Donald J. Trump versus the Ideology of Soviet Fascism

History is the Mother of all sciences. I have been writing about Soviet/Russian subversive activities and interference in our elections for many years, while others have slept under the illusion of the USSR’s collapse. Therefore don’t let the title of this article surprise you. I am a former Soviet attorney who has written on the subject of Soviet Socialism, which I called Soviet Fascism for twenty years, published three books and written over 50 articles on the topic. You haven’t heard of me because our Intelligence Agencies didn’t want to aggravate the situation vis-à-vis Russia and blocked the information about my books and articles. Our government hasn’t responded properly to Soviet Fascism and as a result the world is shocked by revelations of criminal activities by the Russian/KGB government today. I said it twenty years ago and I repeat it today, Wake up America!

A few days before the Democrat Party Convention, I published an article about Hillary’s collaborations with Russian President Putin that continued during her entire tenure as Secretary of State of America. Please read it to learn the ‘real’ agenda of the Democrat leadership. Yes, it was an alliance of the Democrat leadership with the Russian/KGB government to the detriment of our country. Read my latest book Socialist Lies to become acquainted with the Obama/Putin joint venture to see how it sabotaged American interests around the globe for years. Obama and Hillary deserve each other—as they implement their promised transformation of America, they have become stealth enemies of Reagan’s America the Beautiful.

In fact, we see a purposely organized actions to transform America’s Capitalist, market-based economy to Soviet-style socialism. The rising level of political corruption, lawless tricks and violence to prevent Trump’s presidency resembles Stalin’s Russia. Consider the words of a person, who is not a supporter of Trump: What I See Happening In a Trump Presidency, By Bill Bennett: “They will kill him before they let him be president. It could be a Republican or a Democrat that instigates the shutting up of Trump. Don’t be surprised if Trump has an accident. Some people are getting very nervous: Barack Obama, Valerie Jarrett, Eric Holder, Hillary Clinton and Jon Corzine, to name just a few…” Bill Bennet is right, he is identifying the ideology of Soviet Fascism and the Clinton Mafia that I have been warning you about in all my books. Violence? YES! Consider the three Democrat staffers associated with DNC that were murdered in the run up to the opening of the Democrat Convention to cover up the truth…

I see more and more the practices of Soviet Fascism in America. Look at the key topics of discussion in the current presidential campaign–they are crucial to our very existence. Do you know that all of them derived from the same source? For instance, Trump’s recent statement, identifying Obama and Clinton as the co- founders of ISIS deserves more attention, because Trump is wrong only in numbers. There are three co-founders of ISIS—the third one is the Kremlin. Knowledge of Russia is dismal in the contemporary America, we have been dragged into WW III and we flail away at an enemy we can’t clearly recognize.

These circumstances force me to present my opinion on the subject.

Yes, history is the Mother of all sciences. My knowledge of the Soviet history is pretty solid—I lived through it and I’ll discuss the recent events involved in the presidential campaign using this knowledge:

- American economy is shackled—our GDP is 1.2 per cent. Political Correctness and its inventor—Stalin’s war against capitalism

- Terrorism, ISIS, the Muslim Brotherhood—Stalin’s teaching.

- The Clinton Foundation—an appendix of the Soviet Mafia in America.

- Fifty GOP analysts are against Trump and CENTCOM manufacturing data.

- The American economy has been shackled for the last several decades because the Socialist system advocated and incrementally implemented by the Democrat Party isn’t productive—it is a fraud invented by Stalin. Please, read Socialist Lies: From Stalin to Clintons, Obamas, and Sanders. The key point in the book is Stalin’s invention of the Socialist machinery including Political Correctness. The Socialist machinery is a continuation of Marx’s fraud, quadrupled by Stalin. Being the first Soviet leader who “designed” the state of the Soviet Socialist machinery, Stalin created ever more fraud, deceits, and lies delivering to the people a never ending process (struggle) instead of the promised result.

