I planned to spend the month of January clearing out files and getting old interests off of my computer to make room for new ones rather than doing any writing but a telephone call from a person well informed about banking, bank regulations, the American legal system, and many other things (including USA, Inc.), and it changed my plans. He called and asked a simple question: “What’s your opinion of Bitcoin?” I’ve had many other friends ask … and have avoided an answer – until now.

Banking, not currency, is my area of expertise … but the two concepts overlap. Without money, what good is a bank?

What is money? Before I address the topic of Bitcoin, this question must be answered. What is money? What is wealth? What is profit? The three are intertwined, but they are not the same thing.

Money is a reward for labor and risk management. People who run their own independent businesses are rewarded with profit for their good decisions (or take losses for bad ones) involving risk management. People who work for them – or for multinational companies – take no risk but provide the sweat of their brow to gain access to money. Stock market investors are rewarded for their good decisions with profit – or are penalized for bad ones. For most people, however, money is the reward for labor and risk management. After earning it, it becomes the means to survive, giving us access to everything from housing and comfort – to the opposite. Anyone who opens a business every day manages risk. Anyone who invests in various market products – from stocks to bonds and mutual funds and metals – manages risk. When you get to the bottom line, though, money is something the vast majority of people think they can stuff in their mattress or pull from their wallets to pay for a drink at the local bar or to tip a waitress at Denny’s for good breakfast service.

As long as government can put you in prison for not paying your taxes, what backs America’s paper currency is not “nothing.” People tell you that but it is untrue. What supports the Dollar/Federal Reserve Note is the tax base of the nation. Our paper money is backed by the taxes paid by the American people, by the sweat of our brow, by the value of our real estate (before mortgage-backed derivatives ruined it), and our commodities. Generally, productivity determines our wealth, not “things.”

Money is a nationally-recognized medium of exchange – like the U.S. dollar (or Federal Reserve Note – bearing in mind that the word “note” also means “loan”) or the British Pound Sterling or the French Franc or the German Deutsche Mark. But money has changed in the past few years. Computers turned “money” into “virtual currencies” or “digital currencies.” The United States Federal Reserve Note is the largest digital currency in the world. Bitcoin’s claim to being a digital currency is totally minimized when you think about the “digital dollar” for longer than a minute.

Bitcoin supporters – and they are legion – are as dedicated to the concept of a non-government backed currency like Bitcoin as any Greenie is to eliminating carbon footprints. They are pretty radical. They have found something to believe in… something they believe to be better than money produced and regulated and backed by governments around the world.

Supporters of Bitcoin think of it as a non-government (or post-government) currency – but it is not. Government can shut it down anytime it wants. And that was the first answer I gave to the caller who asked the question. A “virtual currency” (like Bitcoin) is invisible. It depends on billions of computers which are linked together. You cannot dilute Bitcoin, you cannot counterfeit it… and those two things make it highly desirable to many people who have lost their confidence in the current central bank-controlled world of money. The dollar is being counterfeited all over the world. The point is, the people have largely lost their trust in government. Like most not terribly bright people, they simply do not recognize the point at which they are going to kill the goose that lays the golden eggs and think that Gordon Gekko’s statement that “Greed is good” is accurate – into infinity. Greed is not good – and fairly earned profits are not bad.

Does Bitcoin bypass central banks and currencies, as its supporters suggest it does? Let me answer that question with a question: How do you obtain Bitcoin? Does someone pay you for it in return for your labor? No… you are paid in the nationally-recognized currency of your nation in return for your labor. People who manage risk to earn profits are also paid in the currency of the realm, so to speak. The only way you can get Bitcoin is to use dollars or yen or francs, etc., to purchase it. Thus, it does not by-pass central banks or currencies. It is dependent upon them for its very existence.

Bitcoin exploded on the American scene… well, it exploded worldwide. The biggest users of Bitcoin are the people of China. The people of India are also heavily invested. People who have had limited access to traditional banks in their nations have been drawn to the Bitcoin digital currency.

The fact is, belief in paper money is crumbling. Why? Because of mortgage-backed derivatives. Because of government reports that tell us inflation is only 3% — when we know what we pay for groceries exceeds that number by far. Because of Quantitative Easing payments by the Federal Reserve to Wall Street banks – certainly not representative of the vast majority of independently-owned commercial banks in America – to prop up the stock market. Because of the manipulation of the precious metals markets by banksters and government agents who act in opposition to the well-being of the citizens of this nation. The fact is, belief in paper money is crumbling because of lies (from ObamaCare to Benghazi to IRS manipulations of tax status qualification). And that has stimulated international interest in Bitcoin.

