Advice to Young, Unemployed Workers by Jeffrey A. Tucker

We are now in the fifth year of very choppy hiring markets for young workers. The latest unemployment numbers once again leave them out from posted gains. Not even the boom in temporary employment included them.

The United States has one of the highest rates of unemployment among 20-to-26-year-olds in the world. Nearly half of the U.S. army of unemployed is under the age of 34. As for those who are hired, there is a huge gap between wage expectations and paycheck realities, which is exactly what you would expect in a post-boom world. A survey by Accenture finds that more than 41 percent of recent U.S. college graduates are disillusioned, underemployed, and not using their college degrees in their work.

The young generation faces challenges unlike any that most people alive have seen. This situation requires new adaptive strategies.

What follows, then, is my letter of advice to young workers.

Dear Young Workers:

Even if it weren’t for the economic stagnation, you would already be facing a tough market. That’s because you are showing up at the job marketplace nearly empty-handed. Our society long ago decided it was better for you to sit in desks for 16 years than to gain any real work experience in the marketplace that is likely to hire you later.

Even if it were legal for you to work when you are capable of doing so—from the age of maybe 12 or 13—the government has imposed these wage-floor laws that price your services out of the market. Then you are told that if you stay in school, you will get a great, high-paying job right out of college. Then it turns out that employers aren’t interested in you. You are beginning to sense that employers think you have few marketable skills and have no demonstrated predisposition to produce.

Here’s the root of the problem: People have been lying to you all your life.

As a young child you were repeatedly fed slogans about the equality of everyone. The urges to compete and win were suppressed in your childhood games, while sharing and caring for others were exalted above all other values.

Then at some point—somewhere between the ages of 7 and 10—something changed. All that caring/sharing stuff ended and a world of dog-eat-dog began. You were expected to get perfect grades, to excel at math and science, to be perfectly obedient, to stay in school for as long as possible. You were told that if you did that, everything would work out for you.

It does work out for some. But only a small minority of people are disposed to both compliance and rote learning. And even for those people, not everyone gets what he’s been promised. As for the rest, there is no plan in place. Those who fall through the cracks are expected to make it on their own somehow.

How do you make it? It all comes down to remunerative work. And there’s the barrier you face right now. You have the desire and you are looking for some institution that values what you have to contribute. But you can’t find the match.

Consider: Why does any business hire an employee? It happens based on the belief that the business will make more money with the employee than without it. The business pays you, you do work, and, as a result, there are greater returns coming in than there would otherwise be.

But think through what this means. It means you have to add more value than you take out. For every dollar you earn, you have to make it possible for the business to earn a dollar plus something extra. This task is not easy. Businesses have costs to cover in addition to your salary. For example, government mandates that businesses be insured. You have to be trained. There could be healthcare costs, too. There are uncertainties to deal with. All of these add to the burden that you place on the business, which adds to the costs of hiring you.

What this means is you have to be more valuable than you think. Why are minimum wage jobs so hard? Because it’s difficult for an inexperienced worker to be worth paying that much. The employer has to extract as much value as possible from the relationship with you just to make that relationship happen at all. That can’t happen right away because odds are you are losing the company money in the first months of employment simply because you are untrained. You end up scrambling like crazy just to earn your keep.

If you already understand this rule—that you must add more value than you take out—you now know more than vast numbers of young workers. And this gives you an advantage. While everyone else is grumbling about the workload and low pay, you can know why you are having to hustle so much and be happier for it. You are producing more for the company than you take out. Doing that consistently is the way to get ahead. In fact, it’s the key to life.

But in order to get ahead, you have to be a player in the first place. It does little good to sit around and wait for the right job at the right pay. Forget all your expectations. If something, anything, comes along, you should jump on it immediately. No job is too menial, despite what you have been told. The goal is just to get in the game. Yes, you have much higher salary expectations, and those might be met someday. But not yet.

The first step is to get into the game at some wage, just something, somewhere. The fear that such work, whatever it is, is somehow beneath you is a serious source of personal undoing. Those who are willing to perform the most “menial” of jobs are the people who can make a good life for themselves. Just because you perceive the job as “menial” does not mean it is not valuable to others and especially, ultimately, to you.

You learn from every job you have. You learn how to interact with others, how a business runs, how people think, how bosses think, and how those who succeed get ahead versus those who fail. Working is a time for learning, as much as or more than school.

People’s number-one fear is that their job will somehow define their lives. Hence, they conclude that a job stocking shelves at Walmart will redefine or dumb down who they are. This notion is absolutely untrue. That job is a brick in your foundation.

In order to get any job, you have to do more than drop off a resume or file one online. You have to emerge from the pack. That means that you have to sell yourself like a commodity. You have to market yourself (and marketing is the least-appreciated and yet most-crucial feature of all commercial acts). That is not degrading; it is an opportunity. Find out everything you can about the company and its products. After you apply, you need to go back and back, meet the managers, meet the owners, all with the goal of showing them how much value you will add to their enterprise.

In this new job, success is not hard, but it requires discipline. Just follow a few simple rules. Never be late. Do first whatever your immediate supervisor tells you to do. Do it much more quickly and thoroughly than he or she expects. When that is done, do some unexpected things that add value to the environment. Never complain. Never gossip. Never partake in office politics. Be a model employee. That’s the path toward thriving.

It’s not just about adding value to the company. It’s about adding value to yourself. The digital age has given us all amazing tools for accumulating personal capital. Get a LinkedIn account and attach your job to your personal identity. Start putting together that essential network. This network is something that will grow throughout your life, starting now and lasting until the end. It could be the most valuable commodity you have outside your own character and skills. Take possession of your work experience and make it your own.

