President Trump’s ‘Taxpayer First’ Budget

President Trump’s first proposed budget shows respect for the people who pay the bills. The administration’s proposal reverses the damaging trends from previous administrations by putting our nation’s budget back into balance and reducing our debt through fiscally conservative principles, all the while delivering on President Trump’s campaign promise not to cut Social Security retirement or Medicare. The budget’s combination of regulatory, tax, and welfare reforms will provide opportunities for economic growth and creation. Get the facts about President Trump’s budget.

BALANCE & CUTTING SPENDING

Unlike any budget proposed by the previous administration, the Fiscal Year 2018 Budget achieves balance within the 10-year budget window and begins to reduce the national debt within that same window.

The policies in this Budget will drive down spending and grow the economy. By 2027, when the budget reaches balance, publicly held debt will be reduced to less than 60 percent of GDP, the lowest level since 2010.

NO CUTS TO MEDICARE & SOCIAL SECURITY

The President’s Budget does not cut core Social Security benefits. And the President is fulfilling his presidential campaign promise not to cut Medicare benefits.

SAVING TAXPAYERS MONEY

President Trump’s budget saves the American people billions of dollars through welfare, tax, and regulatory reform.

SUPPORTING OUR MILITARY

The President is requesting $54 billion, or 10 percent, more than the defense level President Obama signed into law for both the 2017 CR and the 2018 budget cap. This increase balances the need to rebuild the military with the need for disciplined, strategy-driven, executable growth.

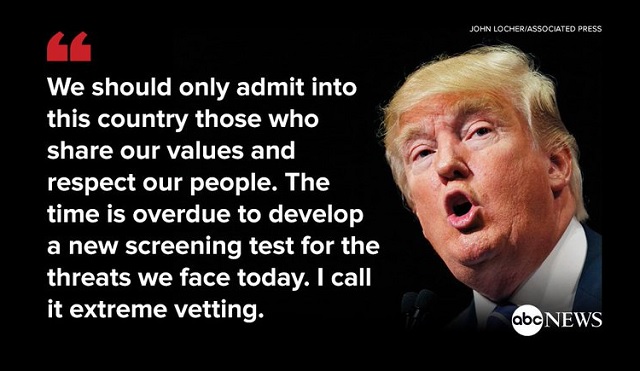

KEEPING AMERICANS SAFE

The Budget includes over $2.6 billion in new infrastructure and technology investments in 2018 to give CBP frontline law enforcement officers the tools and technologies they need to deter, deny, identify, track, and resolve illegal activity along the border.

PUTTING AMERICAN FAMILIES FIRST

President Trump’s budget provides national paid family leave for the first time in the history of this country.

Find out more information about President Trump’s Taxpayer First Budget at WhiteHouse.gov/taxpayers-first

Here are the 66 programs eliminated in President Trump’s budget:

Agriculture Department — $855 million

- McGovern-Dole International Food for Education

- Rural Business-Cooperative Service

- Rural Water and Waste Disposal Program Account

- Single Family Housing Direct Loans

Commerce Department — $633 million

- Economic Development Administration

- Manufacturing Extension Partnership

- Minority Business Development Agency

- National Oceanic and Atmospheric Administration Grants and Education

Education Department — $4.976 billion

- 21st Century Community Learning Centers

- Comprehensive Literacy Development Grants

- Federal Supplemental Educational Opportunity Grants

- Impact Aid Payments for Federal Property

- International Education

- Strengthening Institutions

- Student Support and Academic Enrichment Grants

- Supporting Effective Instruction State Grants

- Teacher Quality Partnership

Energy Department — $398 million

- Advanced Research Projects Agency—Energy

- Advanced Technology Vehicle Manufacturing Loan Program and Title 17 Innovative Technology Loan Guarantee Program

