Counter to practically everything you will read or watch in news coverage, it is the philosophy of conservatism and the practice of capitalism that has done the most to pull millions of people out of poverty.

News coverage tends to focus on the government programs aimed at helping the poor. Some of these include Medicaid, food stamps, WIC, housing assistance, nutrition assistance in schools, for adults and for the elderly — basically cradle to grave safety nets and more. Spending on these, cuts to these, effects of cuts to these, all dominate news coverage, with media organizations making a beeline to find an example of an individual who might be hurt if a cut is made.

These massive anti-poverty programs that, combined, are larger than the entire national budgets of almost every country in the world, provide mere stopgap measures at best. At worst, they create a highway for generational dependency on government largess that strips people of all hope of pulling out of poverty and creating a brighter future. They are taught to be content drifting along the bottom of society.

There are better ways, proven again and again and again, but they are ways that involve politicians and organizations getting out of the lives of people. That dilutes their power, influence and political longevity. And these better ways involve the mass media understanding the basic principles of capitalism and freedom — principles that seem lost to most journalists.

More freedom, more capitalism, better living

Capitalism gets a bad rap on the left, particularly in the fevered safe spaces of academia, because it will inevitably make some people astonishingly wealthy. All boats are raised, but some soar, creating inequalities. In their ivory tower minds filling the young, mushy minds stuck in their classrooms, academicians see capitalism as tycoons and robber barons, pollution-belching smokestacks and sweatshops — all heaved on the backs of the Charles Dickens-like poor.

They don’t see Apple and Google and Ford and Merry Maids and Publix and Super Cuts and Starbucks and the millions of small businesses making almost everyone’s lives better — starting with their employees, but including their products.

At the turn of the 20th century, we were riding in horse-drawn buggies, using outhouses and being warmed by fireplaces. There was no air conditioning and no screened windows. Our diets were often not healthy, particularly through the winter months. Today, a mere historical blip in time, most families own two cars, live in climate-controlled houses multiple times larger than previous generations, enjoy flat-screen TVs, stream shows on-demand, use smart phones, eat all the fresh food we want and work less.

Not one iota of this improvement in living that the cloistered university professors enjoy came from income redistribution schemes. Every bit came through capitalism in some form.

The fact that capitalism breeds income inequality for the feverish folk who worship at the altar of equality overshadows what it actually accomplishes for the poor. And as journalists are fellow-travelers with just a lower-grade fever, they tend to just look at the microscopic aspect and miss the big picture, not realizing that you cannot have capitalism without income inequality. It’s just part of it. To change that means eliminating capitalism and its overwhelming benefits — not least of which, to the poor.

Capitalism in the free market

When capitalism is unleashed, it’s a beautiful thing — if you don’t mind some boats being lifted higher than others on a tide that is lifting them all.

Many will point to the problem of greed in capitalism. But greed is a problem with human nature. As is envy. Capitalism works because it takes advantage of the good, the less good and the bad in human nature.

The good in human nature is the creative, inventive, problem-solving part that can build anything. The less good is that usually happens only if there is a profit to be made. And the bad is that some of the most financially successful are also the most ruthless and heartless. Human nature.

These human forces however, acting in a sea of free markets of free choices, propel innovations, improvements and efficiencies on a daily basis. Technology layered over top of free markets means that land-line phones become clunky wireless phones become Nokia cell phones become Motorola Razr flip phones become Apple iPhones become…whatever next leap is made.

Whatever that leap is, it will not be brought to you by government or by income redistribution or any other form of socialism.

Examples make the case

Venezuela and Brazil are two examples of what happens when fairly free, capitalistic societies bringing themselves out of the destitute third world see uneven income distribution as their major problem. And that can be particularly apparent in the early stages of successful capitalism, which is where these countries were.

They turned to socialism, which requires government-dictated markets and taking money from the capitalists and giving it to the least productive in dribble amounts. Venezuela went further and faster and has all but collapsed economically. Brazil is also traveling the path and is declining rapidly. This, despite the fact that both of these countries are rich in natural resources the world wants, including oil reserves.

In the other direction, we have the Soviet Union, which left the entirety of its sphere of influence impoverished in places that have since improved the standard of living for their people under a capitalist economic structure.

These include Poland, former East Germany, the Czech Republic, Lithuania, Slovakia — countries that do not have the natural resources of Venezuela and Brazil. Some former Soviet countries have not fared as well, but those also have not embraced the free markets necessary to capitalism.

Capitalism’s shockingly successful war on poverty

Too many people think that capitalism is either irrelevant to poverty or the actual cause of it.

Let’s take New York Magazine writer Jesse Singal, who tweeted out “I actually do think ‘poverty can be solved through capitalism’ is a pretty heinous view. Capitalism is not designed to do that.”

Well, it’s not actually “designed” to do anything. It is simply a system existing upon the reality of the laws of nature and man. And we can demonstrate empirically that Singal is 180 degrees wrong, but very representative of the modern liberal.

So let’s first establish the bona fides of capitalism in lifting people out of poverty. The numbers may shock the reader because they are so rarely disseminated. You’ve been warned.

