Have you ever read How I Found Freedom in an Unfree World by Harry Browne? I finished the 1973 book the other day; it was mind-blowing and life-changing. I’ve since restructured how I approach even the most elemental constituents of my life: my moment-to-moment actions and thoughts.

This mind-shift has had immediate, spectacular results. In the past few days, I’ve been dramatically more happy, more clear-thinking, and more deliberate. I’ve had more energy, yet also more serenity. Like Browne, I found freedom by learning to live free.

Harry Browne’s idea of freedom is more mental than physical, more spiritual than political. He doesn’t boil it down in quite this way, but this is my definition for the kind of freedom discussed in his book:

Living Free: Abstaining from preoccupation with the preferences of others and instead maintaining a clear focus on your own preferences.

Before you dismiss this as antisocial selfishness, note that this does not mean being oblivious to the preferences of others. The optimal route to one’s own goals often runs through the goals of others. That is to say, the best way to accomplish what you want is often by eliciting the help of others (whether in the form of goods or service), and the best way to elicit that help is often to appeal to their own preferences: i.e., by offering something they want in return. Such exchanges can involve both the formal trades of business and the loose reciprocities of friendship.

Enlightened selfishness is sensibly sociable. (A whole other essay could be dedicated to the interesting similarities and profound differences between Harry Browne’s notion of selfishness and Ayn Rand’s.)

Freedom doesn’t mean ignoring the preferences of others; it means not compulsively imposing someone else’s preferences on yourself.

Freedom from Social Anxiety

When first adopting this rule for myself, I was amazed to realize how much of my attention was previously used up by worrying about external opinions. Such worries had a constant effect on almost all my thoughts and actions: even down to such basic behaviors as the expression on my face.

Even now, I still sometimes catch myself giving a meek smile as I walk by others as if to express, “I’m harmless and nice. Please like me!” I used to constantly fret over whether the way I was moving, communicating, or otherwise acting came off to others as hostile, weird, dumb, or unbecoming.

Instead of sensibly selfish, I was compulsively unselfish, or “otherish.” My “otherism” was making me neurotic, holding me back, and dimming my shine.

As part of my new philosophy, I’ve made it a point to no longer give a damn about such things. Instead, when I walk, I focus on the next thing I want to accomplish. When I talk, I focus on what I would like to know or convey, or on enjoying myself through conversation.

Relapses into my old social anxieties have become ever less frequent. Now I walk, talk, and act with the air of a man intent on his own purposes – because I am one.

An interesting side effect is that people now seem to treat me with greater respect and friendliness. The funny thing about not caring what others think about you is that it seems to result in others thinking more highly of you. The reverse is also true. Social anxiety has the perverse consequence of generating the very awkwardness it fears.

MYOB to the Max

Again, living free is not being preoccupied with the preferences of others. This means not imposing the preferences of others on yourself. It also means not trying to impose your own preferences on others. It is “selfishness” in the sense of minding your own business (MYOB).

You free yourself when you free the other people in your life.

We often give lip service to the MYOB principle, but very few actually adhere to it. At most, we apply MYOB to strangers out in public, with the huge exception of politics; we’re more than willing to bomb or cage strangers for their own good or for not measuring up to our standards, as long as it’s through the intermediary of public policy.

But when it comes to people in our lives – family, colleagues, friends, etc – MYOB goes right out the window. Because of their closeness and their impact on our lives, we consider their business to be our business. The closer they are to us, the more we feel the need to change them, to fix them, to re-educate them: even if it takes a steady barrage of reprimanding, bullying, nagging, whining, guilt-tripping, and petty criticisms and insults.

Even if it doesn’t involve violence, all of this amounts to trying to supplant someone else’s preferences with your own. It is another form of otherism: of preoccupation with the preferences of others, at the expense of focusing on your own preferences, at the expense of attentively minding your own business.

Such “aggressive” otherism can tie you down just as much as the “defensive” otherism already discussed. When you let yourself become preoccupied with the preferences of others, you make your own happiness contingent on the decisions made by others. And since you can’t really control those people, you thereby give up control over your own happiness.

Ironically, by trying to spiritually subdue the people in your life, you actually subject yourself to an unhealthy dependence on them. You limit your own freedom when you try to limit theirs.