- Mixed Oxide Fuel Fabrication Facility

Health and Human Services — $4.834 billion

- Agency for Healthcare Research and Quality

- Community Services Block Grant

- Health Professions and Nursing Training Programs

- Low Income Home Energy Assistance Program

Homeland Security — $235 million

- Flood Hazard Mapping and Risk Analysis Program

- Transportation Security Administration Law Enforcement Grants

Housing and Urban Development — $4.123 billion

- Choice Neighborhoods

- Community Development Block

- HOME Investment Partnerships Program

- Self-Help and Assisted Homeownership Opportunity Program Account

Interior Department — $122 million

- Abandoned Mine Land Grants

- Heritage Partnership Program

- National Wildlife Refuge Fund

Justice Department — $210 million

- State Criminal Alien Assistance Program

Labor Department — $527 million

- Migrant and Seasonal Farmworker Training

- OSHA Training Grants

- Senior Community Service Employment Program

State Department and USAID — $4.256 billion

- Development Assistance

Earmarked Appropriations for Non-Profit Organizations

- The Asia Foundation

- East-West Center

- P.L. 480 Title II Food Aid

State Department, USAID, and Treasury Department — $1.59 billion

- Green Climate Fund and Global Climate Change Initiative

Transportation Department — $499 million

- National Infrastructure Investments (TIGER)

Treasury Department — $43 million

- Global Agriculture and Food Security Program

Environmental Protection Agency — $493 million

- Energy Star and Voluntary Climate Programs

- Geographic Programs

National Aeronautics and Space Administration — $269 million

- Five Earth Science Missions

- Office of Education

Other Independent Agencies — $2.683 billion

- Chemical Safety Board

- Corporation for National and Community Service

- Corporation for Public Broadcasting

- Institute of Museum and Library Services

International Development Foundations

- African Development Foundation

- Inter-American Foundation

- Legal Services Corporation

- National Endowment for the Arts

- National Endowment for the Humanities

- Neighborhood Reinvestment Corporation

- Overseas Private Investment Corporation

Regional Commissions

- Appalachian Regional Commission

- Delta Regional Authority

- Denali Commission

- Northern Border Regional Commission

- U.S. Institute of Peace

- U.S. Trade and Development Agency

- Woodrow Wilson International Center for Scholars

RELATED ARTICLES:

Why Washington Hates Trump’s Budget

Finally, a Budget That Slashes Funding at Education Department

5 Things Congress Can Do to Get a Budget That Controls Spending

9 Key Takeaways From Trump’s First Budget

RELATED VIDEO: Romina Boccia joins CNBC’s “Closing Bell” to talk President Trump’s budget.

Rachel served as Ron Paul’s communications director on Capitol Hill for 5 years. She is now a freelance-from-home wife and mom who writes extensively about gold and financial markets and occasionally consults on political campaigns, most recently for Sean Haugh for US Senate.

Rachel served as Ron Paul’s communications director on Capitol Hill for 5 years. She is now a freelance-from-home wife and mom who writes extensively about gold and financial markets and occasionally consults on political campaigns, most recently for Sean Haugh for US Senate.

Trump could flex his muscles this week and say to Congress, go back to the drawing boards.

Trump could flex his muscles this week and say to Congress, go back to the drawing boards.

Tax Capital, Wreck Prosperity

Tax Capital, Wreck Prosperity

So, Democrats should be very excited about taxing the rich, so will the 99%ers, like Occupy Wall Street, who have been for taxing the rich. This has been the mantra of the Democrat Party – Tax the Rich!

So, Democrats should be very excited about taxing the rich, so will the 99%ers, like Occupy Wall Street, who have been for taxing the rich. This has been the mantra of the Democrat Party – Tax the Rich!

You claim you want to cut spending while turning a blind eye to unconstitutional expenditures. For example: No attempt has been made to defund the unconstitutionally funded U.S. Department of Education (DOE)

You claim you want to cut spending while turning a blind eye to unconstitutional expenditures. For example: No attempt has been made to defund the unconstitutionally funded U.S. Department of Education (DOE)

The

The