The problem with America’s currency today is that too much of it is being “printed” – though it’s not really printed these days. It’s just key-coded into a computer. Another problem is Bitcoin stock volatility … it’s gone up 9,000% just this year. Now that could take the currency market on the ride of its life, couldn’t it? Currencies need to be stable or the world can’t be stable. A nation’s currency needs a lack of volatility. One reason so many people want a currency that is backed by gold and silver is because they are sufficiently rare as to prevent too much duplication of them and, thus, a certain amount of non-volatility is achieved. You can’t print – or key-code – a bar of gold into a computer. One of the things supporters point out is that Bitcoin programmers replicated something that cannot be counterfeited or diluted. Well, they say that – but that’s an assumption that hasn’t withstood sufficient tests of time, hacker technology, and marketplace manipulations. It is unproven.

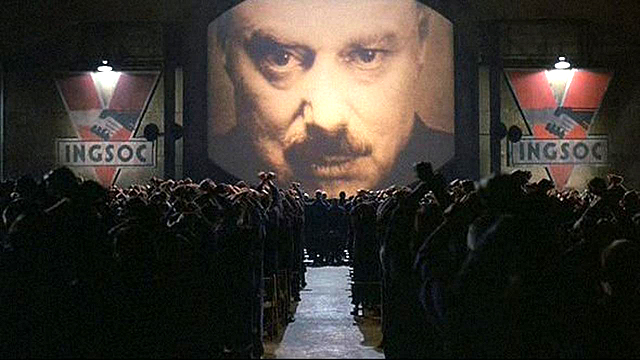

How do you get Bitcoin? You must use the currency of your nation to purchase it. So Bitcoin does not by-pass currency and central banks as advertised. You need your national currency to gain access to it. Thus, Bitcoin’s primary value lies in its stock market price, not in any established market value – perceived, not actual value. And government can shut down Bitcoin anytime it chooses. How? Turn off access to the computer. If you do not think government controls what has access to the Internet, you have not been following the news. Should Bitcoin ever become a real threat to the central banking system, Bitcoin will be shut down. Do you really believe that a central banking system that has seen every President assassinated (or attempts made) when they tried to break away from the central banking system is going to hesitate for one moment to cut off access to Bitcoin should it become a threat? Please!

On June 4, 1963, President John F. Kennedy signed Executive Order 11110 giving the Treasury Department explicit authority “to issue silver certificates against any silver bullion, silver, or standard silver dollars in the Treasury.” In other words, for every ounce of silver in the U.S. Treasury vault, the government could place new currency into circulation. More than $4 billion in U.S. Notes were created in $2 and $5 denominations. President Kennedy was assassinated five months later … while the Treasury Department was printing $10 and $20 United States Notes (incidentally the $10 and $20 Notes were never circulated). After the Kennedy assassination, the U.S. Notes Kennedy had issued were immediately taken out of circulation. Almost all of the paper currency in the United States – over 99% — is Federal Reserve Notes, not the United States Notes John F. Kennedy constitutionally created.

Abraham Lincoln needed financial assistance to finance the War Between the States (some call it the Civil War). New York banks offered him loans at a 24% to 36% interest rate. Instead, Lincoln got Congress to allow him to produce Greenbacks. The Greenback solution worked so well, Lincoln intended to make it a permanent policy… one that would do away with the need for a central bank. As history teaches us, President Lincoln was shot on Good Friday, April 14, 1865, while watching a play at Ford’s Theater. There were attempts on the life of President Andrew Jackson, too. Jackson firmly opposed central banks and his vow to prevent a central bank was the thrust of his Presidential campaign. He was elected – which should tell you what the people wanted.

Do you really believe the richest, most amoral, most powerful organization in the world – the Bank of International Settlements whose members are the central banks of the world – would have a problem in shutting Bitcoin down in a New York minute if they thought it represented any kind of threat to them? I don’t. All they have to do is remove Bitcoin from the Internet… and without the Internet, there is no Bitcoin. It is, however, interesting to ponder if Bitcoin is a false flag designed to lead people down a yellow brick road, promising a solution to the central bank problem while concurrently creating a huge bubble! We’ll see.

Too, there are technical problems with Bitcoin. For example, if I owe you $1,000 today and give you the correct amount of Bitcoin to pay that debt, by the time you cash my payment the value of the Bitcoin may have sunk sufficiently that you get only half of what you loaned me. That is a solid argument against Bitcoin as a day-to-day form of currency. When something is that volatile, it cannot be used as a medium of exchange. Those who argue that we should use gold and silver coinage rather than paper bills need to own up to the volatility of precious metals, too. We have seen in the past years how easily the gold and silver markets can be manipulated. That’s why they, alone, aren’t good mediums of exchange… under the current system certain banksters get a minute or 15 seconds on the computer before anyone else can invest and set the price for precious metals for the day, making them too volatile. Until the manipulation problem is solved, that problem remains. Part of the solution is using all commodities to back a nation’s currency. The entire world market of commodities cannot be manipulated at the same time.

