Benefit Corporations: The new government-industrial complex

President Eisenhower warned America about a growing military-industrial complex stating, “This conjunction of an immense military establishment and a large arms industry is new in the American experience. The total influence — economic, political, even spiritual — is felt in every city, every Statehouse, every office of the Federal government. We recognize the imperative need for this development. Yet we must not fail to comprehend its grave implications. Our toil, resources and livelihood are all involved; so is the very structure of our society. In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist.”

Whenever and wherever government and industry partner Americans face “the acquisition of unwarranted influence”.

Most recently we saw how appointed officials working in partnership with a corporation can directly impact every Floridian. Robert Trigaux, Tampa Bay Times Business Columnist, in “At the PSC, a confederacy of yes men — and women” wrote:

The first thing we do is pass a truth-in-government law that changes the name of the Florida Public Service Commission [PSC] to the Florida Utility Suckup Club.

The PSC hearing held in Tallahassee this past week was beyond embarrassing. It was billed as a review and vote on a proposed settlement with Duke Energy Florida to finalize who gets stuck paying for the $5 billion wasted by the company on the broken Crystal River and the proposed-then-canceled Levy County nuclear power plants.

The vote: 4 to 1 in favor of the settlement agreement. Duke Energy’s Florida customers — victims would be a better word — will pay a whopping 64 percent, or $3.2 billion. Duke shareholders will pay just 20 percent, or $1 billion. The rest will be covered by an insurance policy.

This is a terrible precedent.

Trigaux and Floridians should be prepared for ever more “terrible” precedents.

Since Eisenhower’s speech in 1961 Florida has seen a government industrial complex with growing influence — economic, political, even spiritual — felt in every city, county and in Tallahassee. This greatest threat to one-man-one-vote and local control of government goes by many names: globalization, regionalism, sustainability and a new form of corporation called simply “B” Corp or “Benefit Corporation”.

According to the BenefitCorp.net website, “Certified B Corporations are leading a global movement to redefine success in business…Business, the most powerful man-made force on the planet, must create value for society, not just shareholders…Over 600 businesses have already joined our community, encouraging all companies to compete not just to be the best in the world, but to be the best for the world. As a result of our collective success, individuals and communities will enjoy greater economic opportunity, society will address its most challenging environmental problems, and more people will find fulfillment by bringing their whole selves to work.”

Esquire magazine is quoted on the B Corp website, “B Corps might turn out to be like civil rights for blacks or voting rights for women – eccentric, unpopular ideas that took hold and changed the world.” B Corps want to fundamentally change American business.

Nineteen states and the District of Columbia have passed Benefit Corporation legislation. There is a move to pass Benefit Corporation legislation in Florida. The model Benefit Corporation legislations states, “This chapter authorizes the organization of a form of business corporation that offers entrepreneurs and investors the option to build, and invest in, businesses that operate with a corporate purpose broader than maximizing shareholder value and a responsibility to consider the impact of its decisions on all stakeholders, not just shareholders. Enforcement of those duties comes not from governmental oversight, but rather from new provisions on transparency and accountability included in this chapter.”

This fundamental change has been embraced by the Florida Chamber of Commerce in the form or regionalization. In July 2012, Dale A. Brill, Ph.D., wrote on the Florida Chamber website, “Let’s get the bad news out of the way: Too many participants in the private and public economic development arena are missing the considerable opportunity represented by regionalism when they insist on going it alone—even when there is insufficient economic density to make a real difference despite the best of intentions.”

Brill notes, “Let’s start with three straight-forward explanations of regionalism that you already know to be true but may not recognize as one in the same: ‘There is strength in numbers.’ ‘The sum of the parts is greater than the whole.’ ‘I get by with a little help from my friends.’ … Regionalism’s genesis can be traced to the increasing role played by coordinated investments as catalysts for economic development.”

Brill uses Harvard professor Michael Porter’s definition of economic regions, “Economic regionalism exists where geographically contiguous regions coordinate economic development activities tied to a comprehensive economic development strategy. Economic regionalism focuses on the collaboration of organizations, governments, and businesses across multiple jurisdictions. These stakeholders work to manage the economic opportunities and constraints created by the geographic and social characteristics of a region.”

Regionalism, sustainability and “B” Corps are part of the idea of globalization. Everything feeds into a system that move power – economic, political, even spiritual – away from the city and county into regions that can have grave consequences that Florida is just experiencing with Duke Power – Florida.

Milton Friedman wrote, “Many people want the government to protect the consumer. A much more urgent problem is to protect the consumer from the government.” What we are seeing is the government and businesses working in concert to protect each other at the expense of consumers. The Duke Power – Florida is a case in point.

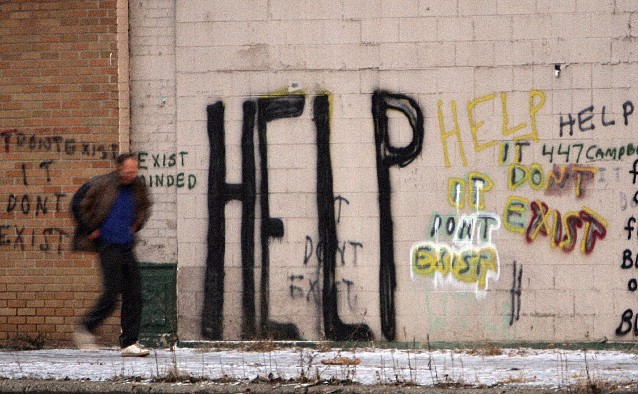

As Trigaux wrote, “There are a few voices expressing opposition. But they are faint and few…I fear for Florida.”

EDITORS NOTE:

Florida League of Cities in addition to individual municipalities, leagues and organizations of local community authorities have also endorsed the Earth Charter. ICLEI – The Local Governments for Sustainability endorsed the Earth Charter – Sustainable Development in the year 2000. The Florida League of Cities, which is a voluntary municipal league comprised of 404 of Florida’s 408 municipalities and six charter counties, endorsed the Earth Charter in 2001. In the same year, the Earth Charter was also endorsed by the US Conference of Mayors, the official nonpartisan organization of the nation’s 1,183 cities with populations over 30,000.

The National Association of Regional Councils (NARC) serves as the national voice for regionalism. NARC advocates for and provides services to its member councils of government and metropolitan planning organizations.

RELATED:

Benefit Corporations: The Demise of Free Enterprise

VIDEO: Florida Chamber of Commerce – The Importance of Regionalism to Florida’s Future

Regionalism and Fair Housing Enforcement

Walter Tejada Elected to National Association of Regional Councils to promote Regionalism

Joseph J. Dioguardi is a former member of Congress from New York and Certified Public Accountant. Dioguardi in his book “

Joseph J. Dioguardi is a former member of Congress from New York and Certified Public Accountant. Dioguardi in his book “

Why stop Seven50?

Why stop Seven50?