Stalin designed his model of socialism by substituting the result with the process. To do so, he used two key Marxist concepts: promises and an indefinite time span to fulfill the promises. The deception mechanism started there. Using time, while promising “a bright future,” private property was confiscated and nationalized throughout Russia. Stalin was the first leader in the world who had successfully transformed the Russian social strata and built a new socialist economic system–a strictly regulated centralized system, served by the army of a huge bureaucracy, subordinated to him.

Hence, the birth place of Soviet Fascism is Russia, and the author and architect is Joseph Stalin. Do you not recognize those elements being implemented here? Tens of thousands of regulations on our economy, placed there by a huge federal bureaucracy! Hence the knowledge of the Soviet history and the activities of the Soviet Academy of Science under the KGB auspices is crucial for every politician and mandatory for those dealing with the domestic and foreign policy today.

To cover up his fraud, Stalin invented a method of manipulating the human mind—Political Correctness. Stalin had an incredible ability to mislead, lie, and defraud, he was so skillful at the politics of fraud that nobody could compete with him in the art of intrigue. Political correctness (the Communist Party line) had no opponents (he killed most of them) and reigned in the country, giving Stalin absolute POWER. Unprecedented personal destruction of his opponents with the help of the Soviet media, which all belonged to the government and was totally subordinated to Stalin. This ubiquitous machinery of Stalinist Socialism is now applied by many foreign leaders who fight Western civilization. Just watch an organized, vicious assault on Trump by our liberal media, then consider this history of Political Correctness:

“In the early-to- mid 20th century, contemporary uses of the phrase “Politically Correct” were associated with the dogmatic application of Stalinist doctrine, debated between formal communists (members of the Communist Party) and socialists. The phrase was a colloquialism referring to the communist party line, which provided for “correct” positions on many matters of politics, according to American educator Herbert Kohl writing about debates in New York in the late 1940s and early 1950s.”

This Stalinist practice has spread across the world. You wouldn’t find a TV station, radio, any public or private discussions where these two words are not pronounced hundreds times every day. The term has become so familiar to our ears that we are using it and had never thought about its origin, let alone about its author. I am not sure that even those who came to America from the socialist countries new the origin of the term. Only a few did.

Actually Political Correctness was presented as the official policy of the Russian Government in the newspaper Izvestia in 1933. The arrogant American Left armed with Stalin’s PC is changing the very character of our America the Beautiful, destroying the American dream. The best illustration of that is the Democrat Party Convention, with a skillfully crafted system of devious lies. I am not surprised that Obama, the community-organizer/radical activist, promised to transform America, and he is using Stalinist tricks and methods to achieve the result. You saw many times the Democrats lying to cover up the fraud like Stalin did… Socialist Lies, pp. 18-24

Terrorism, ISIS, The Muslim Brotherhood—Stalin’s teaching

I have to start again with history of Stalin. He was the first Soviet leader, who was brought up and educated in Muslim culture. In his war against capitalism, he noticed the similarity in agendas of Islam and Communism. At the end of WW II the opportunity came to formally unite the two, when Nazi Germany was defeated and the leaders of Muslim Brotherhood moved from Berlin to Moscow. Stalin married Islam with Communist ideology using the Muslim Brotherhood in his agenda against capitalism. The marriage gave birth to the ideology of Islamism and a political Jihad—and the KGB was a parent of both. Infiltration to the Middle East began with recruitment of Arafat in the 1950’s became global and never ended since. All terrorist groups and ISIS are the logical continuation of KGB policy in cahoots with the Muslim Brotherhood today. They are fighting WW III. Socialist Lies, by Simona Pipko, Xlibris, 2016

If you follow Obama’s foreign policies, you will find an incredible similarity with Stalin’s policy toward the Muslim Brotherhood: Obama advocated and helped the criminal thug Morsi to build so-called “democracy” in Egypt, providing him with American foreign aid in the form of high-tech planes, arms military equipment and ammunition. What Stalin began in the end of 1940’s was continued by all consequent Soviet leaders during the 20th century. The Democrats and Obama with Russian help brought that policy to the 21st century. Yet, Obama wasn’t the first American President collaborating with Russia—Bill Clinton preceded him…

The Clinton Foundation—an Appendage of the Soviet Mafia in America

I have written many pages about the Soviet Mafia that ran Stalinist Socialism and spread itself across the globe. For this reason I called the Clinton Gang, the Clinton Mafia. I have had a dislike for Bill Clinton ever since I saw him among a group of the Russian youngsters, organized by the KGB in the 1970s. Then, I found out that Clinton lived with the family of a KGB member in Moscow. Knowing what I know about the KGB presented me a real picture of that man.

