Are You Sick and Tired of Sending Your Tax Dollars to a Federal Government that Doesn’t Give Damn about You?

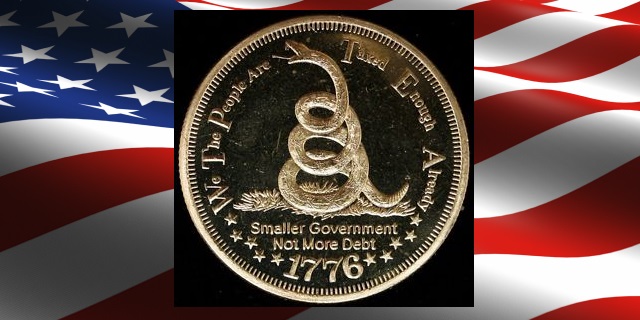

As we the tax paying citizens of America approach the 2024 tax season, we are witnessing a growing anger against the federal government.

Washington, D.C. doesn’t give a damn about you, they just want your money to spend on everything and anything that keeps them in power.

All three branches of government are wasting our money in different ways.

Big Government Writ Large

Let us look at a list of our top criticisms and recommendations of the Big Federal Government spending troika.

Truths and recommendations (a short list):

- They tax us more and more and then spend furiously on things that do nothing for the American citizen. BTW, when was the last time you saw a tax cut?

- The growing national debt, now reaching $34+ trillion. Printing money isn’t the answer, cutting government spending, except for mandatory items like Social Security, Medicare, and Medicaid, is.

- Spending more and more money to support illegal aliens, a.k.a. illegal migrants/drug cartel members/foreign terrorists/child traffickers/drug traffickers, who are coming across our borders by the thousand each and every week.

- Spending billions on foreign wars, with the exception of fully supporting the state of Israel. It’s time to defund foreign wars and use that money to build up our own prosperity.

- Buying foreign oil and natural gas when we have abundant amounts right under the ground and off the shores of America.

- Investing in private green companies that waste our tax dollars and then go broke.

- Bailing out students who took out federal government loans to go to college or university. What are we teaching our children about taking responsibility for their own debts? We need to return student loans back to the private sector.

- Using our tax dollars to fund foreign entities, e.g. the PLO, and even terrorists organizations, like Hamas, via our monetary support of the United Nations and U.N.R.W.A.

- Funding federal department that are unconstitutional, e.g. the Department of Education.

- Stop over paying our federal elected officials, their staff, appointed members of the various departments and their staffs and the growing numbers of federal employees, e.g. the IRS armed agents. Cut the pay at every level.

- Wasting our tax payer dollars to attack we the people, via a two-tiered and militarized justice system, that seeks to destroy our Constutional Republican form of government.

- Finally, making us taxpayer fund a bloated Executive Branch, Congressional and Supreme Court staff. Cut each branch in half and you will see half the damage done to we the people.

The Bottom Line

Many today are addicted to a bloated, corrupt, and wasteful big government.

It’s past time to cut government and with it government spending.

Time to implement the Fair Tax and get rid of the federal income tax.

We live in the free state of Florida. Florida gets its income from a state 6% sales tax. Florida has a multi-billion dollar surplus.

Get the idea?

Time to defund, defang and damn the federal government to hell.

©2024. Dr. Rich Swier. All rights reserved.

RELATED VIDEO: CBS POLL: More Than Half Of Americans Say Prices Will Keep Going Up If Biden Is Re-Elected

POST ON X: Here is how big government is working to stay in power.

BREAKING: AG Garland announces that the Biden DOJ is working to end voter ID laws

Why? Because asking for an ID is racistpic.twitter.com/5yOPFGucQn

— End Wokeness (@EndWokeness) March 3, 2024

How can low income persons have high marginal rates? For example, it is not uncommon for married couples earning $30,000 per year with two children to face high marginal tax rates. Given the level of their federal marginal tax bracket, and their loss of the Earned Income Tax Credit from earning extra income and their exposure to marginal Social Security/Medicare taxation, their current total marginal effective tax on earning an extra dollar can be over 35 percent, and possibly over 45 percent.

How can low income persons have high marginal rates? For example, it is not uncommon for married couples earning $30,000 per year with two children to face high marginal tax rates. Given the level of their federal marginal tax bracket, and their loss of the Earned Income Tax Credit from earning extra income and their exposure to marginal Social Security/Medicare taxation, their current total marginal effective tax on earning an extra dollar can be over 35 percent, and possibly over 45 percent. Karen Walby, Ph.D. is the Director of Research for Americans For Fair Taxation.

Karen Walby, Ph.D. is the Director of Research for Americans For Fair Taxation.

For 238 years, historians have analyzed the lives, motivations and contributions of these 56 patriots.

For 238 years, historians have analyzed the lives, motivations and contributions of these 56 patriots.