The Republican In Name Only Socialists Just refilled the Corrupt Ukrainian government Pensions

The do nothing Socialist Republican Party continued its reckless spending of our hard earned tax money by handing the corrupt Ukrainian government $69.84 billion dollars. This means the Ukrainian government officials will still be able to take their vacations to Italy and Greece this summer and get their pension funds refilled. Also the Ukrainian fire department and basket weaving grandmothers will also get paid.

Does anyone know what happened to all the past tax payer money our republican socialist and communist democrat party gave to Zelensky the president of Ukraine? A man who has blocked new future elections in Ukraine which is on par with the communist dictatorships of Cuba and Venezuela.

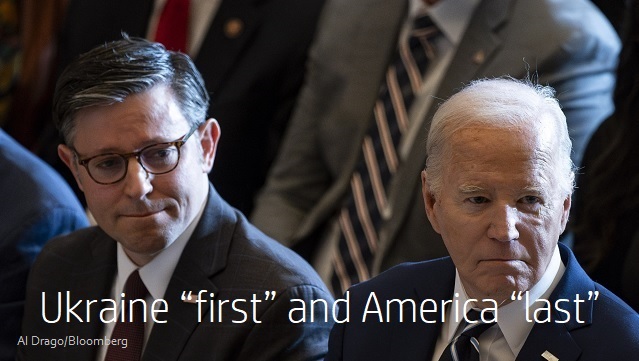

What’s interesting is that our own government contractors like Lockheed Martin and others only received $23 billion to restock our republic’s weapons for self defense. So House Speaker Johnson and his pal Comrade Joe Marxist Biden continue to put Ukraine “first” and America “last”.

This is the norm for the worthless fraud republicans working with their communist democrat pals in congress. Inflation will never get under control with these low IQ cockroaches running the republic. Which means the value of my house will continue to rise exponentially. Which is good for me but not for our economy.

As an after thought note – The U.S. Army is requesting $185.9 billion for fiscal year 2025 budget request an increase by a dismal $400 million. Not that the Army needs the money considering nobody is joining the ranks of this once powerful patriotic branch of the armed forces.

Patriotic Americans who once considered a military career do not want to take showers with guys who think they are women playing soldier, nobody is interested in the woke indoctrination, even our Space Force is led by a guy wearing a thong and red lipstick.

Americans are also sick and tired of watching the dismantling of history with the renaming of army bases. Even our powerful diesel tanks are being converted into green new deal battery powered shells so we don’t pollute the air of our enemies.

The Republican party has pretty much dissolved into an abyss of Socialist ideology by refusing to block all this garbage as they wander far off the conservative path thumbing their noses at their constituents who elected them.

The real grass root conservative republicans are hard working Americans that have been stabbed in the back multiple times by these scum liberal Republican in Name Only socialists.

Rep. Mike Gallagher has just quit Congress. His final act was to vote in support of giving our hard earned tax dollars to the corrupt Ukrainian government. Good riddance to him.

Rep. Jake LaTurner, R-Kan., has also announced that he will not seek re-election this fall. Rep. Kay Granger, R-Texas, announced in October 2023 she would not seek re-election. She has been collecting a tax payer paycheck since 1997. A career politician indeed.

Rep. Cathy McMorris Rodgers, R-Wash, who chairs the Energy and Commerce Committee and has served for nearly 20 years, she announced in February 2024 she would not run for another term. Lastly Rep. Patrick McHenry, R-N.C., chairman of the House Financial Services Committee has thrown in the towel.

So the fake news media will no doubt announce the republicans are losing their grip on power by a thin margin when in all reality nothing has changed in the arrangement of the deck chairs on the Titanic. There is no ideological difference between the Republican and Democrat members of Congress. So losing republicans changes nothing. The Communist agenda continues to advance.

I estimate during my 40 year affiliation with the GOP before terminating my R to the Conservative Party of Florida I spent over $250,000 of my own money helping republicans get elected plus I helped raise over a million dollars with my political affiliations in Texas and Montana during the Bush year’s and thereafter after.

My hard work got me some nice invitations such as breakfast in the White House with the Bush administration folks. It was a nice experience to meet Condoleezza Rice but looking back all I did was help advance the socialist destruction of our republic.

Not anymore. We can make a difference though by electing Trump in November 2024. If you want to secure our republic and give Trump the authority to veto all the crap expenditures being pumped out of the Congress vote Trump. Stay strong patriots.

©2024. Geoff Ross. All rights reserved.

RELATED ARTICLES:

House Bursts Into Pro-Ukraine Chant During Foreign Aid Vote

House Adjourns Without Forcing Vote On Mike Johnson’s Speakership

‘Disastrous Foreign Policy’: Biden Admin Funded Both Sides Of Growing Israel-Iran Faceoff

Here Are The 30 GOP Senators Who Voted To Reauthorize Warrantless Spying Tool

RELATED VIDEO: Mike Johnson’s Deep State Sell-Out | Rep. Thomas Massie, Sen. Mike Lee, David Sacks

POST ON X:

Mike Johnson betrayed America once again.

After doing nothing to secure America’s Southern border, reauthorizing FISA to spy on the American people without a warrant, fully funding Joe Biden’s DOJ that has indicted President Trump 91 times, and giving Biden’s political gestapo a… pic.twitter.com/8ZnQB5ry5j

— Rep. Marjorie Taylor Greene🇺🇸 (@RepMTG) April 20, 2024