Later it was the election, where a suspicious threat to Ross Perrot made Bill Clinton the U.S. President in 1992. His connection with Russia has always alarmed me. His presidency just doubled my dislike for him, as enormous harm had been done to America. Later, in writing my third book and researching Bill Clinton again, I found out an interesting fact that, perhaps will convince you of the validity of my suspicions.

Researching Bill’s whereabouts, I read about Bill Clinton and his visit to Moscow. On June 9, 1991, two-and- a half months before announcing his candidacy for the U.S. Bill Clinton flew to Moscow. The True Story of the Bilderberg Group, by Daniel Estulin, Trine Day LLC, 2009, p.52. Moreover, some people knew about it. The Arkansas Democrat ran the story under the headline Clinton Has Powerful Buddy in the U.S.S.R.—New Head of KGB.

I am not asking why Clinton flew to Moscow. I know why. Knowing the KGB and its suspicions of any foreigner, my question is – who provided the secret means of communication with the Russian Security Services (the KGB) to enable an American plane to land without any complications to the Moscow airport? In the light of the recent Hillary Clinton scandals involving foreign money, you should consider the means of communication. It can bring light on Benghazi and many other unsolved scandals—it is at the crux of the matter in the upcoming election.

“The FBI has now enlisted Bharara’s office in part for his aggressiveness that many career DOJ attorneys may lack. Over the years the Clinton Foundation has collected $2 billion in donations from all over the world that sparked FBI suspicion, as well as the general public. In its 15 years, the Clinton Foundation has taken in more than $2 billion in donations from around the world, the Daily Caller reported. At stake is how did Hillary Clinton use her position as Secretary of State to influence foreign donors in what is commonly referred to as a “Pay for Play” scheme. “FBI, US Attorney Launch Probe Into Clinton Foundation, By Mark Swanson Friday, 12 Aug 2016.

A “Pay for Play” scheme is the essence of the Soviet Mafia activities – poker ante in Putin’s playbook. Moreover, donations from corrupt countries and terrorists have led many to believe that Bill and Hillary could be the founders/abettors of disgusting terrorist groups including ISIS. They are. Therefore, practical knowledge of today’s Russia is a must in any such investigation…Yet, I am afraid that Mr. Bharara will wind up dead before he even finds anything. You have to know Soviet Fascism to survive…

The Clinton Foundation is much more than what you know about it. Representative Michele Bachmann said, “The Clinton Foundation was nothing more than an international money laundering ring.” I would say the Clinton Foundation is more than that: it is the eyes and ears of the Kremlin. Writing about America’s politics vis-à-vis contemporary Russia is my routine for the last few decades and I am constantly addressing the subject of organized crime as a part of the Soviet Mafia to emphasize how the institutionalized corruption spreads across the globe. The Clinton Foundation is an appendix of the Soviet Mafia in America.

There is another event that deserves attention and deep thinking about the Clinton Mafia. Do you remember Monica’s “blue dress?” I have found an interesting chronology connected to the “blue dress” in 1998. The FBI asked for Clinton’s blood sample to compare it with the sperm’s stain on the “blue dress,” three days later the terrorists committed two tragic blasts of American Embassies in Africa. Coincidence? Don’t tell me about the coincidences in life. It is the “work” of the Russian connection to divert attention from Clinton and “the blue dress.” This is a segment in the Clinton collaboration with the Russian KGB government. Clinton is not the only one…

As a matter of fact, while writing Socialist Lies, I have introduced a new term—Obama/Putin joint venture named Destruction of the American Republic, pp.191-193. It was done at the time of the Nuclear Agreement with Iran, boosted by Russia. You have as a result two Democrat American Presidents with a failed Progressive Policy that has brought America to the point of no return. I hope you agree with me: Knowledge is Power—knowledge of history a must in the 21st century. Liberalism is the most destructive force in our country: liberals destroyed the Democrat Party of Harry Truman, and now they are destroying America the Beautiful…