In 1820, when capitalism began taking hold in some western countries, poverty worldwide stood at 94 percent of the world’s population. As the capitalistic system took hold and grew through the 19th and 20th centuries, poverty plummeted worldwide. By 1981, it was down to 53 percent, according to Max Roser, a fellow at the Institute for New Economic Thinking at Oxford University’s Martin School. But large parts of the world were still under the boot of Communism.

Since 1981, with the fall of the Soviet Union seven years later, capitalistic liberalization in China, expansion of capitalism in Asia and South America and the globalization of the economy, only 17 percent of the world’s population was living in poverty by 2011, according to Roser’s study. (The poverty measurement is based on the monetary value of a person’s consumption in constant dollars. Consumption is a better gauge than raw dollars because a dollar can buy so much more in some countries than others.)

“In the past only a small elite lived a life without poverty,” Roser says. “Since the onset of industrialisation – and as a consequence of this economic growth — the share of people living in poverty started decreasing and kept on falling ever since.”

In another metric that partially coincides with the fall of Communism and completely coincides with the expansion of capitalism, the number of people living in extreme poverty worldwide declined by 80 percent from 1970 to 2006. Extreme poverty in this case is measured by people living on a dollar a day or less, so it is using the raw dollar adjusted value, but still makes the point.

Nearly 27 percent of the global population was in extreme poverty in 1970. By 2006, that was down to 5.4 percent — from more than 1 in 4 people to about 1 in 20. These are astonishing accomplishments, but they get virtually no media coverage and so most people do not know about them. It’s entirely possible that most members of the media are unaware of them, too, as they progressed through socialist-dominated higher education without ever being exposed to these truths.

“It was globalization, free trade, the boom in international entrepreneurship. In short, it was the free enterprise system, American style, which is our gift to the world,” American Enterprise Institute president Arthur Brooks said in 2012.

But wait, there’s more!

According to Steven Horwitz, analyzing data for the Foundation for Economic Freedom, the world is economically 120 times better off today than in 1800 as a direct result of the explosion of capitalism.

That estimate comes from multiplying the improvement of the average person’s consumption of goods, by the gain in life expectancy worldwide, by seven (the increase in global population.)

Horwitz explains that this has improved the quality of life also in immeasurable ways:

“The competitive market process has also made education, art, and culture available to more and more people. Even the poorest of Americans, not to mention many of the global poor, have access through the Internet and TV to concerts, books, and works of art that were exclusively the province of the wealthy for centuries.”

Further, thanks to capitalism increasing the value of labor while extending lifespans, people now spend a much smaller percentage of their lives needing to work for pay.

Capitalism has even played a critical role in cutting mortality rates in half globally for children under five by both improving medical equipment, medicine and delivery systems. All of those things being used by charitable organizations were created by for-profit companies under the capitalistic system. It’s safe to say this was not happening and would not have happened under the Soviet Union’s government-directed system.

Conservatism undergirds capitalism

So why is conservatism’s philosophy integral to successful capitalism? In short, because conservatism calls for individual freedom, free markets, the rule of law and its enforcement, and the freest trade possible.

Again, liberal writer Jesse Singal demonstrates the thinking of the left. He tweeted that the “whole philosophy” of conservatives is to be mean to poor people. This tied to Trump’s proposed budget that includes cuts to Meals on Wheels.

Actually, this is precisely what horror writer Stephen King thinks. He tweeted that “A Salon headline articulated a question I’ve been asking myself for years: Why are Republicans so mean to poor people?”

This is ignorance on display, but in part explicable ignorance in that probably every media organ that Singal and King imbibe is put out by people of the same liberal worldview and unaware — or unwilling to accept — the facts of capitalism and conservatism’s role.

So let’s look at how conservative principles undergird capitalism and allow it to thrive.

The primary ingredients required to cook up a capitalistic economy include private property, private control of production, accumulation of capital, competition and free markets.

- Capitalism requires the right to private property. People cannot buy and sell things if they cannot own them in the first place. They cannot accumulate capital if they are not allowed to own something that they can sell for a profit, or others can buy for a need or in hopes of turning their own profit. Conservatism favors protections for private property rights while modern liberalism consistently works to erode those rights.

- Capitalism requires that private companies and people control production — including land, labor and capital. In a Communist country, the government owns and controls these production factors and sets production levels and prices. Thousands or millions of private companies in capitalism control these production factors to create efficiencies and maximize profit. Conservatism favors limited government involvement and modern liberalism seeks to extend government’s role in virtually every area of an individual’s life.

- Capitalism requires the accumulation of capital by private enterprises, which provides an incentive to work harder, innovate and produce more so individuals and companies can increase their personal capital. Access to this capital can be made available through banks and investors to other individuals and companies. Conservatism believes in companies and individuals keeping as much of their personal capital (earned income) as possible while liberals believe government should get ever more private money to use on government programs.

- Capitalism requires competition in industries. Companies compete to provide people with the goods and services they want at the price they are willing to pay. This drives companies to create better and cheaper goods and services — something that a government system simply cannot do. Conservatism and liberalism are similar on this count, with both understanding that monopolies are bad for capitalism.

