Can Soaking the Rich Reduce Income Inequality? by Karen Walby, Ph.D.

On the campaign trail recently, Bernie Sanders, a candidate running for the Democratic Party’s presidential nomination, said that America’s leaders shouldn’t worry so much about economic growth if that growth serves to enrich only the wealthiest Americans. And that our economic goals have to be redistributing a significant amount of wealth back from those in the top one percent of households according to income to the households at the bottom of the income distribution.

Most of the candidates for the Republican presidential nomination have said in one way or another that creating economic growth and with it economic opportunity is the best way to address the issue of income inequality. The subject is so popular it even has its own website, inequality.org.

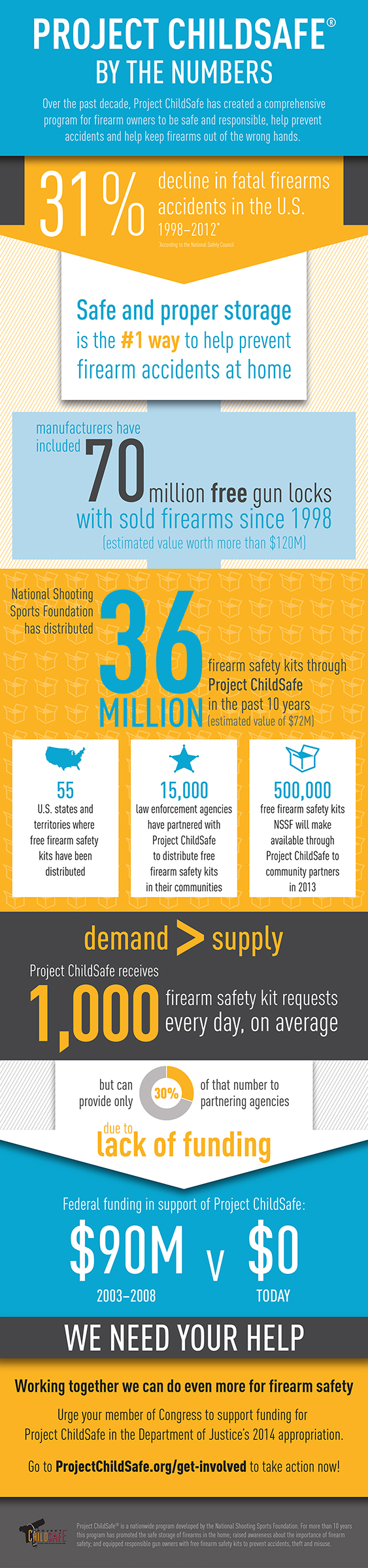

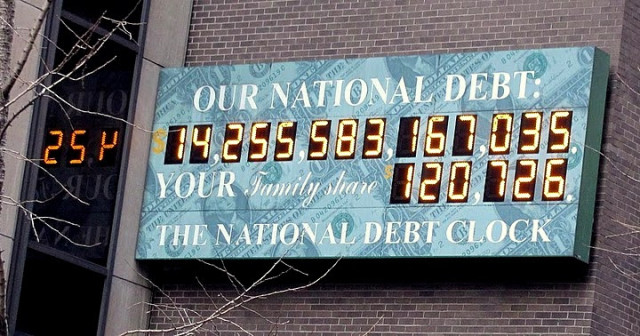

Income inequality refers to the extent to which income is distributed in an uneven manner among a population. In the US, income inequality, or the gap between the rich and everyone else, has been growing markedly, by every major statistical measure, for some 30 years. While there is general agreement that this is something that needs to be addressed, a consensus on how to reduce income inequality remains elusive.

Three economists from the Brookings Institute recently looked into this issue in their article “Would a significant increase in the top income tax rate substantially alter income inequality?” And their findings are enlightening: They found that even a big increase in the marginal tax rate for top earners would have “shockingly little effect” on after-tax income inequality.

To briefly summarize their findings, they hiked the top income tax rate from 39.6 to 50%, a 26% increase. For households in the 95th to 99th percentiles of income, taxes would rise by an average of $6,464 a year while for the top 0.1 percent, the average yearly tax increase would be in $568,617. This rate increase would generate $96 billion in additional tax revenues.

But what effect would increasing taxes on the richest households have on reducing the income difference between the richest and the poorest households?

To answer that, the authors calculated the Gini coefficient for after-tax income before and after the 26% increase in the tax rate for the richest households. (The Gini coefficient is an index that ranges from 0, if everyone has the same earnings (maximum equality), to 1, if a single person has all the earnings and everyone else has none (maximum inequality.)

Under the current income tax rates, the after-tax income Gini coefficient was estimated to be .574. Raising the top marginal tax rate to 50 percent would reduce the Gini coefficient to .571, only a one-half of one percent decrease in income inequality. Incredibly, even when the authors assumed that all of the $96 billion in increased tax collections would be redistributed on an equal basis to the households in the bottom 20%, the Gini coefficient was only reduced to .560, a reduction in income inequality of only 2.4 percent.

So it turns out that the primary justification for keeping the progressive income tax system, that it is more beneficial to the poor, has been exposed for the fantasy it is.

The FAIRtax, a single rate tax on all consumption which replaces all federal income and payroll taxes, avoids the pitfalls of attempting to soak the rich. Thanks to the prebate, poor households would pay no sales taxes in net terms. Second, it eliminates the highly regressive Social Security and Medicare payroll taxes. And third, it effectively taxes wealth as well as wages: When the rich spend their wealth and when workers spend their wages, they will both pay taxes. This broadens the effective tax base to include wealth, not just the income earned on it (much of which is currently exempted or taxed at a low rate under the current system). Thus, one can lower the required consumption tax rate and, thereby, reduce the tax burden on workers.

ABOUT DR. KAREN WALBY

ABOUT DR. KAREN WALBY

Karen Walby, Ph.D. is the Director of Research Americans For Fair Taxation. To learn more about the Fair Tax click here.

They demanded he drop out of the race. They’re a 501c3 organization, and such organizations are not supposed to intervene in campaigns either on behalf of or in opposition to a candidate. Clearly the gang of thugs at Hamas-linked CAIR, designated a terror organization by the United Arab Emirates, is in violation of the law here, but it is almost certain that Obama’s politicized Justice Department will take no action.

They demanded he drop out of the race. They’re a 501c3 organization, and such organizations are not supposed to intervene in campaigns either on behalf of or in opposition to a candidate. Clearly the gang of thugs at Hamas-linked CAIR, designated a terror organization by the United Arab Emirates, is in violation of the law here, but it is almost certain that Obama’s politicized Justice Department will take no action.