You free yourself when you free the other people in your life: when you abdicate the responsibility of improving or correcting them, whether for your sake or theirs.

Detox Your Mind

For me, this side of enlightened selfishness has been just as liberating as the other. It made me realize how cluttered my mind used to be: cluttered, not only with an irrational fear of external judgment, but with my own compulsive habit of constantly judging others.

It would be an interesting experience to count the number of times somebody aggravated you in a single day. If you were brutally honest with yourself when making the tally, I bet you’d be surprised. Your imperfect spouse, your noisy kids, your nosy parents, that annoying colleague, that unsmiling cashier, that inconsiderate driver, that swaggering passerby; even people who likely will never feel the heat of your judgment, like that obnoxious celebrity or that monstrous politician. It all adds up.

That is a lot of toxic negativity throughout your every day. Aggressive otherism distracts you from your own affairs and corrodes your sense of well-being. And for what? It almost never does any good; you almost never manage to sustainably change the object of your scorn.

Therefore, aggressive otherism is a recipe for a chronic sense of frustration and impotence. Indeed, that is precisely what makes it so stressful; it is distressing to be preoccupied with things you cannot change: things like your coworker’s personality or the outcome of a national election.

I’ve found that enlightened selfishness just washes all that psychic acid away. Whatever foibles and vices I perceive in other individuals are their own business, not mine. There is nothing I can do to rectify the failings of politicians and other distant strangers. And if I try to fix the supposed failings of those close to me, I will most likely just end up aggravating them and myself and damaging our relationship.

Once I accepted these truths, it became easy to kick the habit of reflexively judging people. I no longer felt the responsibility to judge and correct society or any part of it outside of my own skull. I have dropped that burden, and what a weight off my shoulders, what freedom, freedom to focus on the things I can profoundly and decisively improve: namely, my own affairs.

Now, when I catch myself mentally throwing shade at someone else, I shake it off and tell the other person in my mind, “You do you,” and return my attention to my own endeavors.

All of my relationships have benefited from this mindset shift, from my marriage to my career. Trying to re-educate the other person is the source of nearly all conflict in relationships. Without such a quixotic crusade, my relationships have become serenely simple; it’s all about enjoying the other person’s company and/or profiting from their freely-given cooperation.

If there is no such enjoyment or profit in the relationship, then there is always the option of exit; I am free to part ways and seek more suitable life/business partners, which is a much more effective recourse than trying to wring enjoyment or profit out of another person by forcing them to become more suitable to my preferences. Thankfully, all of my current relationships are good ones, so that hasn’t been necessary.

Unleashed Potential

Embracing enlightened selfishness and quitting compulsive otherism has swept away the entangling, encumbering cobwebs from my mind. Clearing the static of distracting preoccupations with the preferences of others has freed my precious time and attention to focus on improving my own life according to my own lights. And this has naturally involved redoubling my efforts toward the cooperative ventures that most powerfully create joy and profit: my family, my jobs, my friendships, etc.

Now the world is my oyster. I no longer see the world as a minefield of obligations to appease or re-educate others, but as an open vista of opportunities to accomplish the things I want, often with the free and willing cooperation of clients, customers, vendors, colleagues, friends, and loved ones. As a result, my initiative, productivity, mental clarity, goodwill, and joyfulness have all ascended to a new level.

The Source of Otherism

This approach to life isn’t some philosophical artifice manufactured by Harry Browne. Sensible, sociable selfishness is the natural mindset of human beings. The only reason it is so rare is that almost all of us have had otherism spiritually beaten into us by psychological child abuse.

Throughout our formative years, domination parenting and regimentation schooling subjected us to a constant barrage of authority-dispensed carrots and sticks, praise and admonishment, training us to ever judge our own conduct according to imposed, external standards.

This made us addicted to the dopamine rush of being patted on the head and paranoid about the judgment of authority figures and classmates. We carry this neurosis throughout our lives. Even as grown-ups, we are still disapproval-phobic approval junkies, constantly jonesing for our next fix of external validation.

The flipside of this lesson is the conviction that others should continually judge their conduct by our standards, and that it is our responsibility to enforce those standards through force or peer pressure.

