How did we become addicted to big government?

The growing national scandal surrounding the IRS targeting individuals and organizations with a certain political stand is endemic of big government. This large bureaucracy is fulfilling its role as the keeper of the big government keys. But how did America get to this point of a huge and intrusive government?

Social Security is perhaps the best example of how Americans become addicted to big government, especially tax giveaways and the enshrined systems that sustain them. America’s addiction to government control over its citizens has increased to the point that today many are dependent on federal handouts to maintain their health, happiness and well being.

Karl Marx said, “Religion is the opiate of the people.”

Today, “Big government is the opiate of the people.”

Let’s review a brief historical perspective on how America got here and then open up the much needed national discussion on the need for big government.

We the people began to embrace big government 104 years ago with the founding of the Intercollegiate Socialist Society (ISS) in New York City on September 12, 1905 in Peck’s Restaurant. An organizational meeting was held and Jack London was elected President with Upton Sinclair as First Vice President. The ISS was established to, “throw light [in America] on the world-wide movement of industrial democracy known as socialism.” Their motto was “production for use, not for profit.”

Production for use, not for profit is the prime goal of big government.

So how could socialists begin selling big government and its redistribution of wealth ideology? First they had to gain unfettered control of production. On February 3, 1913 Congress passed and the states ratified the Sixteenth Amendment to our Constitution. Congress grabbed control of production via the federal income tax. America taxed its productivity by tapping every American’s wages. With the millions, then billions, and now trillions of dollars that Congress collected, they could entice or even force the strongest American to take the big government drug.

Then on April 8, 1913 Congress passed and the states ratified the Seventeenth Amendment to the Constitution which transferred U.S. Senator Selection from each state’s legislature to popular election by the people of each state. These two events made it much easier to collect and distribute big government as now Senators were no longer loyal to their state legislatures or primarily concerned with state sovereignty. Now U.S. Senators, along with U.S. Representatives, saw the value of spreading the big government drug amongst the people in return for votes.

During the Great Depression Congress created the first “opiate for the masses” and named it Social Security. It was to be a social insurance program run by government, in other words guaranteed government largesse for life. The Social Security Act was signed into law in 1935 by President Franklin Roosevelt. He and Congress said this new drug would keep those unemployed, retirees and the poor financially secure. He called it the New Deal. All we needed to do was just pay in and all would be well.

In 1937 the United States Supreme Court in U.S. vs. Butler validated the Social Security Act and stated that, “Congress could, in its future discretion, spend that money [collected from the income tax] for whatever Congress then judged to be the general welfare of the country. The Court held that Congress has no constitutional power to earmark or segregate certain kinds of tax proceeds for certain purposes, whether the purposes be farm-price supports, foreign aid or social security payments.” All taxes went into the general fund.

Testifying before the Ways and Means Committee of the House of Representatives in 1952, the chief actuary of the Social Security Administration said—“The present trust fund is not quite large enough to pay off the benefits of existing beneficiaries”—those already on the receiving end, in other words. In 1955 chief actuary believed that it would take $35 billion just to pay the people “now receiving benefits”.

In 1935 under the Social Security program the Congress included the Aid to Families with Dependent Children Act (AFDC). During the late 1950s many states realized that this act, while created to help widows with children, was being used to subsidize women having children with men they were not married to. Louisiana alone took 23,000 women off the AFDC act rolls based upon their immoral behavior.

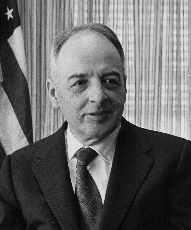

Arthur S. Flemming, Department of Health and Human Services under President Dwight David Eisenhower

In 1960 Arthur S. Flemming, then head of the Department of Health and Human Services under President Dwight David Eisenhower and a key architect of Social Security, issued an administrative ruling that states could not deny eligibility for income assistance through the AFDC act on the grounds that a home was “unsuitable” because the woman’s children were illegitimate. In 1968, the United States Supreme Court’s “Man-in-the-House” rule struck down the practice of states declaring a home unsuitable (i.e., an immoral environment) if there was a man in the house not married to the mother. Thus, out-of-wedlock births and cohabitation were legitimized. In very short order, the number of women on welfare tripled and child poverty climbed dramatically. The assault on the family was on and Congress and the Supreme Court were co-pushers of this new government largesse drug called AFDC.

In effect big federal government became the pimp, the homes of single mothers became the brothels and the fathers became the Johns. The children begotten by these women became the next generation of big government addicts. Just as a baby born to a mother doing crack is addicted to cocaine, so too are these children born with a lifetime addiction to the onerous and destructive drug – big government.

Then Congress added a new ingredient to the powerful Social Security drug called Medicare on July 30, 1965.

Congress created Medicare as a single-payer health care system. Medicare was for those over 65 years old and was signed into law by President Lyndon B. Johnson. President Johnson called it part of his Great Society program. Congress immediately got more addicts to begin taking this drug. At the same time Congress added a second even more powerful ingredient to this drug called Medicaid. This new ingredient brought into being an entirely new distribution system – all of the states of the union. Even though this new program violates state sovereignty it was passed anyway, in no small part because Senators were no longer accountable to the State Legislatures but rather committed to pushing government largesse.

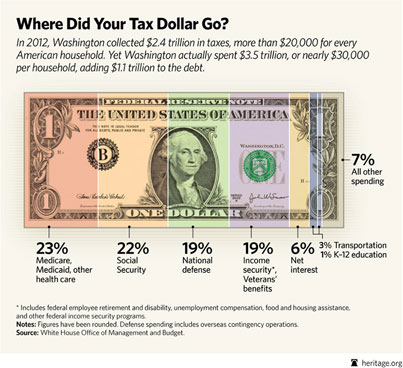

The states were now helping pay for and distribute this powerful and expensive big government designer drug. The drug was offered to low-income parents, children, seniors, and people with disabilities. Congress now had more people on the Social Security drug than ever before. Congress had turned a corner – addiction to government largesse was now imbedded in our society. But Congress was not finished for it kept looking for more clients until we now know that the estimated unfunded liabilities for these four drugs are:

• Social Security – $10.7 trillion

• Medicare Parts A and B – $68 trillion

• Medicare Part D – $17.2 trillion (created in just 3 years)

America’s addiction to big government will cost our children and grandchildren an estimated $95.9 trillion dollars. The gross domestic product of the entire world in 2007 was $61 trillion. Big government is the true opiate of the people. The following is a quote from a May 26, 1955 Herald-Tribune News Service article:

“Seven Amish bishops appealed to Congress today to exempt members of their church from receiving any benefits of the Social Security program. They are willing to continue paying Social Security taxes, however . . . . The bishops made it clear that no elder of the church would think, today, of applying for Social Security or any other government benefits. They want the law changed, they said, to ‘remove temptation’ from their children and grandchildren.”

The IRS scandal may be the straw that breaks the back of big government. It may even bring down the Sixteenth Amendment?