An Open Letter To Ways And Means

Welcome back to Washington and Happy New Year

As you return to the business of the House Committee on Ways and Means, you and your colleagues will, in many ways, determine the direction of our nation by the decisions you will soon make on fundamental tax reform.

You have a clear and distinct choice to make. You can continue to pander to the special interests that will forever hold you hostage to their gluttonous demands, or you can break from this insidious cycle and fully represent the will of the people who elected you.

If you choose to continue in the bondage of special interest slavery, the demands they exact will rise to levels that even you cannot imagine. Once the fatted calf becomes addicted to the feed trough, its’ appetite becomes insatiable.

Contrast this to the people who elected you who simply want to pay their fair share of taxes without the fear and intimidation of an agency that continues to be used as a political weapon.

Even the IRS’s own watchdog, Nina Olson, stated in her just published annual report, “Public trust in [IRS] fairness and impartiality was called into question because of reports the IRS subjected certain applicants for tax exempt status to greater review based on political-sounding games.”

Sadly, Olson’s only remedy is an IRS generated U.S. taxpayer Bill of Rights. By the way, didn’t you already try this in 1988 when Congress passed the first of three Taxpayer Bill of Rights?

To Olson’s suggestion, ladies and gentlemen, isn’t this a little like the fox guarding the hen house; just like the U.S. Justice Department appointing Barbara Bosserman to lead the IRS targeting investigation?

Silly me, I am sure any individual who shelled out over $6,000 in donations to the Obama campaign will show total impartiality during a criminal probe involving conservative organizations.

The bottom line is this – the American people want a simple and fair system of taxation without all the drama, theatrics and corruption. They want the fox to leave the hen house and they want their representatives to put a stop to the longstanding reign of terror by the IRS.

The FairTax® Plan does this and more.

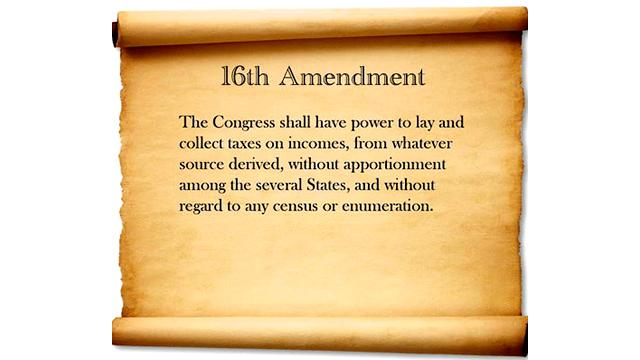

Reduced to its most basic terms, the FairTax eliminates taxes on wages while taxing wealth and borrowing when spent. It eliminates the income/payroll tax system and replaces it with a single rate tax on consumption.

More importantly, it is fair, simple and universal in application – no exceptions, no exclusions, and no more special interests feeding at the trough. And, it fosters economic growth and efficiency while fully funding the government.

You will soon have a decision to make on fundamental tax reform.

Option 1: You tinker with the current system, call it major reform and continue in the bondage of special interests. With this option the American people continue as the losers.

Option 2: You represent the will of the people who elected you and enact HR 25, The FairTax Act, freeing them from the bondage of an out-of-control IRS and a gobbledygook tax code that is fast approaching 100,000 pages. With this option, the American people have a fair and simple tax code that also eliminates the yearly tax return nightmare that has already begun.

Which decision will you make? Perhaps you can draw inspiration from General Robert E. Lee who once said, “You have only always to do what is right. It will become easier by practice, and you enjoy in the midst of your trials the pleasure of an approving conscience.”

Your electorate awaits your decision. Remember, they too have decisions to make in November 2014.

New Zealander Trevor Loudon, the author of

New Zealander Trevor Loudon, the author of