If you remember the famous 1938 fight for the world heavyweight boxing title between Detroit’s Joe Louis and Germany’s Max Schmeling, you’ve been around awhile. If you don’t, there’s a good chance you’ve heard about it from your father or grandfather. It was a rematch that Louis, known as the “Brown Bomber,” won in just 124 seconds.

Joe Louis was a hero not only for who and what he fought and beat but also for maintaining his integrity along the way. He dealt personally with poverty and racism. He overcame a speech impediment and the loss of his father at an early age. He took on the best boxers of his day. He battled the Nazis. He crossed swords with the Internal Revenue Service. When he died at age 66 in 1981, he was widely revered as a champion of character and was beloved by good people of every color.

The grandson of slaves, Joe Louis Barrow was born in 1914 in Lafayette, Alabama. He barely spoke until he was in the second grade. At age 12, he moved with his mother, his stepdad, and his seven siblings to Detroit after a scare from the Ku Klux Klan. To his credit, Joe never viewed the racism of a few as indicative of the many. He judged men and women the way he wanted them to judge him: namely, by what Martin Luther King would call “the content of their character.” In spite of his mother’s desire that he pursue either cabinetmaking or the violin, he showed an early penchant for pugilism. He dropped “Barrow” and became simply “Joe Louis” when he started competing in the ring as a teenager, apparently because he didn’t want his mom to know he was boxing. She soon found out, as did the rest of the world.

Louis judged men and women the way he wanted them to judge him.

The Great Depression was in full swing when Louis fought the first big match of his amateur career in 1932. He lost to a future Olympian. Undaunted, he went on to win all but 3 of his next 53 fights (43 were knockouts) and caught the attention of boxing promoters. He went pro in 1934.

One of the most famous dates in boxing history is June 22, 1937. That’s when Louis went up against heavyweight titleholder James Braddock, knocking him out in the eighth round. Americans black and white stayed up all night across the country in celebration, but the joy was especially high in black communities. Here’s how author Langston Hughes described it:

Each time Joe Louis won a fight in those depression years, even before he became champion, thousands of black Americans on relief or W.P.A. and poor, would throng out into the streets all across the land to march and cheer and yell and cry because of Joe’s one-man triumphs. No one else in the United States has ever had such an effect on Negro emotions — or on mine. I marched and cheered and yelled and cried, too.

Of 72 professional fights, Louis scored 57 knockouts and lost only three matches. For 12 years (1937–1949), he held the heavyweight championship. It was the longest stretch of winning titles in the sport’s history. His closely watched 1938 defeat of Max Schmeling embarrassed the Third Reich because it said to the world, “This Aryan superiority thing is nothing more than propaganda.”

A month after Pearl Harbor, Louis enlisted in the US Army and went off for basic training to a segregated cavalry unit at Fort Riley, Kansas. The army used him to cheer up the troops by sending him some 20,000 miles for 96 boxing matches in front of two million soldiers. He was eventually given the Legion of Merit for his “incalculable contribution to the general morale.” It was in the army that he befriended Jackie Robinson, the future major league baseball player. Louis persuaded a commanding officer to drop charges against Robinson for punching out a fellow soldier who called him the N-word.

Nobody who ever really knew Joe Louis, it seems, had an unkind word for him. Perhaps the worst ever said was actually spoken in jest, by fellow boxer Max Baer: “I define fear as standing across the ring from Joe Louis and knowing he wants to go home early.”

A very different fight that Louis waged is less well known than his boxing. It was with the Internal Revenue Service. As we do in our day, Louis had to contend in his with a president whose fingers itched to get into the pockets of wealthy Americans. I first learned of this story from historian Burton Folsom, author of the superb book New Deal or Raw Deal?

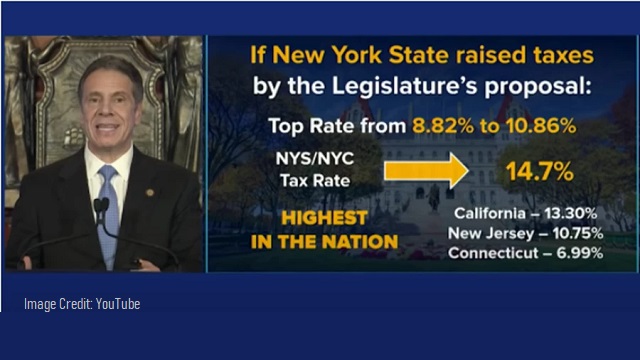

In 1935, President Roosevelt pushed Congress to raise the top income tax rate to 79 percent, then later to 90 percent during and after World War II. In the war years, Joe Louis donated money to military charities, but the complicated tax laws wouldn’t allow him to deduct those gifts. Although Louis saw almost none of the money he won in charity fights, the IRS credited the full amounts as taxable income paid to Louis. He had even voluntarily paid back to the city of Detroit all the money he and his family had received in welfare years before, but that counted for nothing with the feds.

Louis retired as heavyweight champion in 1949, but his tax debt was approaching $500,000. After an IRS ruling in 1950, the debt began accumulating interest each year. Louis felt compelled to come out of retirement in 1950 to fight Ezzard Charles, the new champion. After the fight, his mother begged him to stop but, he said, “she couldn’t understand how much money I owed…. The government wanted their money, and I had to try to get it to them.”

The next year, Louis fought Rocky Marciano and lost. The fight earned him $300,000. With a 90 percent tax rate on high incomes, what he had left was peanuts, but he gave it all to the government. When his mother died in 1953, the IRS swiped the $667 she left him in her will. With interest compounding, his debt by 1960 had soared to more than $1 million.

According to Folsom, “Louis refereed wrestling matches, made guest appearances on quiz shows and served as a greeter at Caesar’s Palace in Las Vegas — anything to bring in money” for the IRS.

The notorious mobster Frank Lucas (still living today at 85) was so disgusted with the IRS’s treatment of Louis that he once paid a $50,000 tax lien against the boxer. Even Max Schmeling came to the rescue, assisting with money when Louis was alive and then paying funeral expenses when the boxer died in 1981.

You may not think of Louis in connection with the game of golf, but he made an impact there as well. Golf was his longtime, personal hobby. In 1952, he became the first black American to play at a PGA Tour event. Just as Jackie Robinson broke the color barrier in baseball, Joe Louis broke it in golf. He cofounded The First Tee, a charity that introduces golf to underprivileged children. Today, his 68-year-old son, Joe Louis Barrow Jr., is the organization’s CEO.

Joe Louis, a decorated army veteran and world-class athlete, remained a symbol of black achievement in spite of his tax troubles, which finally came to an end when the IRS settled and the US government — to which he had given so much — finally got off his back.

When Louis died, President Reagan waived the rules to allow him to be buried in Arlington National Cemetery with full military honors. He was a man who fought on many fronts and emerged as a great example every time.

For further information, see: