Republican Study Committee Moves To Revamp Long-Standing Welfare Programs

The Republican Study Committee’s Fiscal Year 2024 budget will propose amending key welfare programs, including several that provide cash directly to recipients.

The budget, excerpts of which were obtained exclusively by the Daily Caller ahead of its Wednesday release, directs all federal welfare programs to include work requirements and limits cash payouts to recipients. It also converts several programs into state block grants and eliminates marriage penalties throughout the welfare system.

“For too long, the Left has pushed Americans into dependency on government welfare programs. Strengthening work requirements for those receiving government benefits empowers individuals through a good job and raises them up from dependency to self-sufficiency,” RSC Budget and Spending Task Force Chair Ben Cline said in a statement to the Daily Caller. “People want to support themselves and their families rather than prolong their economic hardship. It’s time to get Americans back to work and leave the disastrous policies of President Biden and the Left in the past.”

Government handouts during and in the aftermath of the COVID-19 pandemic have helped contribute to labor shortages, economists generally agree. COVID-19 relief packages initially gave recipients a $600 supplement to their unemployment insurance, effectively an increase of $15 per hour. Many Republican-led states ultimately rejected the American Rescue Plan’s unemployment expansion, and their job numbers rebounded faster than those states that maintained the expansion.

The RSC budget would cap unemployment insurance payouts at the recipient’s previous salary level. It also mandates that work-eligible recipients of Temporary Assistance for Needy Families actually be employed. The current structure of the program requires states to meet a certain workforce participation rate in order to receive funding that they can then distribute. The RSC plan also prohibits states from using TANF funds to pay for other programs.

In addition to strengthened work requirements, the RSC budget also promotes marriage by eliminating tax penalties for married couples who access welfare programs and entitlements. Economists from across the political spectrum have noted that cohabiting adults living just above the poverty line receive more benefits from programs like Medicaid, SNAP, the Child Tax Credit and the Earned Income Tax Credit than married couples.

House Republicans are already gearing up for a protracted battle with the Senate and White House over the Fiscal Year 2024 appropriations process. The Fiscal Responsibility Act set budget caps for FY2024 discretionary domestic spending at FY2022 levels, and limits FY2024 defense spending to a 3.3 percent increase. Some members, however, want to limit all discretionary spending to FY2022 levels, a goal House Speaker Kevin McCarthy and House Appropriations Committee chairwoman Kay Granger have said that they will pursue by writing appropriations below the Fiscal Responsibility Act’s caps.

Senators in both parties have argued for spending levels to be set at the caps, with Senate Appropriations Committee ranking member Susan Collins of Maine saying members would “go up to” the caps. Others, including Minority Leader Mitch McConnell, worry that a House budget would limit defense spending.

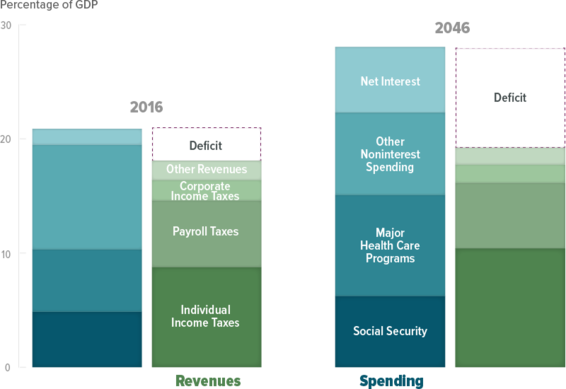

The RSC budget would cut spending by $16.3 trillion over ten years, according to an RSC aide, and reduce taxes by $5.1 trillion over the same period.

AUTHOR

MICHAEL GINSBERG

Congressional correspondent.

RELATED ARTICLE: EXCLUSIVE: RSC Chairman Kevin Hern Calls For ‘Strong Debt Limit Bill’ By End Of April

EDITORS NOTE: This Daily Caller column is republished with permission. ©All rights reserved.