Fifty GOP analysts against Trump and CENTCOM is manufacturing

What I said in the preceding paragraphs are a partial answer to this segment. But in addition, look attentively on the recent history of our Intel. We are constantly losing our Western culture and the traditional values of civilization. The most crucial loss is our system of government left to us by our Founding Fathers. Our Federal Government is responsible to defend us from our enemies foreign and domestic. One of the most important ways the government does that is through intelligence gathering and analysis. For the past couple of decades our Intel has failed miserably to do their job:

- Some of those 50 GOP analysts were consulting George W. Bush on Putin’s soul— they legitimized him and his action– you know the result.

- Some of those 50 analysts are blocking information on my books and articles. My computer is checked 24/7, my phone is tapped, my mail is arrested. I was kicked out from two universities, because I was teaching, speaking and writing the truth about Stalin and Russia. Our Intel left America blind and naked against the enemy in the current WW III.

- Those 50 GOP analysts missed all anti-American activities of the left during the last decades. The best example is a criminal connection of our Secretary of State Hillary Clinton and Iranian President Ahmadinejad in 2009. The law forbid any dealing with terrorists. You know the result—it is Obama Nuke Deal with Iran, the biggest sponsor of terrorism after Russia…

- George Soros is the enemy, freely working against our interest for the last decades and our Intel had not been able to expose him, though there were multiple opportunities to show who he is and his real face.

- Our Intel has missed a criminal deal of Obama, Putin, and Sarkozy toward Libya. We are paying a dear price for this deal. Socialist Lies, pp. 125-126.

- Our Intel has missed another criminal deal of the Clinton administration in the 1996 election. The criminal deal was executed by Rahm Emanuel and governor of Pennsylvania Ed Rendell in the 1996 election—Pennsylvania voted Democratic…The fix was in and the same trick was repeated in the 2012 election, when, as we found out after the fact, not one person voted for Romney in Philadelphia…

These are only a few examples to save the time. However, another result of Intel’s miserable failure is the infiltration of our enemies into all strata of our society and government, especially military. CENTCOM’s alteration of real ISIS data is one result of that, yet, it is only one example—the consequences of the infiltration will be more dramatic and deadly in the future. We are dealing with Soviet Fascism.

Look at our media—everybody is talking about ideology, but nobody named it, despite the fact that I have written about Soviet Fascism for the last twenty years. We are dealing with a public media that serves one party’s interest—the Democrat Party. Hence, our Intel and the incompetent mainstream media are responsible for all these failures. Just a couple of days ago Trump clearly pointed out that under

Obama and Secretary of State Clinton, ISIS achieved unprecedented success in a short time because of the environment the Democrat leadership had created. He is right, but you saw the media negative reaction and perversion. Please, read my description of the events, confirming his statement. Socialist Lies, pp. 191-193

We are at war in WW III waged by Soviet fascism. Alas, my beloved America can’t recognize it…

To be continued at www.simonapipko1.com.

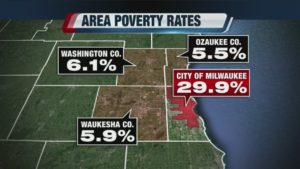

Today, per capita income in Milwaukee is $19,199 (

Today, per capita income in Milwaukee is $19,199 (

Dear Mr. Trump,

Dear Mr. Trump,

About the Association of Equipment Manufacturers (AEM) –

About the Association of Equipment Manufacturers (AEM) –

A new investigative report showed that Tesla Motors’ contract company, Eisenmann, paid a smaller Slovenian company, Vuzem, to hire foreign workers through the B-1 visa program. The companies misrepresented the foreign workers in order to obtain the visas so they could import cheaper, foreign labor instead of hiring American workers.

A new investigative report showed that Tesla Motors’ contract company, Eisenmann, paid a smaller Slovenian company, Vuzem, to hire foreign workers through the B-1 visa program. The companies misrepresented the foreign workers in order to obtain the visas so they could import cheaper, foreign labor instead of hiring American workers.