Bidenomics Inflate-and-Spend Policies Are Penny Bad, Pound Foolish

Under a metal standard, inflation is caused by bad pennies. Under the Biden standard, inflation is a bad penny, in that it keeps turning up. In fact, nearly two years after inflation peaked in the summer of 2022, the Bureau of Labor Statistics (BLS) reported Wednesday that inflation is still chugging along at nearly twice the Federal Reserve’s target rate. Not only does the Biden administration not understand inflation’s cumulative burden on workers and families, they don’t seem to understand the economic phenomenon at all.

According to BLS, the Consumer Price Index (CPI) increased 0.4% in March and the same percentage in February, for a 12-month increase of 3.5%. Excluding the volatile categories of food and energy, core inflation rose 0.4% in March, matching February and January, and rose 3.8% over the past 12 months. Costs continue to rise across the economy, from gasoline (1.7%) to transportation services (1.5%) to electricity (0.9%) to apparel (0.7%) to medical care services (0.6%). For families who already feel like they’re carrying an armload of bricks, March’s report just placed one more brick on top.

The government has two ways to respond to inflation. One way is monetary policy, primarily controlled by the Federal Reserve raising interest rates to combat inflation and lowering them to combat recessions. The other way is fiscal policy, or how much money the federal government collects and expends.

As Federal Reserve Chair Jerome Powell has “repeatedly insisted,” the Fed wants to keep price inflation at 2% annually — at least they do on paper. But economist Marc Goldwein observed that, “at our current pace, we’ll have 4%-4.5% inflation.” A third grader could explain that four is twice as much as two.

Despite its professed commitment to 2% inflation, the Federal Reserve has been reluctant to raise interest rates at all, and it has only done so slowly and gradually. The Fed was recently contemplating cuts to the interest rate as early as June, even though inflation had not yet returned to its 2% target.

Indeed, considering who first proclaimed the emperor’s nakedness, perhaps the Federal Reserve Board could learn wisdom from a third grader’s simplicity. “The CPI rebound is one more data point that the Fed’s monetary policy isn’t as tight as it claims,” argued The Wall Street Journal (WSJ). “Three months is more than a blip in the data.”

While the March inflation report wasn’t good, at least it may have forced the Fed to respond seriously. The WSJ suggested the ongoing prices hikes are “depriving [the Fed] of a credible justification for cutting rates.” An asset management strategist predicted to CNBC that “there is likely sufficient caution within the Fed … that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making.”

Speaking of the election, that decision point could be far more impactful to the other inflation-control level, fiscal policy. Voters have virtually no say over who runs the Federal Reserve, but they are directly responsible for choosing members of Congress and the occupant of the White House — those figures responsible for setting the nation’s fiscal policy.

Thus far, the vast majority of Americans are deeply frustrated about the cost of living. A recent WSJ poll of seven swing states found that 74% of voters thought inflation had moved in the wrong direction over the past year.

The White House has argued that “the only problem in the economy is consumer psychology,” noted the WSJ. “But if voters are downbeat about the economy, persistent inflation is a good reason. Price increases across the Biden Presidency are unlike anything Americans have seen in recent decades. They have been a particular shock for low-income and younger workers who haven’t accumulated a wealth cushion in the stock market or housing values.”

“It is not ‘the rich’ who are suffering in this economy; it’s everyone else,” declared National Review’s Charlie Cooke. “Grocery prices are up by more than 30 percent since 2020. The costs of new mortgages have skyrocketed, as have the costs of financing, insuring, and repairing a car.” Meanwhile, real average hourly wages are down 2.54% since January 2021, according to the WSJ.

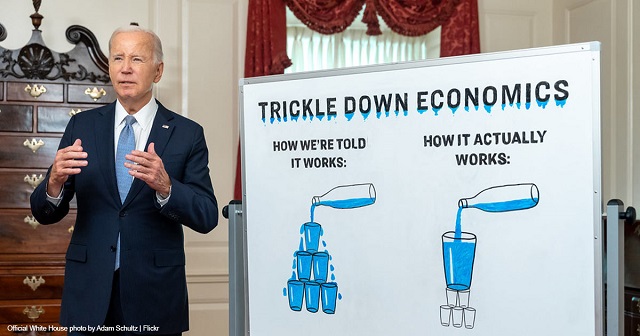

The connection between the government’s disgraceful conduct and the disastrous consequences for average Americans is no secret. Inflation always occurs when there is too much money and not enough to spend it on. When the federal government runs a deficit, it effectively dumps extra money into circulation (even if the debt must be paid back later). When the federal government runs an obscenely large deficit, it can spark an inflationary cycle. That is exactly what happened when Congress went on a spending spree during COVID — a spree which has never stopped.

“The problem is the federal government ran a $2 trillion deficit last year, is set to run a similarly large deficit this year, and if Biden gets what he wants, it will run a $1.8 trillion deficit next year,” noted economic analyst Dominic Pino. The U.S. government is currently running a deficit equivalent to about 7% of national GDP — far more than other countries — without either a war or a recession to justify it,” Pino complained. “One really big thing that could help prevent these ugly situations is for the federal government to stop spending so much money that it doesn’t have.”

