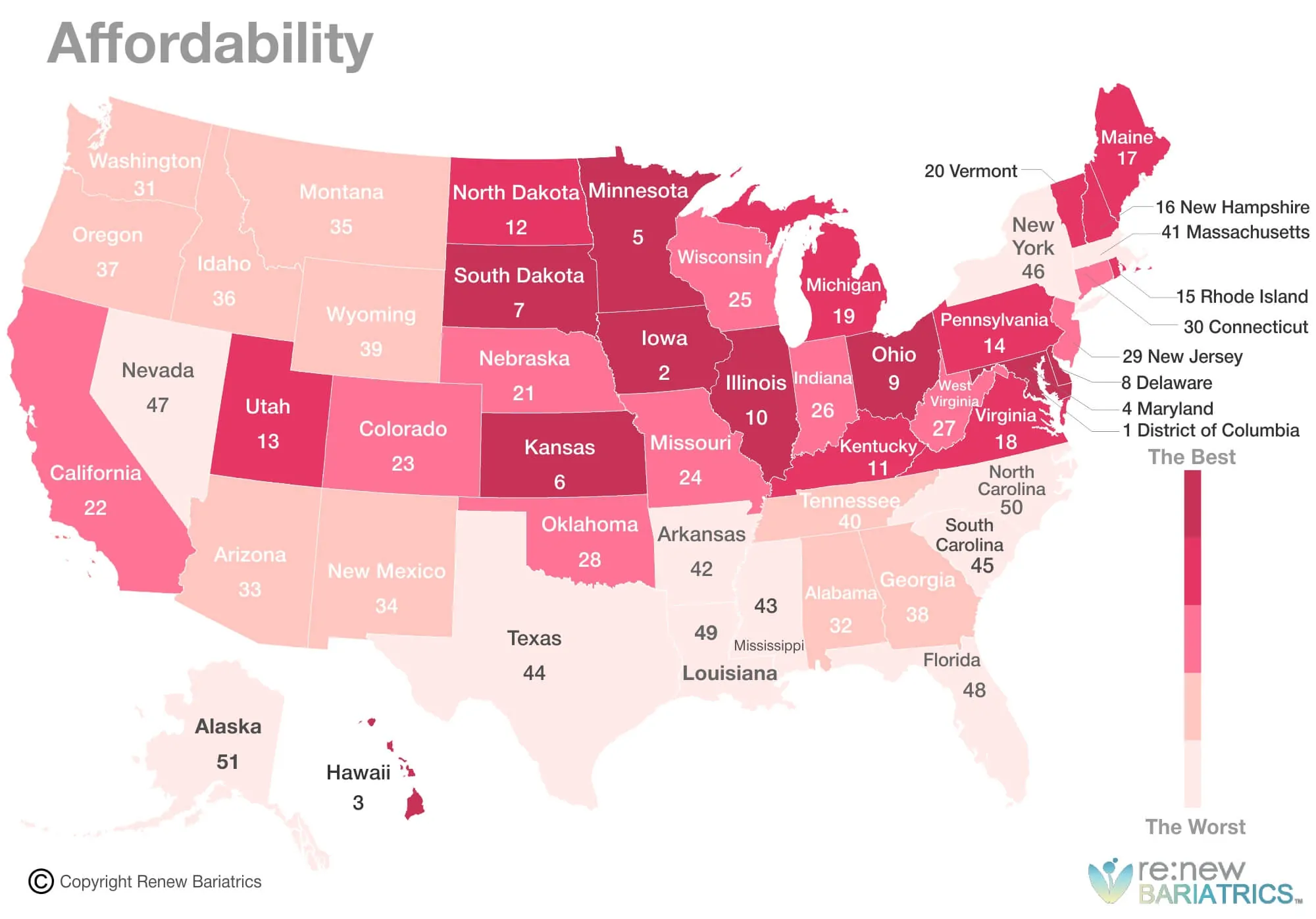

Healthcare’s Affordability

Healthcare’s Affordability Healthcare’s Availability

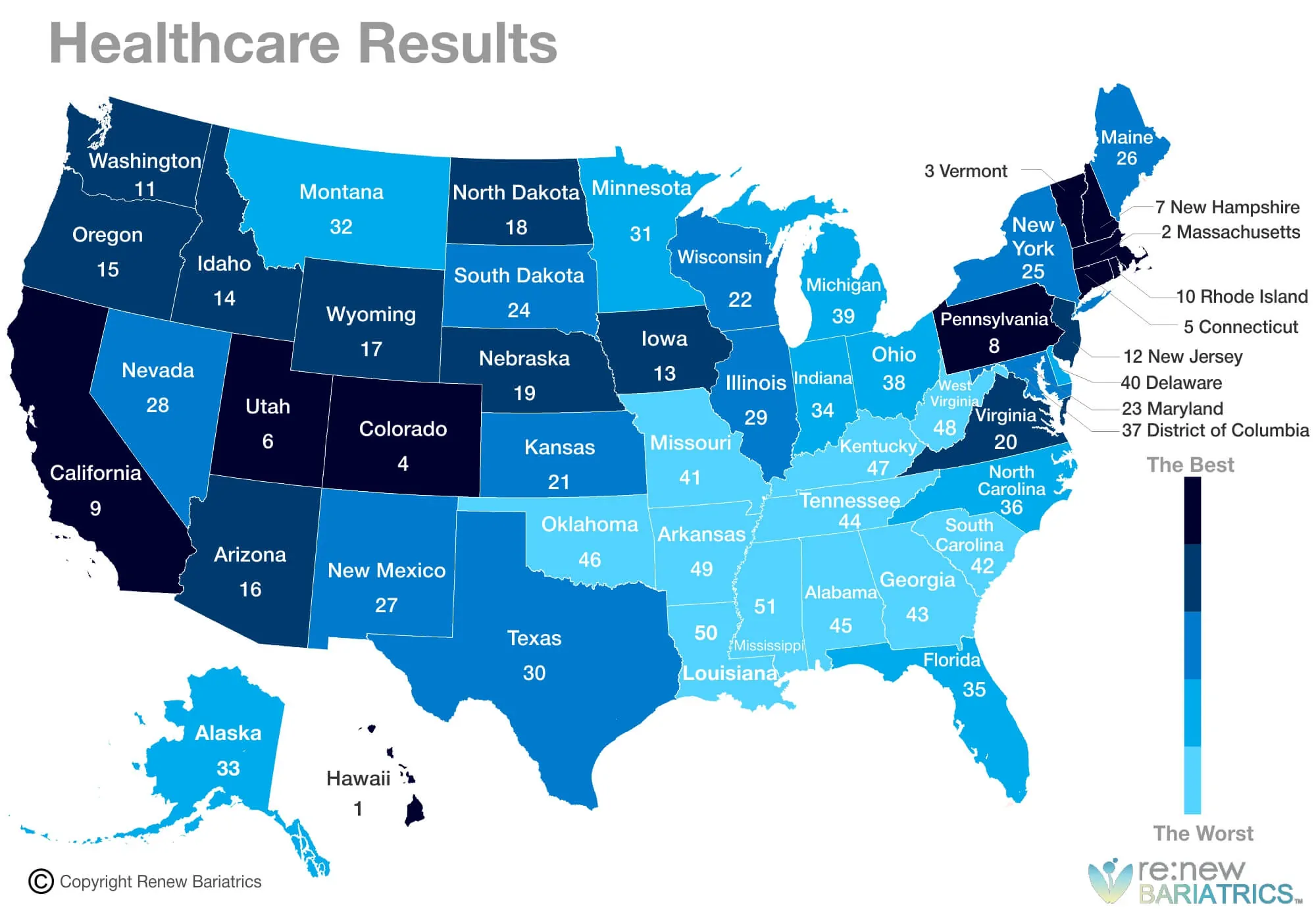

Healthcare’s Availability Healthcare’s Results, Outcome

Healthcare’s Results, Outcome Individual State’s Healthcare

Individual State’s Healthcare