Digital currencies are, Bitcoin supporters say, the wave of the future. What they neglect to state is that the US Federal Reserve Note is already the world’s largest digital currency.

Many people are aware that a global currency reset is scheduled. Actually, it has already begun. No doubt that the dollar is in big trouble … we all know that. The world’s central banks will soon get rid of the dollar as the international currency of trade and a global currency reset will be used to achieve that. It will not be a hidden event — you will hear the words “global currency reset.” It is scheduled to happen within the next three months… but there are many a slip between cup and lip.

There are 204 countries that agreed with the IMF to revalue their currencies. It is said they have agreed to keep their currencies within a 5% differential of each other. That doesn’t mean the collapse of the US dollar. That comes later. The hope is that the global currency reset will prevent currency wars – which is what we have right now and it’s hurting everyone. In some nations, currencies will be devalued. In others, value will increase. When a currency is devalued, the cost of labor goes down – which appeals to multi-national corporations. Some say the US dollar will go down 30%. – I think the global currency reset will cause the dollar to go down more than that, but that’s just my opinion. In relation to other currencies in the world, the US dollar will be revalued in relation to the value of other currencies worldwide. How will worldwide currency values be established? Productivity and population… and we’re back to where I started this article: the value of money is determined by labor and risk management.

What does that mean? If the dollar drops by 30% , it means 30% inflation. As America gets over its love affair with cheap Chinese products – after the Chinese currency is revalued upward – future costs of those products will be much higher. So there will be a secondary cost increase – and that means more inflation beyond the original 30%.

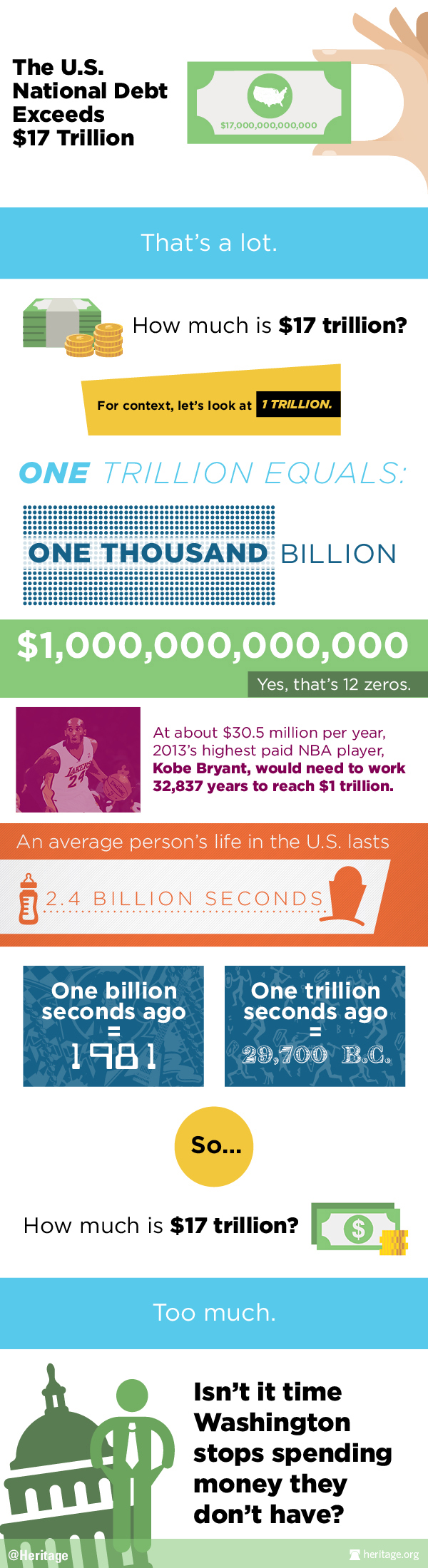

The currencies will be reset, they say, according to the assets of the country. What is America’s big industry? You’ve heard it from me a hundred times this past year: Debt. That’s why I call the economic driver of our nation “debtism” rather than “capitalism.” We have no manufacturing or industrial base. With Quantitative Easing, the Federal Reserve System’s Balance Sheet has increased from 12 (plus) trillion at the end of the Bush Administration to an explosive $17 trillion under Obama. There are no assets left in America. Debt is our biggest asset.

And now you know why I’ve also been saying for the past year that the best investment you can make is things you will need in the immediate future: Underwear, clothing, toilet paper, shoes (for adults), canned goods and other long-term food, medical materials – iodine, e.g.. They are all going to shoot sky-high in the coming months and years. Take a look at those things on which you are most dependent – and stock up on them.

Notice to marketers: We are now moving from a want-driven marketplace to a needs-driven marketplace.