As a result of Washington’s reckless debt guzzling, “the Fed alone won’t be able to cure our sustained inflation,” argued National Review’s Veronique De Rugy. Extinguishing this inflationary blaze will take two committed parties who are hooked up to a hydrant. The Fed’s firehose cannot put out the fire until Congress and the president put down the flamethrower.

President Joe Biden paid lip service to this responsibility on Wednesday when he reacted to the BLS report with the claim, “Fighting inflation remains my top economic priority.”

“Who is he kidding?” retorted the WSJ editors. “His real priority is to keep the government and consumer spending spigot wide open with subsidies galore for electronic vehicles, student-loan write-offs and social welfare. His other main priority is using regulation to put government in control of more of the economy. None of this restrains prices.”

Biden attempted to preempt the obvious rebuttal. “I have a plan to lower costs for housing — by building and renovating more than two million homes — and I’m calling on corporations including grocery retailers to use record profits to reduce prices,” he declared. “My agenda is lowering costs for prescription drugs, health care, student debt, and hidden junk fees.”

Fear not, troubled householder! Lord Biden has heard your cries for price relief and has demonstrated his unparalleled knowledge of economics by demanding that prices be lower. Gape awestruck at his superior insight and bend a thankful knee.

Pino skewered “any sector-specific efforts to fight inflation” as “a game of economic Whack-a-Mole.” Since the fundamental “problem is too much money chasing too few goods,” he explained, “if you scare some of the money away from one category of goods, it will scurry to another category.” Thus, he predicted that “inflation will likely show up in seemingly random places” from month to month.

There are two methods to make a large float lie on the bottom of a pool. The first method is to simultaneously press down on every inch as it tries to rise to the surface. The second method is to drain the pool. Biden is not only trying the first method, but is also continuing to fill the pool.

A clever reader may object that Congress has at least as much control over fiscal policy as the president, as Congress is the organ of government responsible for raising the debt limit, authorizing spending, passing a budget (or, in lieu of a budget, a pork omnibus), and passing any other spending bills. Under normal circumstances — and under the Constitution — I would agree.

It’s true that Congress has failed — and has been failing — at its stewardship of taxpayer dollars (or, more accurately, the dollars future taxpayers have not yet earned).

However, it’s also true that Biden keeps trying to incur other costs not authorized by Congress. President Biden on Friday announced new plans to cancel student loans, something the Supreme Court already ruled he lacked the authority to do. In a lawsuit filed Monday that challenges Biden’s new student loan forgiveness scheme, seven state attorneys general argued the plan — which would cost $475 billion across 10 years — “is only the most recent instance in a long but troubling pattern of the President relying on innocuous language from decades-old statutes to impose drastic, costly policy changes on the American people without their consent.”

In exchange, Biden offered to target junk fees and build some houses. (By the time the federal government finishes “building and renovating more than 2 million homes” at the speed of a sloth in syrup, they’ll likely have to admit those units are barely sufficient to house the more than 2.3 million migrants who have illegally entered the country under Biden’s watch.) But forget about Biden lobbing inflation grenades into a crowded concourse; concentrate instead on how he personally supplied every member of the crowd with rubber gloves to shield themselves.

In November, the public will get their first direct opportunity to grade Biden’s performance as the nation’s chief executive, as well as the disgraceful conduct of other government officials who pretend to be in charge of fiscal policy. How will they rate them? “Americans, history shows us, will forgive a president who is obliged to fight inflation with higher interest rates,” Cooke granted, “unless, of course, he is the same president who is blamed for the inflation in the first place.”

Monetary policy and fiscal policy work like tongs. Between them, they can take hold of inflation — so long as both prongs contract. Getting inflation under control requires draining off all the excess money through higher interest rates — and then not adding more through deficit spending. But this plan would require a measure of fiscal discipline not seen in Washington — or the Fed — for decades.

Judging by the history of other nations, governments who embark on a debt-fueled vote-buying binge rarely restrain themselves until they crash off a fiscal cliff. Will American voters force our elected officials to be wiser?

We may learn the answer in November. For now, the Biden administration’s plan to combat inflation is to place trash cans under every drip from the ceiling, but never fix the leaky roof.

AUTHOR

Joshua Arnold

Joshua Arnold is a senior writer at The Washington Stand.

RELATED ARTICLE: GOP Senator Demands Biden Admin Review Chinese Communist-Linked Firm Planning Midwest Factory

EDITORS NOTE: This Washington Stand column is republished with permission. All rights reserved. ©2024 Family Research Council.

The Washington Stand is Family Research Council’s outlet for news and commentary from a biblical worldview. The Washington Stand is based in Washington, D.C. and is published by FRC, whose mission is to advance faith, family, and freedom in public policy and the culture from a biblical worldview. We invite you to stand with us by partnering with FRC.