The upshot of this universal curriculum is a world full of guilt-ridden, meddlesome, virtue-signalling neurotics ever at war with each other and within themselves. Most of our problems, both personal and political, can be traced to this backward, abusive upbringing.

But don’t waste your energy blaming older generations for our plight. Pavlovian conditioning and obedience training were the only kinds of “education” our parents and teachers knew, having been subjected to it themselves in their own childhoods.

Thankfully, Harry Browne was able to break this cycle of psychic violence by rehabilitating, deinstitutionalizing, and emancipating himself: by rediscovering the freedom and self-sovereignty that dwelt within him all along, and by broadcasting the message that it dwells in us too, that “You’re free – if only you’ll realize it,” as he put it.

Wisdom, Serenity, and Courage

To live free is to provide yourself with your own answer to the Serenity Prayer:

God, grant me the serenity to accept the things I cannot change,

Courage to change the things I can,

And wisdom to know the difference.

Living free is having that wisdom. It is granting yourself the serenity that comes with the acceptance of a basic fact: that you cannot ultimately control what others do or how they think of you. It is making room in your soul for the courage to unreservedly tackle the one thing you can fundamentally change for the better: your own life.

Your freedom is a saving gift you give yourself. Keep reminding yourself until it sticks:

You’re free if you want to be.

Dan Sanchez is Managing Editor of FEE.org. His writings are collected at DanSanchez.me.

For the past 40 years, intellectual property, technology development, and

For the past 40 years, intellectual property, technology development, and

The common perception is that patents are a path to riches. If an inventor or entrepreneur files a patent, he can then build a successful technology company under the protection of that patent and eventually sell out to companies like Apple and Facebook.

The common perception is that patents are a path to riches. If an inventor or entrepreneur files a patent, he can then build a successful technology company under the protection of that patent and eventually sell out to companies like Apple and Facebook.

huge returns all through the 1920s. The stock market was the place to be if you wanted to get rich quick. People borrowed heavily to purchase shares. And then it all came crashing down.

huge returns all through the 1920s. The stock market was the place to be if you wanted to get rich quick. People borrowed heavily to purchase shares. And then it all came crashing down. It is my opinion that when the Patent Bubble bursts, it could be far worse than the housing bubble.

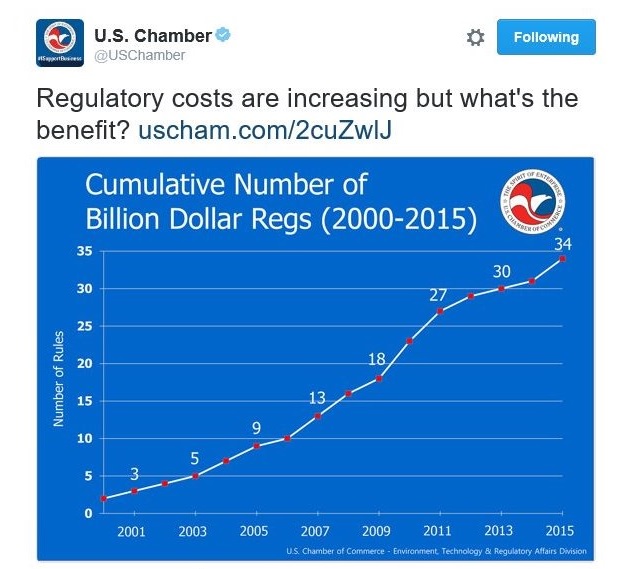

It is my opinion that when the Patent Bubble bursts, it could be far worse than the housing bubble. Too much money chasing the same sector results in price inflation. Those inflated prices are always unsustainable. When this patent bubble bursts, it will hurt the entire economy.

Too much money chasing the same sector results in price inflation. Those inflated prices are always unsustainable. When this patent bubble bursts, it will hurt the entire economy.

Here at home, most recent polls predict that Secretary of State Clinton will win the election and that belief has been priced into the markets in much the same way that ‘Bremain’ was priced into markets prior to the ‘Brexit’ vote.

Here at home, most recent polls predict that Secretary of State Clinton will win the election and that belief has been priced into the markets in much the same way that ‘Bremain’ was priced into markets prior to the ‘Brexit’ vote.