- Capitalism requires the free market forces of supply and demand — millions of individuals making billions of decisions in their own interests, driving production amounts and prices. Conservatism believes the free market will generate what people want and need at prices they can afford, while liberalism increasingly believes that government should be controlling these elements.

The future must always be fought for

There are no guarantees that what we have today we will have tomorrow. The quality of life most Americans enjoy — and by all world and historic standards, it is an amazing quality of life right down to poor Americans — we have because of the freedoms we enjoy.

Those freedoms are the foundation upon which a thriving capitalistic economy is built. The abundant American middle class is a result of the freedom and capitalism combination. The extensive infrastructure of roads, airports, parks, schools, law enforcement and so on is built with the money gleaned from capitalism — and by capitalists.

That politicians have misspent trillions of dollars over generations is not capitalism’s fault, nor the fault of the philosophy of conservatism (apart from the Republican and Democratic parties.)

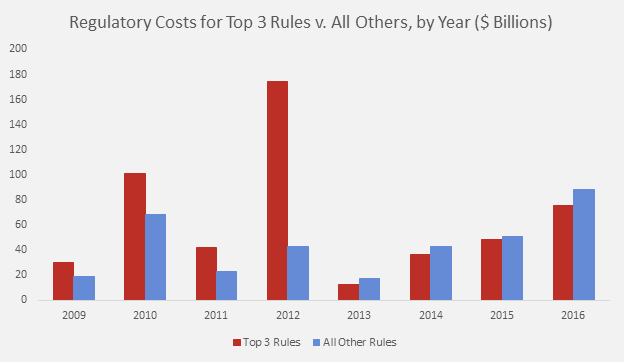

For instance, the more that government takes out of the economy to pay for stuff, the more it restricts access to capital and the slower companies can grow and add goods and jobs.

Liberalism is philosophically fine with doubling our national debt to $20 trillion over eight years. But that is money not available to be loaned to companies. In fact, it’s not available at all. Liberalism always wants higher tax rates on companies. But that too is money that then cannot be spent on expanding and innovating and adding jobs. Conservatism believes in living within financial means and fiscal responsibility, which creates prosperity generationally in part by assuring plentiful capital available to entrepreneurs and businesses.

The case for capitalism improving the quality of life across the board, and reducing poverty worldwide, is undeniable in the data. By understanding the linchpin that is conservatism’s protection of freedoms and individual rights, we can see the way forward to maintaining a strong and prosperous nation, and continuing to be that bright shining city on a hill.

EDITORS NOTE: This column originally appeared on The Revolutionary Act.

Today all too many Americans have fallen victim to the massive fraud campaign that has been foisted on Americans by politicians and a laundry list of special interest groups including the U.S. Chamber of Commerce and labor unions such as the

Today all too many Americans have fallen victim to the massive fraud campaign that has been foisted on Americans by politicians and a laundry list of special interest groups including the U.S. Chamber of Commerce and labor unions such as the

Tax Capital, Wreck Prosperity

Tax Capital, Wreck Prosperity

So, Democrats should be very excited about taxing the rich, so will the 99%ers, like Occupy Wall Street, who have been for taxing the rich. This has been the mantra of the Democrat Party – Tax the Rich!

So, Democrats should be very excited about taxing the rich, so will the 99%ers, like Occupy Wall Street, who have been for taxing the rich. This has been the mantra of the Democrat Party – Tax the Rich!

They are equally capable of rationalizing that economic misery in places such as

They are equally capable of rationalizing that economic misery in places such as

And the death of Cuba’s long-time dictator gives hope that the people of that island nation may soon escape

And the death of Cuba’s long-time dictator gives hope that the people of that island nation may soon escape  As you can see, this is an area where Western Europe

As you can see, this is an area where Western Europe  Indeed, an average ranking of 89 means that most Eastern European nations are in the bottom half of the world.

Indeed, an average ranking of 89 means that most Eastern European nations are in the bottom half of the world.

When journalists fail to report on the plight of American workers and their families, the majority of Americans have no idea about this outrageous betrayal.

When journalists fail to report on the plight of American workers and their families, the majority of Americans have no idea about this outrageous betrayal.

As you might suspect, it would be an understatement to say this puts me in the belly of the beast (for

As you might suspect, it would be an understatement to say this puts me in the belly of the beast (for  I’m not joking. I

I’m not joking. I  Most of the discussions focused on how tax laws, tax treaties, and tax agreements can and should be altered to extract more money from the business community. Participants occasionally groused about tax evasion, but the real focus was on ways to curtail tax avoidance. This is noteworthy because it confirms my point that the anti-tax competition work of international bureaucracies is guided by a desire to

Most of the discussions focused on how tax laws, tax treaties, and tax agreements can and should be altered to extract more money from the business community. Participants occasionally groused about tax evasion, but the real focus was on ways to curtail tax avoidance. This is noteworthy because it confirms my point that the anti-tax competition work of international bureaucracies is guided by a desire to