While doing all this excellent work, you need to be thinking about two possible paths forward, each of them equally viable: advance within this one firm or move to another firm. You should go with whichever is to your best advantage. Never stop looking for your next job. This is true now and always throughout your life.

A huge mistake people make is to embed themselves emotionally in one institution. The law encourages this attitude by tying all sorts of advantages to the status-quo job you currently hold. You get health benefits, time off, scheduled raises, and it is always easier to stick with what you know. To do so is a mistake. Progress comes through disruption, and sometimes you have to disrupt yourself to make that progress happen.

To be willing to forgo the security of one job for the uncertainty of another gives you an edge. Average people around you will sacrifice every principle and every truth for the sake of security. People, with very few exceptions, fear the uncertainty of an unknown future more than the seeming security of a known status quo. They will give up every right and every bit of their souls for the promise of security (whether it be through a paycheck or an armed police officer), even to the point of personal misery or obeying a wicked despot (whether it be a boss or a dictator). You can break free of this tendency, but it takes courage, risk-taking, and a conscious act of defying convention.

You should always think of yourself as a productive unit that is always on the job market. You can go from institution to institution, always upgrading your skills and hence your wages. Never be afraid to try something new or to plunge into a new work environment.

Clever finance management here is crucial. Never live at the level that matches your income. Your standard of living, instead, should match your next-best employment opportunity, the one you have forgone or the one you might take next. If you stick with this practice—and it requires discipline—you will be free to choose where you work and to take greater risks. You will also develop a cushion should something go wrong.

At the same time, there could be advantages to sticking around one place, even as everyone else around you is moving from here to there. Even if that happens, you should still think of yourself as being on the market. You are governing yourself. Don’t let yourself be beholden to anyone, but understand also that no one owes you a living. That’s the only way to make clear judgments about your career path.

At every job, you are going to learn so much about human ethics, psychology, emotions, and behavior. Most of what you will learn will be enlightening and encouraging. Some of it, however, is not pretty and might come as a shock.

First, you will discover that people in general are extremely reluctant to admit error. People will defend an opinion or an action until the end, even if every bit of logic and evidence runs contrary. Sincere apologies and genuine admissions of error and wrongdoing are the rarest things in this world. There is no point at all in demanding apologies or in becoming resentful when they fail to appear. Just move on. Neither should you expect to always be rewarded for being right. On the contrary, people will often resent you and try to take you down.

How do you deal with this problem? Don’t get frustrated. Don’t seek justice. Accept the reality for what it is. If a job isn’t working out, move on. If you get fired, don’t seek vengeance. Anger and resentment accomplish absolutely nothing. Keep your eye on the goal of personal and professional advancement, and think of anything that interrupts your path as a diversion and a distraction.

Second, we all want to believe that doing a great job and becoming excellent at something will lead to personal reward. This is not always or even often true. Excellence makes you a target of envy from those around you who have failed by comparison. Excellence can often harm your prospects for success. Meritocracy exists, and even prevails, but it is realized through your own initiative, and it is never just granted freely by some individual or institution. All personal and social progress comes about because you alone push through the attempts of everyone around you to stop it.

Third, people tend to possess a status-quo bias and prefer to follow orders and instructions; most people cannot imagine how the world around them might be different through initiative and change. If you can train yourself to imagine a world that doesn’t yet exist—to exercise the use of imagination and creativity in a commercial framework—you can become the most valuable person around. You might be among those who can be real entrepreneurs. You might even change the world.

As you develop and use these talents, and as they become ever more valuable to those around you, remember that you are not infallible. The commercial marketplace punishes pride and arrogance and it rewards humility and the teachable spirit. Be happy for your successes, but never stop learning. There is always more to know because the world is ever-changing, and none of us can know all things. The key to thriving in this life is to be prepared to not only change with it but to get in front of the change and drive it.

From where you are now, unemployed with few seeming prospects, your future might look hopeless. This perception is not true. There are barriers, to be sure, but they are there to be overcome by you and you alone. The world does not work like you were told it works when you were a kid. Deal with it and start engaging the reality around you right now just as it is, using intelligence, cunning, and charm. You are the decision-maker, and whether you succeed or fail ultimately depends on the decisions you make.

In many ways, you are a victim of a system that has conspired against you. But you get nowhere by acting like a victim. You don’t need to be a victim. You have free will and the capacity for self-governance; indeed, you possess the human right to choose. Today is the day to start exercising it.

Find a Portuguese translation of this article here.

ABOUT JEFFREY A. TUCKER

ABOUT JEFFREY A. TUCKER

Jeffrey Tucker is a distinguished fellow at FEE, CEO of the startup Liberty.me, and publisher at Laissez Faire Books. He will be speaking at the FEE summer seminar “Making Innovation Possible: The Role of Economics in Scientific Progress.”

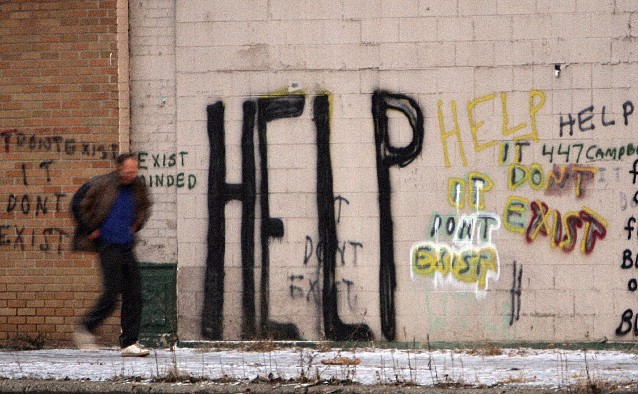

EDITORS NOTE: The featured photo is courtesy of FEE and Shutterstock.